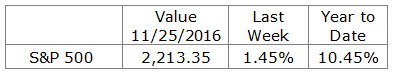

Stocks, as measured by the S&P 500, were up another 1.45% last week. The yield on the benchmark 10-Year Treasury also continued higher and was up four basis points to 2.37%.

Rising stock prices and declining bond prices (higher interest rates) is generally the norm. In a free market, economic expansion leads to increased demand for capital which pushes interest rates higher. Bond prices decline in a rising interest rate environment. Economic expansion also creates opportunity for increased corporate earnings which in turn supports higher stock prices. Over time, it is common to experience a rising stock market in the face of the Fed “normalizing” by raising its Fed Funds rate. During expansions, the stock market will experience corrections.

Market corrections can occur at any time. It is not a given the Fed’s rate increase will trigger a correction but it does not mean an increase will not happen. It is best not to try to time the market. One cannot consistently call market tops and the resulting bottoms. Jason Zweig provides a reasonable definition of market timing in his book, The Devil’s Financial Dictionary,

Market Timing, n. The attempt to avoid losing money in bear markets; the most common result however, is to avoid making money in bull markets.

ON THE ONE HAND

- Existing home sales increased two percent to a seasonally adjusted annual rate of 5.60 million in October from an upwardly revised 5.49 million in September. First-time buyers accounted for 33% of sales, up from 31% one year ago. Greater participation by first-time buyers allows existing homeowners to relocate and to upgrade to more expensive houses.

- Durable orders for October surprised most economists by increasing 4.8%. The boost was largely the result of a 12.0% spike in transportation orders. On top of this, September’s number was revised up to +0.4% from -0.1%. Excluding transportation, durable orders increased one percent. Both numbers were much better than expected.

- The final result for the University of Michigan’s Consumer Sentiment Index was an increase of 6.6 points to 93.8, a 2.7% increase from the previous year. The release of the index came with the notes, “the post-election gain in the Sentiment Index was +8.2 points above the November pre-election reading… Presidential honeymoons, however, can quickly end if they are unaccompanied by prospects that economic conditions will actually improve in the future.”

ON THE OTHER HAND

- Initial jobless claims increased by 18,000 for the week ending November 19 to 251,000. This week’s increase is not all “other handed” as it follows last week’s sharp decline of 21,000 (revised). The last four weekly jobless claims numbers from oldest to most recent are, 259K, 266K, 254K, 233K and 251K. Claims remain near historical lows and well below the 300,000 level that would trigger concerns about the labor market.

- New single-family home sales declined 1.9% in October to a seasonally adjusted annual rate of 563,000. In addition, September was revised downward to 574,000 from the previously reported 593,000. There is plenty of room for improvement in this segment of the economy.

ALL ELSE BEING EQUAL

The minutes of the Fed’s November Open Market Committee meeting were released last Wednesday. “Most participants expressed a view that it could well become appropriate to raise the target range for the federal funds rate relatively soon, so long as incoming data provided some further evidence of continued progress…” The data since the meeting has continued to provide evidence of an improving labor market and somewhat higher inflation. Market rates have continued to move higher. Most expect the Fed to get in the game at the next FOMC meeting, December 13 & 14.

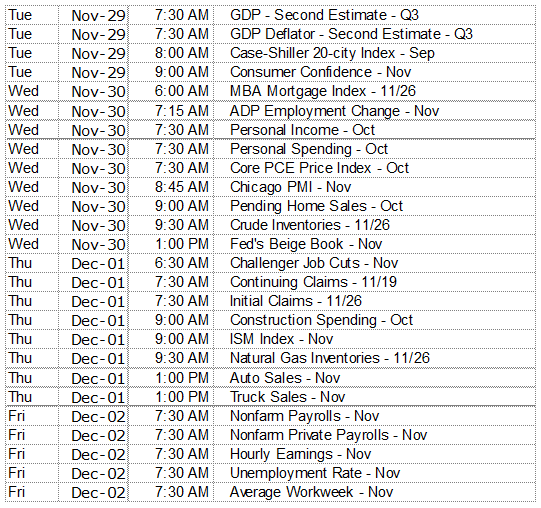

THE WEEK AHEAD