The anniversary of the 2008-09 financial crisis bottom came and went on March 9. Since early 2009, the U.S. economy has been in one of the shallowest and longest recoveries in history. The 24/7 cable news financial analysts are obviously disappointed in the lack of action. We have had neither a boom nor a bust for 10 years. Some complain about the lack of rapid growth, yet others warn the recovery is tired, and the economy is overdue for a fall. The opinion givers want action, lots of it. Action attracts viewers and sells advertising. However, quickly changing economic trends do little to benefit workers, consumers, businesses or investors.

The economy has done very well without a boom like the one which peaked in 2007. There is no reason businesses, workers and consumers should not cautiously plan for continued slow and steady growth for many years to come. Without a boom, there are few reasons to expect a bust.

Investing is not a sprint but a marathon. It is not a quarter-to-quarter guessing game but a decades long process. Decisions along the way are deliberate and steady. Aesop’s tale of the tortoise and the hare comes to mind. In this tale, the over-confident and entertaining, yet easily distracted hare lost the race to the steady and determined tortoise.

On the One Hand

- January retail sales were up 0.2% and excluding autos, rose 0.9%. Offsetting this increase were downward revisions to December’s already negative report. December retail sales were revised to show a sales decline of 1.6% instead of the originally reported decline of 1.2% and ex-auto sales were revised to -2.1% from -1.8%.

- The Consumer Price Index (CPI) was up 0.2% in February, compared to January. The CPI is up 1.5% for the 12 months ending in February.

- The Producer Price Index (PPI) for February rose 0.1% in the month and stands at 1.9% year-over-year.

- Durable Goods Orders rose 0.4% in January. Nondefense orders and shipments were each 0.8% higher for the period.

- Initial unemployment claims increased by 6,000 to 229,000, although the four-week average declined 2,500 to 223,750. Continuing claims rose 18,000 to 1.776 million.

- The preliminary University of Michigan Index of Consumer Sentiment moved higher to 97.8 following February’s final reading of 93.8.

On the Other Hand

- Business inventories rose 0.6% in December increasing the inventory-to-sales ratio to 1.38 from 1.36 the previous month and 1.34 twelve months ago.

- Construction spending declined 0.6% in December, following the 0.8% increase in November.

- Import prices and export prices were each up 0.6% in February.

- New home sales dropped 6.9% in January to an annual rate of just 607,000. For the year ending in January, new home sales were down 4.1%.

- Industrial production rose just 0.1% in February following the January decline of 0.4%. The capacity utilization rate dipped to 78.2% from 78.3% in January.

All Else Being Equal

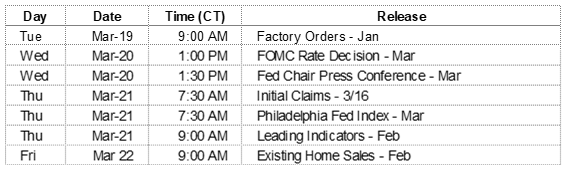

The Federal Open Market Committee meets this week. No rate changes are anticipated but market watchers will still be tuned into Fed Chairman Powell’s press conference on Wednesday afternoon.

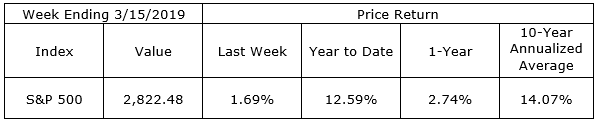

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.