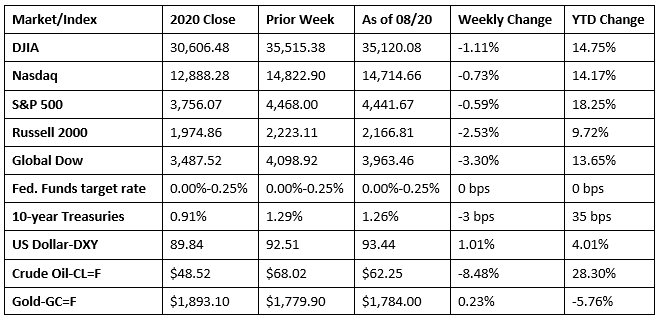

Stocks closed the week lower over concerns about the pace of global economic growth. China, the world’s second-largest economy, saw retail sales and industrial production slow as that country tries to contain the fallout from the latest resurgence in COVID cases. In addition, the minutes from the July Federal Open Market Committee meeting indicated that at least some of the members are considering tapering the Fed’s asset-purchase program sooner rather than later. Each of the benchmark indexes listed here lost value. The Global Dow fell 3.3%, the Russell 2000 dipped 2.5%, and the Dow dropped 1.1%. The dollar and gold prices advanced, while crude oil prices declined 8.5%. The yield on 10-year Treasuries marginally decreased. The market sectors were mixed for the week, with utilities, consumer staples, health care, information technology, and real estate gaining ground, while energy, materials, financials, industrials, and consumer discretionary fell.

Stocks were mixed last Monday, with the Dow and the S&P 500 reaching record highs, while the Nasdaq, the Russell 2000, and the Global Dow slipped lower. Crude oil prices dipped, the dollar was mixed, and the yield on 10-year Treasuries fell nearly 3.0%. Health care, consumer staples, and utilities led the market sectors, while energy slid 1.8%.

A string of five consecutive record finishes for the Dow and the S&P 500 ended last Tuesday, as each benchmark index suffered its largest decline since July 19. Stocks closed lower following a weaker-than-expected retail sales report and concerns about the economic impact of the Delta variant. The Nasdaq (-0.9%), the Russell 2000 (-1.2%), and the Global Dow (-0.9%) also dipped lower. Treasury yields and crude oil prices decreased, while the dollar advanced. The market sectors generally fared poorly, with only health care and real estate advancing. Consumer discretionary (-2.3%), materials (-1.2%), industrials (-1.1%), and communication services (-1.0%) fell the most.

Last Wednesday saw Wall Street continue to falter as each of the benchmark indexes lost value, led by the large caps of the Dow and the S&P 500, which dipped 1.1%. The Nasdaq fell 0.9%, the Russell 2000 declined 0.8%, and the Global Dow decreased 0.5%. Energy fell 2.4%, followed by health care (-1.5%), information technology (-1.4%), and consumer staples (-1.3%). Crude oil prices dropped to $64.59 per barrel, their lowest closing price since mid-May. The yield on 10-year Treasuries increased 1.2%, while the dollar was little changed from the prior day. The slide in stock values may be in response to minutes from last month’s Federal Reserve meeting, which indicated that a decision on a reducing its bond-purchasing program could happen in 2021.

Stocks were largely mixed last Thursday, with the Nasdaq and the S&P 500 eking out gains (0.1%), while the Global Dow (-1.7%), the Russell 2000 (-1.2%), and the Dow (-0.2%) dipped lower. Treasury yields and crude oil prices fell, while the dollar advanced. Asian and European markets fell on COVID concerns. Consumer staples, information technology, and real estate led the sectors, while consumer discretionary, industrials, and energy faded.

Last Friday proved to be Wall Street’s best day of the week. Each of the benchmark indexes advanced, led by the Russell 2000 (1.6%) and the Nasdaq (1.2%). The S&P 500 (0.8%) and the Dow (0.7%) pushed higher. The Global Dow inched up 0.1%. Each of the market sectors gained ground, with information technology, utilities, and communication services leading the pack. Ten-year Treasury yields rose, while the dollar and crude oil prices dipped.

The national average retail price for regular gasoline was $3.174 per gallon on August 16, $0.002 per gallon more than the prior week’s price and $1.008 higher than a year ago. Gasoline production increased during the week ended August 13, averaging 10.0 million barrels per day. U.S. crude oil refinery inputs averaged 16.0 million barrels per day during the week ended August 13; this was 191,000 barrels per day less than the previous week’s average. For the week ended August 13, refineries operated at 92.2% of their operable capacity, up from the prior week’s level of 91.8%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Retail sales dipped 1.1% in July from the previous month but stand 15.8% above the July 2020 totals. Retail trade sales also slowed, falling 1.5% last month. Contributing to the dip in overall retail sales were motor vehicle and parts dealers (-3.9%); building material and garden equipment and supplies dealers (-1.2%); clothing and clothing accessories stores (-2.6%); sporting goods, hobby, musical instrument, and book stores (-1.9%); and online sales (-3.1%). Sales increased at food services and drinking places (1.7%), miscellaneous store retailers (3.5%), and gasoline stations (2.4%).

- According to the latest report from the Federal Reserve, industrial production rose 0.9% in July. Manufacturing output increased 1.4%, largely due to an 11.2% increase in motor vehicles and parts. The output of utilities decreased 2.1% in July, while mining rose 1.2%. Overall, total industrial production in July was 6.6% above its year-earlier level but 0.2% below its pre-pandemic (February 2020) level.

- Building permits and home completions increased in July, according to the latest report from the Census Bureau. The number of building permits issued rose by 2.6% above the June rate and is up 6.0% from July 2020. Building permits issued for single-family homes dipped 1.7% in July. Home completions in July advanced 5.6% from the previous month. Single-family home completions increased 3.6% last month. Housing starts dipped 7.0% in July but are 2.5% above the July 2020 rate. In July, housing starts for single-family homes were 4.5% lower than June’s totals.

- For the week ended August 14, there were 348,000 new claims for unemployment insurance, a decrease of 29,000 from the previous week’s level, which was revised up by 2,000. This is the lowest level for initial claims since March 14, 2020, when it was 256,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended August 7 was 2.1%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended August 7 was 2,820,000, a decrease of 79,000 from the prior week’s level, which was revised up by 33,000. This is the lowest level for insured unemployment since March 14, 2020, when it was 1,770,000. For comparison, during the same period last year, there were 920,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 9.7%. During the last week of February 2020 (pre-pandemic), there were 219,000 initial claims for unemployment insurance, and the number of those receiving unemployment insurance benefits was 1,724,000. States and territories with the highest insured unemployment rates for the week ended July 31 were Puerto Rico (4.9%), California (3.8%), Illinois (3.6%), the District of Columbia (3.2%), New York (3.2%), Connecticut (3.1%), Rhode Island (3.1%), New Jersey (3.0%), the Virgin Islands (3.0%), and Nevada (2.8%). States and territories with the largest increases in initial claims for the week ended August 7 were Virginia (+4,197), California (+3,267), Maryland (+1,738), Oregon (+1,602), and Illinois (+1,430), while the largest decreases were in Michigan (-4,093), New York (-2,921), Georgia (-2,623), Indiana (-2,577), and Missouri (-2,401).

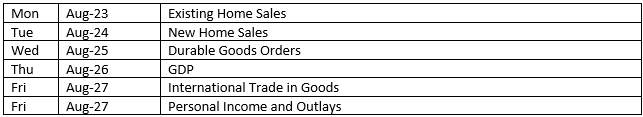

Eye on the Week Ahead

There’s plenty of important economic data available this week. July figures on sales of existing and new homes are out. The housing sector has slowed from the torrid pace set earlier in the year. Durable goods orders have been rising, with new orders increasing 0.8% in June. July is expected to see a similar advance in new orders. The second estimate of gross domestic product for the second quarter is also out this week. The first estimate showed that the economy expanded at a 6.5% annualized rate.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.