The market predictions for 2017 are out. One of our resolutions for each year should be to remind ourselves to take these exciting forecasts with a grain of salt. For an example of the lack of value in these calendar year predictions, one need look back just eight years to the beginning of 2008. The consensus prediction for the year was for a market gain of 11.1% but the result was a decline of 38.5% as measured by the S&P 500. Calendar year predictions are not helpful.

Another useful resolution would be to review our personal finances. This is a useful endeavor each and every year. A review of my financial progress over the past twelve months and the development of a plan for the coming year will generate results. We are better off if we focus on the things we can control. We have no control over the rates of return we will earn over the next year but we do have control over our spending habits and our savings rates.

These resolutions, as the saying goes, are simple but they are not easy. Planning is dull and calendar year market predictions are exciting. Focus on the things we can control. Planning is what will lead us to long term financial success.

Let TCK help you streamline your planning effort. Does your plan have you nearing retirement? Are you beginning to consider your options? Lee Anne Thompson provides her thoughts on a couple of considerations in her piece, I NEED PROTECTION FOR MY 401(K) DISTRIBUTION, on the TCK website. Check the link to read her article and then contact Lee or your officer to learn more.

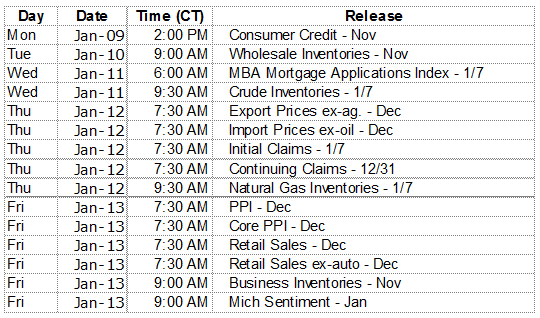

What We Are Watching So You Don’t Have To

On The One Hand

- Consumer credit continued to expand in November. Last week’s report showed total outstanding consumer credit increased by $24.6 billion on top of the $16.2 billion increase in October.

- Initial jobless claims increased by 10,000 to 247,000 while continuing claims for the week ending December 31 fell by 29,000 to 2.087 million. This was the 97th consecutive week in which initial jobless claims were below 300,000, a run not seen since 1970.

- The Producer Price Index reported prices increased 0.3%, in line with expectations.

- Retail sales increased 0.6%. Excluding autos, sales were up just 0.2%. On an annual basis, sales were up 3.3%. Excluding autos, annual sales were up 3.1%.

- The University of Michigan’s Index of Consumer Sentiment was basically unchanged at 98.1.

On The Other Hand

Business inventories increased 0.7% in November and October inventories were revised to show a decline of 0.1%. Sales increased 0.1% in November following a 0.7% increase in October. The inventory to sales ratio continues to limit pricing power.

All Else Being Equal

Consumers cautiously continue to drive slow growth of U.S economy. Businesses remain very cautious but the trend for job and wage growth appears to be picking up. Barring geopolitical or tax and trade policy shocks, pace should improve.

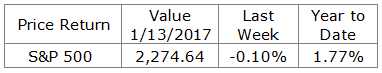

Last Week’s Market

The Week Ahead