Last Monday saw stocks advance following encouraging news in the development of yet another COVID-19 vaccine. The Russell 2000 climbed nearly 2.0%, followed by the Dow, the Global Dow, the S&P 500, and the Nasdaq. Treasury yields and crude oil prices surged, while the dollar was mixed. Among the market sectors, energy jumped higher, followed by industrials, financials, materials, and consumer discretionary. Health care, information technology, and real estate fell.

Cyclical stocks led the surge last Tuesday as the market pushed ahead for the second consecutive day. The Dow eclipsed 30,000 for the first time, and the S&P 500 hit a record. Among sectors, energy and financials soared, followed by materials, communication services, and industrials. Crude oil prices and Treasury yields climbed, while the dollar sank.

Cyclical and value stocks have been favored over mega-caps and tech stocks this month. Yet last Wednesday saw a reversal of that trend, but not enough to overcome a pre-holiday sell off. Of the indexes listed here, only the Nasdaq (0.5%) advanced. The Global Dow was essentially unchanged from the prior day, while the Dow (-0.6%), the Russell 2000 (-0.5%), and the S&P 500 (-0.2%) lost value. Crude oil prices continued to climb, while the dollar declined. Treasury yields were mixed.

Stocks continued to push higher the day after Thanksgiving. The Nasdaq added nearly 1.0%, followed by the Russell 2000, the Global Dow, the S&P 500, and the Dow. The yield on 10-year Treasuries fell, along with the dollar and crude oil prices. Among the major market sectors, health care, communication services, and technology gained, while energy and utilities fell.

Optimism over favorable vaccine reports provided encouragement for investors over the holiday-shortened week. Several of the benchmark indexes hit record highs last week, continuing an upward trend in the market. The Russell 2000 and the Global Dow added the most value by the end of the week, followed by the Nasdaq, the S&P 500, and the Dow. Each of the indexes listed here are now well above their 2019 year-end values, with the Nasdaq nearly 40.0% higher.

Crude oil prices continued to climb, closing at $45.53 per barrel by late Friday afternoon, up from the prior week’s price of $42.17 per barrel. The price of gold (COMEX) continued to slide last week, closing at $1,781.90, down from the prior week’s price of $1,869.40. The national average retail price for regular gasoline was $2.102 per gallon on November 23, $0.009 lower than the prior week’s price and $0.477 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The second estimate for the third-quarter GDP showed annual growth at 33.1%, unchanged from the first estimate, but a vast improvement over the pandemic-impacted second-quarter estimate of -31.4%. Driving the GDP increase was consumer spending, as measured by personal consumption expenditures, which accounts for more than a quarter of the overall increase in GDP. Personal consumption expenditures increased to 40.6%, while consumer prices increased 3.7%. Real gross domestic income (GDI) increased 25.5% in the third quarter, in contrast to a decrease of 32.6% in the second quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 29.2% in the third quarter, in contrast to a decrease of 32.0% in the second quarter.

- In October, personal income decreased 0.7% and disposable (after-tax) personal income dropped 0.8%. The decrease in personal income in October was led by a decrease in government social benefits, primarily reflective of a decrease in Lost Wages Supplemental Payments, a Federal Emergency Management Agency program that provides wage assistance to individuals impacted by the pandemic. Personal consumption expenditures, a measure of consumer spending, increased 0.5%, while consumer prices were unchanged from September. For the 12 months ended in October, consumer prices are up 1.2%, a sign of weakened inflationary trends.

- Sales of new single-family homes fell 0.3% in October from September’s total. Despite the decrease, new home sales were 41.5% ahead of their sales pace in October 2019. The median sales price of new houses sold in October 2020 was $330,600. The average sales price was $386,200. The estimate of new houses for sale at the end of October was 278,000, representing a 3.3 month supply at the current sales rate.

- The international trade in goods deficit was $80.3 billion in October, up $0.9 billion, or 1.2%, from September. Exports of goods for October were $126.0 billion—$3.4 billion, or 2.8%, more than September exports. Imports of goods for October were $206.3 billion—$4.4 billion, or 2.2% more than September imports.

- The manufacturing sector continued to rebound in October. New orders for manufactured durable goods, up six consecutive months, increased $3.0 billion, or 1.3%. This increase followed a 2.1% jump in September. Transportation equipment, up for five of the last six months, led the increase, at $0.9 billion, or 1.2%. Shipments of manufactured durable goods in October, up for five of the last six months, increased $3.1 billion, or 1.3%. Unfilled orders for manufactured durable goods in October, down for seven of the last eight months, decreased $2.8 billion, or 0.3%, while inventories, up for two consecutive months, increased $1.3 billion, or 0.3%. New orders for capital goods increased 2.7% in October, while new orders for nondefense capital goods fell 0.2%.

- For the week ended November 21, there were 778,000 new claims for unemployment insurance, an increase of 30,000 from the previous week’s level, which was revised up by 6,000. According to the Department of Labor, the advance rate for insured unemployment claims was 4.1% for the week ended November 14, a decrease of 0.2 percentage point from the prior week’s rate. For comparison, during the same period last year, there were 211,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended November 14 was 6,071,000, a decrease of 299,000 from the prior week’s level, which was revised down by 2,000. The highest insured unemployment rates in the week ended November 7 were in California (7.9%), Hawaii (7.1%), Nevada (6.9%), the Virgin Islands (6.9%), and Alaska (6.3%). The largest increases in initial claims for the week ended November 14 were in Louisiana (+33,573), Massachusetts (+9,859), Texas (+5,216), Kentucky (+3,770), and Minnesota (+3,608), while the largest decreases were in Illinois (-20,581), Washington (-8,904), New Jersey (-7,990), Florida (-7,045), and Georgia (-4,201).

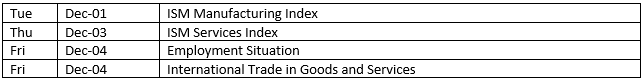

Eye on the Week Ahead

Employment data for November is out this week. October saw 638,000 new jobs added and the unemployment rate dip to 6.9%. However, with the uptick in COVID-19 cases last month, both figures may have reversed course in November with fewer new jobs created, possibly driving the unemployment rate higher.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.