From the bad news sells category comes the questionable headline of the week:

There’s a more than 25% risk of a US recession in the next year.

I have little argument with the facts behind the headline above. I do disagree with the way those facts were announced, considering the same information could have been presented with the headline below:

There’s nearly a 75% chance of no US recession in the next year.

While our complex economy is influenced by many variables which will change over time, in today’s snapshot, the circumstances favor heavy odds of no U.S. recession in the next year.

Linda Duessel, a Senior Equity Strategist at Federated Investors recently asked, “Might our media be uttering “crisis” too many times, much as the boy who cried, “Wolf”?”

Moving on to our weekly recap of the week’s economic reports, we will start with a quote from Harry Truman, President of the United States from April 12, 1945 to January 20, 1953: “I was in search of a one-armed economist so that the guy could never make a statement and then say: ‘on the other hand.’”

On the One Hand

- Business inventories were unchanged in August following a 0.3% increase in July. Total business sales were up 0.2% following a 0.2% increase in July. Year-over-year inventory growth of 4.2% and sales growth of 1.1% should keep prices stable for the near term.

- Initial claims for the week rose 4,000 to 214,000 and the four-week moving average for initial claims were higher by 1,000 to 214,750. Although rising slightly, the claims report is positive given the fact the increase is from and to historically low levels. This is the 241st month in which initial claims has been below 300,000. Continuing claims declined by 10,000 to 1.679 million.

On the Other Hand

- Retail sales declined 0.3% in September following an upwardly revised 0.6% increase (from +0.4%) in August.

- Both housing starts and building permits declined in September. Housing starts were down 9.4% for the month. Building permits declined 2.7%. If there is a bright side to the reports, starts and permits were down due to softness in multi-unit dwellings. Single family starts were up 0.3% and single-family permits rose 0.8% in the month.

- Industrial production was weak in September, in part due to the strike at General Motors. Production declined 0.4% in the month following an upwardly revised 0.8% increase in August. Total capacity utilization slipped to 77.5% from 77.9% in August.

- The Conference Board’s Leading Economic Index declined 0.1% in September, the second decline in a row given the downward revision to last month’s unchanged reading to a decline of 0.2%. The Coincident Economic Index was unchanged following August’s 0.3% increase and the Lagging Index was up 0.1% following a decline of 0.4% in August.

All Else Being Equal

There is little the Fed can do to alter the course of economic progress in the current environment. Business investment decisions are not being postponed due to the current easy monetary policies around the world. Interest rates do not need to be lower. The current cautious climate which is contributing to slowing growth around the globe is due to current and proposed tax schemes, including tariffs, and misguided regulation by central planners around the world.

U.S. growth continues but at a slower pace. The Atlanta Fed staff’s latest guess for Q3 growth is 1.80%. The New York Fed’s Nowcast stands at 1.90% for Q3 and it currently estimates the current quarter’s growth rate to slow to 1.10%.

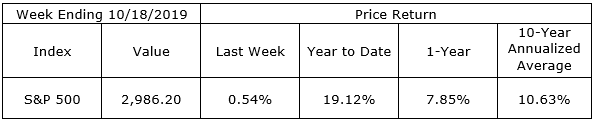

Last Week’s Market

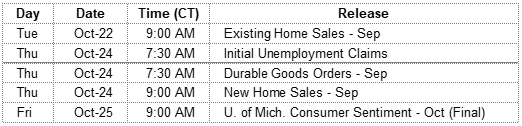

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.