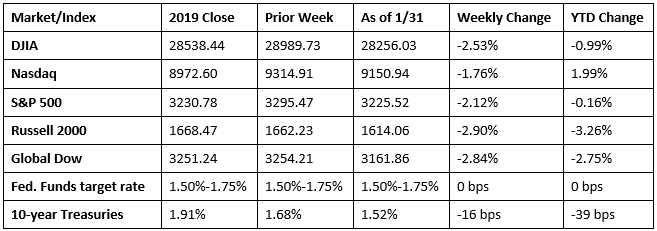

Investors continue to be rattled by the growing concern over the spread of the coronavirus, pulling money from stocks for the second week in a row. Each of the benchmark indexes listed here fell, led by the small caps of the Russell 2000, which lost close to 3.0% for the week. The Dow closed the week down more than 600 points while the S&P 500 dropped by more than 2.0%. The Global Dow also gave back almost 3.0% in value by last week’s end. Only the Nasdaq lost less than 2.0% — but not by much, closing the week down by 1.76%. As stock values plummeted, long-term bond prices soared, pushing yields significantly lower.

Oil prices dropped again last week, closing at $51.61 per barrel by late Friday afternoon, down from the prior week’s price of $54.21. The price of gold (COMEX) surged higher last week, closing at $1,592.70 by late Friday afternoon, up from the prior week’s price of $1,570.70. The national average retail regular gasoline price was $2.506 per gallon on January 27, 2020, $0.031 lower than the prior week’s price but $0.250 more than a year ago.

Last Week’s Economic News

- The initial, or advance, estimate of the gross domestic product showed the economy grew at an annual rate of 2.1% — the same as in the third quarter. In the fourth quarter, a downturn in imports, an acceleration in government spending, and a smaller decrease in nonresidential (business fixed) investment were offset by a larger decrease in private inventory investment and a slowdown in consumer spending. The price index for gross domestic purchases increased 1.5% in the fourth quarter, compared with an increase of 1.4% in the third quarter. The personal consumption expenditures price index increased 1.6%, compared with an increase of 1.5% in the third quarter. Excluding food and energy prices, the personal consumption expenditures price index increased 1.3%, compared with an increase of 2.1% in the prior quarter. Personal consumption expenditures (consumer spending) rose by 1.8% in the fourth quarter, compared with a 3.2% jump in the third quarter.

- Following its meeting last week, the Federal Open Market Committee voted to maintain the target range for the federal funds rate at 1.50%-1.75%. In support of its decision, the Committee noted that the labor market remains strong and that economic activity has been rising at a moderate rate. Although consumer spending has been rising at a moderate pace, business fixed investment and exports remain weak, and inflation continues to run below the Fed’s 2.0% target rate. The FOMC does not meet again until mid-March.

- Consumers saw their personal income (pre- and post-tax) grow by 0.2% in December (0.4% in November). Consumer spending increased by 0.3% in December (0.4% in November) while prices for consumer goods and services advanced by 0.3% (0.1% in November). Excluding food and energy, consumer prices increased 0.2%. For the year, consumer prices advanced 1.6%, well below the Fed’s 2.0% target for inflation.

- While sales of existing homes enjoyed robust gains in December, new home sales didn’t fare quite so well. Sales of new single-family homes dropped 0.4% in December from the prior month. Nevertheless, new home sales finished 2019 23% above the December 2018 totals. The median sales price of new homes sold in December was $331,400. The average sales price was $384,500. Inventory in December was at a 5.7-month supply (5.5 months in November).

- At first blush, December looked like a strong month for long-lasting, durable goods as new orders increased by 2.4% following a 3.1% slide in November. However, a closer look reveals that most of the gain was driven by a surge in defense aircraft. Excluding transportation, new orders for durable goods actually fell 0.1% in December. New orders for nondefense capital goods decreased 6.5% last month while core capital goods (excluding defense and aircraft) dropped 0.9%. Shipments of manufactured durable goods, down six consecutive months, decreased 0.2% in December. Not surprisingly, unfilled orders (-0.1%) fell while inventories (+0.5%) increased for the seventeenth of the last eighteen months.

- The international trade in goods deficit was $68.3 billion in December, up $5.3 billion from $63.0 billion in November. Exports of goods for December were $137.0 billion, $0.4 billion more than November exports. Imports of goods for December were $205.3 billion, $5.8 billion more than November imports. The trade in goods deficit this past December was $11.5 billion under the deficit in December 2018 ($79.8 billion).

- For the week ended January 25, there were 216,000 claims for unemployment insurance, a decrease of 7,000 from the previous week’s level, which was revised up by 12,000. According to the Department of Labor, the advance rate for insured unemployment claims remained at 1.2% for the week ended January 18. The advance number of those receiving unemployment insurance benefits during the week ended January 18 was 1,703,000, a decrease of 44,000 from the prior week’s level, which was revised up by 16,000.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Eye on the Week Ahead

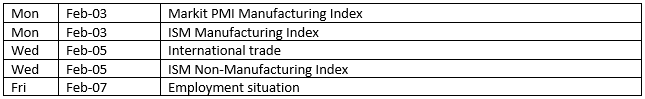

Industrial production and labor data headline this week’s economic reports. Purchasing managers’ surveys on the state of manufacturing for January are out at the beginning of the week. Industrial production in general, and manufacturing specifically, have been relatively weak for quite some time. On the other hand, employment has been strong. December saw 145,000 new jobs added, although wage growth for 2019 was less than 3.0%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.