The economic reports for the week were overwhelmingly positive. The Fed decided to hold rates at current levels for the time being and confirmed its previously stated intent to raise short term rates slightly and gradually as the year progresses. Market interest rates responded to the continued strength by rising.

Interest rate markets are beginning to react to the strength in the economy. Market rates are rising across the board. The 2-Year Treasury yield which began the year at 1.88% finished the week at 2.14%. The 10-Year Treasury, slower to react, has risen to a four year high of 2.85% from 2.40% at the start of the year. Expectations are for gradual increases in market rates through the year. At present, we do not expect yields on fixed income investments to rise to a level which would cause a significant flow of investment capital out of stocks and into bonds.

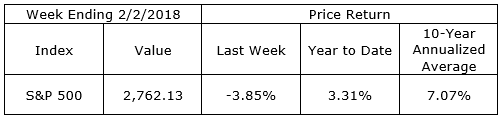

The long anticipated stock market correction may be underway. Last week’s 3.85% decline from the previous Friday’s all time high close of 2,872.87 for the S&P 500 Index woke everyone up. An additional decline of 10% or 12% would not be surprising and would, in fact, be healthy.

On The One Hand

- Personal income and personal spending increased 0.4% in December. Personal spending for November was revised up to 0.8% from 0.6%.

- The PCE Price Index was up 0.1% and core-PCE prices were 0.2% higher. For the year, the PCE Price Index was up 1.7%.

- The Consumer Confidence Index was 125.4 in January up from an upwardly revised 123.1 in December.

- The fourth quarter Employment Cost Index showed costs for civilian workers rose 0.6% versus a 0.7% increase for the third quarter. For the year, compensation costs for civilian workers increased 2.6% compared to 2.2% for 2016.

- Initial claims declined by 1,000 to 230,000. Continuing claims rose 13,000 to 1.953 million.

- The ISM Manufacturing Index posted a reading of 59.1 for January, down slightly from December’s 59.3 level but higher than expectations. Levels above 50 are indicative of expansion.

- Construction spending increased 0.7% in December following a 0.2% downward revision to a 0.6% increase in November. Annual total construction spending was up 2.6% for the year.

- Nonfarm payrolls surprised on the upside by adding 200,000. Over the past three months, job gains have averaged 192,000 per month. Average hourly earnings rose 0.3% in the month putting earnings growth for the year up 2.9%. The average workweek in January was 34.3 hours, down from 34.5 hours in December. In January, the manufacturing workweek was 40.6 hours, down from 40.8 hours in December. The labor force participation rate held steady at 62.7% in December.

- Factory orders increased 1.7% in both December and November after a November revision of +0.4%.

- The final Consumer Sentiment index was posted at 95.7 for January, up from the preliminary reading of 94.4 and down just slightly from December’s 95.9 level.

On The Other Hand

- The Chicago Purchasing Managers Index came in at 65.7 for January, down from December’s 67.8. This is not significantly negative as the December figure was at a near seven year high and any reading above 50 is a signal of expansion.

- Preliminary fourth quarter productivity reported a 0.1% decline in nonfarm business sector labor productivity declining 0.1%. Unit labor costs rose 2.0%.

All Else Being Equal

It is good to see compensation rising for workers. At the same time, employment costs are a major component of business costs. Economists and investors will be watching this series for signs of cost push in the inflation figures as the year progresses. Wage cost push could however be postponed for some time if the economy experiences an increase in the labor force participation rate.

The Atlanta Fed surprised everyone last week by raising its GDPNow estimate for first quarter real GDP growth to a rate of +5.4%. The Atlanta Fed’s effort has resulted in some wildly volatile swings as a quarter progresses so it is useful to check it against the New York Fed’s GDP Nowcast. Last week’s Nowcast projected real GDP growth for Q4 of 3.2%. The key takeaway from these forecasts is not their absolute values but their use as general indicators of the direction and strength of the economy. They are signaling not only continuing growth but accelerating growth.

Last Week’s Market

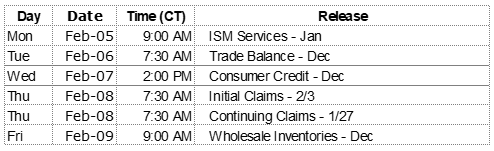

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.