The yield on the 10-Year Treasury stood at 3.20% early last November and the S&P 500 stood at 2,800, down about 4% from its late September high. The market timers’ crystal balls flashed images of recession and steep stock price declines. The Fed, we were told, had sealed the deal when it raised the fed funds range to 2.25%-2.50% on December 19th. Woe is we.

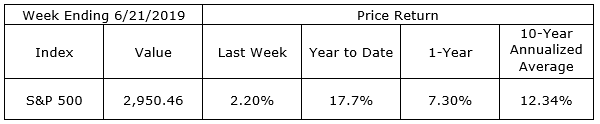

Three trading days later, stocks bottomed. The S&P 500 had declined nearly 20% from its high as nervous market timers ran for the exits. From its Christmas Eve low, the S&P 500 has recovered and after its 25% gain, now stands at a new all-time high. The yield on the 10-Year Treasury stood at 2.00% last week. The Fed has done nothing. Last week, it decided to leave its fed funds range at 2.25% to 2.50%. The rate of growth of the U.S. economic expansion has slowed but a recession remains off in the distance.

A wise person once said, “Prediction is difficult, especially about the future.” The better plan is to concentrate on the events and trends in life which we have some control over. Focusing on one’s rate of spending and saving, for example, can be managed without the need for attempts at predicting what the Fed might do and how it will influence rates or stock prices.

On the One Hand

- Initial unemployment claims declined by 6,000 to 216,000 putting the four-week moving average for initial claims at 218,750. Continuing claims were down 37,000 to 1.662 million. This was the 224th straight week of initial claims below 300,000.

- Existing home sales rose 2.5% in May to a seasonally adjusted annual rate of 5.34 million from an upwardly revised 5.21 million in April. On an annual basis, total sales remained 1.1% below the same period a year ago.

On the Other Hand

- Housing starts were off by 0.9% in May to a seasonally adjusted annual rate of 1.269 million. Building permits increased just 0.3% in May to a seasonally adjusted annual rate of 1.294 million.

- The Leading Economic Index was unchanged in May following a negative revision of 0.3% in April leaving the reading at an increase of just 0.1%.

All Else Being Equal

The Fed chose to leave short-term rates where they were. The fed funds range stands at 2.25% to 2.50%. The FOMC recognized the recently softening growth rate and sent the signal that a lower rate could be in store at its July meeting.

The Atlanta Fed staff’s GDPNow model estimates real GDP growth in the second quarter of 2019 is currently at 2.0 percent, down from 2.1 percent the previous week.

Last Week’s Market

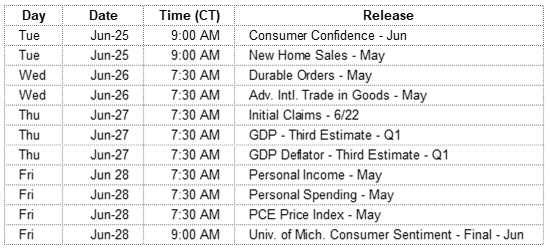

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.