With 44% of S&P 500 companies reporting, revenues and earnings have been a hodgepodge. FactSet revealed 61% of companies reported revenues above expectations and 77% of companies have posted earnings which beat expectations. However, do not forget that expectations have been lowered significantly beginning in late 2018 in anticipation of a 2019 recession which has not developed.

Stocks reacted by finishing the week at a record high as measured by the S&P 500 and the Nasdaq Composite. The Dow, weighted down by Boeing, failed to add itself to the list. While stagnation in foreign economies, trade disputes and EU fractures continue to be a concern, recent financial and economic data in the U.S. has investors postponing their recession forecasts. Fed action this week is likely to further ease any near-term recessionary fears.

On the One Hand

- New single-family home sales increased 7.0% in June to a 646,000 unit annual rate. Sales are up 4.5% from a year ago.

- New orders for durable goods rose 2.0% in June. Taking some of the glow off of June’s gain was a downward revision of 1.0% in May’s decline of 2.3%.

- Initial claims for unemployment insurance fell 10,000 last week to 206,000. The four-week moving average for initial claims decreased by 5,750 to 213,000. Initial claims have now been at or below 250,000 for a record ninety-four consecutive weeks. Continuing claims declined 13,000 to 1.676 million.

- The first estimate for Q2 real GDP growth was reported at an annual rate of 2.1%, in the upper half of the range of expectations. Real GDP is up 2.3% from a year ago. The Personal Consumption Expenditures grew 4.3%. The GDP Deflator increased at a 2.4% annual rate in Q2 after increasing 1.1% in the first quarter.

On the Other Hand

Existing home sales were 1.7% lower in June versus May, to a seasonally adjusted annual rate of 5.27 million. Total sales were 2.2% lower than the same period a year ago.

All Else Being Equal

The FOMC rate decision will be announced on Wednesday. Evidence of economic weakening in the U.S. has been scant since the June FOMC meeting. This supports the argument for keeping the Fed Funds rate at its current range of 2.25% to 2.50%. At the same time, the Fed’s feared resurgence in inflation has not materialized which could be used as support for a decision to reduce its range by as much as one-half percent. The pundits are going to have fun this week.

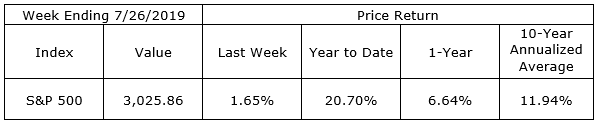

Last Week’s Market

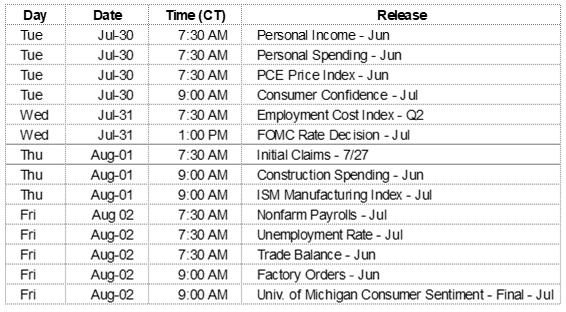

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.