We believe competition in the financial services industry is good. Investors are best served when they can choose among a variety of service providers including both fiduciaries and non-fiduciaries. Freedom to choose only works when clients have a clear understanding of the business model of the firm and the nature of the relationship he or she will have with the firm’s representatives or financial advisers.

One of the better proposals I have seen regarding this issue was put forward in 2015 by New York City Comptroller Scott Stringer when he proposed a state law which would require non-fiduciary advisers to clearly state the nature of their relationship with a client. Rather than five paragraphs of fine print legalese, he proposed non-fiduciary advisers use large print at the top of their account agreements to state the simple fact, “I am not a fiduciary. Therefore, I am not required to act in your best interests, and am allowed to recommend investments that may earn higher fees for me or my firm, even if those investments may not have the best combination of fees, risks, and expected returns for you.”

Stringer’s simple proposal has not made it into law. Simple seldom gets much traction in the financial services industry or state and federal legislatures. While the Department of Labor’s Fiduciary Rule is stalled in the courts, the Securities Exchange Commission has proposed some rules of its own. For more on the movement to protect investors read the post Chris English has on TCKansas.com, Fiduciary Rule Update.

On The One Hand

- Producer Price Index (PPI) rose 0.1% in April putting the year-over-year rate of producer price increases at 2.6%.

- The Consumer Price Index (CPI) rose 0.2% in April. The new data places the CPI up 2.5% from a year ago.

- Initial unemployment claims were unchanged at 211,000. The four-week moving average for initial claims was 216,000, a level not seen since December 1969. Continuing claims rose 30,000 to 1.790 million but still remain at historically low levels.

- Import prices increased 0.3% in April and were up 3.3% over the prior twelve months. Export prices rose 0.6% and were up 3.8% year-over-year.

- The preliminary University of Michigan Consumer Sentiment Survey for May was unchanged from the April final reading of 98.8, continuing near a 14-year high.

On The Other Hand

There was no “On The Other Hand” data last week.

All Else Being Equal

Prices are clearly increasing at a rate firmly above the Fed’s target rate of 2.0% and it is clear the institution needs to move away from its loose monetary policy. Expect the Fed to raise rates at its June meeting followed by two more hikes before the end of the year.

The Atlanta Fed’s GDPNow forecast for real Q2 growth is holding firm at 4.0%.

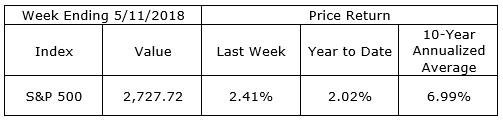

Last Week’s Market

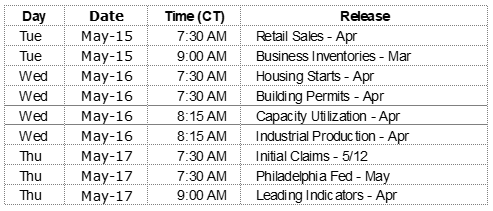

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.