Investment decisions require more than gut feeling responses to current news. Typically, after a long decline in stock prices, a good deal of risk has been removed from the market, yet investors perceive the risk has increased. Conversely, when stock prices are high and rising, investors perceive the risks of investing to be much lower than they actually are. There are several reasons why such misjudgment occurs. The facts are always difficult to pull from noise which makes up much of the news reporting on markets. The herd instinct is very real. It is comfortable to do what everyone else is doing. Acting on gut instincts, which works very well in many circumstances, is not the best way to approach decisions having to do with personal finance. Those decisions require more study and a deeper level of thinking.

As we have pointed out before, your primary personal financial situation and goals are far more significant considerations in your investment decisions. Your age, the amounts and timing of your purchases, the ultimate goals for the funds you are investing and the time horizons aligned with those goals are critical. Then, you should begin your study of market valuation. Market studies are fascinating. In the long run, economic trends and financial data determine prices. In the short run, human psychology produces the wide swings in public market valuations. Combined, these make for some very interesting studies. Take a look at Chris English’s answer to an investor’s query about the right time to invest in the article, Triple Record, for some interesting market facts. Then, proceed with rational thought and try to keep your gut instincts in check.

On The One Hand

- Both personal income and personal spending were up 0.4% for the month of April and the PCE Price Index was up 0.2%. The personal savings rate as a percentage of disposable income remained at 5.3%.

- Weekly initial unemployment claims rose by 13,000 to a still relatively low 248,000. Continuing claims declined by 9,000 to 1.915 million.

- The ISM Manufacturing Index was 54.9 for May, up slightly from the 54.8 April figure. A reading above 50.0 indicates expansion in the manufacturing sector.

- The U.S. trade deficit widened to $47.6 billion in April. In the last year, exports are up five percent while imports are up 8.3%. While the U.S. must become more competitive, the figures show economic activity is expanding.

On The Other Hand

- The Conference Board’s Consumer Confidence Index declined to 117.9 in May from a downwardly revised 119.4 in April.

- Total construction spending in April declined 1.4%. The poor report was partially offset by a sizable revision of the March report, rising to show an increase of 1.1% from the originally reported decline of 0.2%.

- Light vehicle sales were reported to be at a seasonally adjusted annual rate of 16.66 million units in May versus 16.88 million units for April. Sales were three percent below May of 2016. Domestic declined to 13.05 million from 13.28 million in April. Domestic auto sales were 11.4% below the May 2016 rate.

- May nonfarm payrolls increased by 138,000 and April payrolls were revised downward to 174,000 from the previously reported 211,000. The headline unemployment rate was 4.3%, down from 4.4%. The U6 unemployment rate declined to 8.4% from 8.6% in April. Average hourly earnings rose 0.2% in the month of May and are up 2.5% year-over-year.

All Else Being Equal

The economy continues to grow but restraint among consumers and businesses has been noticeably greater than that of investors. Economic data continues to be mixed. Personal income and spending are growing at an uninspiring rate. Recent consumer confidence reports hint consumers have grown less enthusiastic about the short-term outlook. Employers are not laying off workers but they are also not hiring at an enthusiastic rate. Pressure on wages remains in check which has prevented the wage push many have anticipated would add to overall inflation. Businesses are as cautious about adding new human capital as they are about adding to capital investment. The slow U.S. growth is a reasonable approach to the unprecedented Fed and Treasury actions over the past eight years.

The Fed, in its May Open Market Committee meeting minutes, called recent disappointing economic growth, “transitory”. On Friday, the Atlanta Fed confirmed the view by announcing its latest estimate for real Q2 GDP growth of 3.4%. Other forecasters also believe economic growth will continue by declaring a 90% probability of an increase in the fed funds rate at the next FOMC meeting in ten days. As usual, attempts to predict the future remind me of John Maynard Keynes’ famous quote, “the only function of economic forecasting is to make astrology look respectable”.

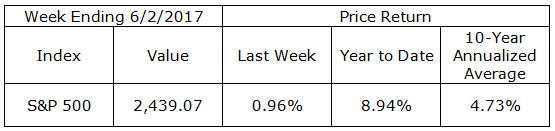

Last Week’s Market

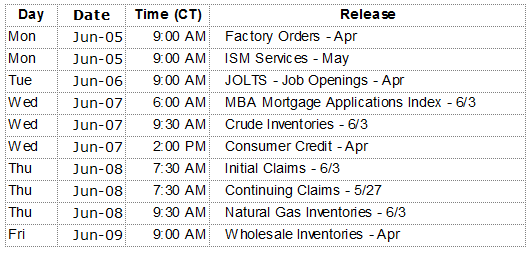

The Weed Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.