Now is not the time to sell quality equities. The S&P 500 index closed down 30% from its all-time high just 18 trading days ago. At the same time, it is worth remembering that Monday’s low close was 253% above the Great Recession low on March 9, 2008. Investors need to stay focused on their personal plans and ignore the media’s reporting on the strategies of hedge funds managers and high frequency traders.

Simple calculations will show you and your family’s needs over the next 10, 15 and 20 years cannot be met by investing in 10-Year Treasury notes yielding 0.8%. The process of maintaining the purchasing power of your portfolio in the face of inflation over the long-term must include a significant allocation to financially sound, well managed companies. The price we must pay for this much needed long-term growth is the short-term volatility we are currently experiencing.

TCK’s investment process sells stocks when share prices exceed the intrinsic value of a company’s shares. These excess valuations almost always occur when market indexes are hitting new highs, not after they have declined 30%. Recent market declines are pricing shares below, sometimes well below, the intrinsic values of those shares. Now is the time to take advantage of discounted share prices. It is inconceivable that so many investors are selling stocks at today’s bargain prices. Truly wise investors are not selling out of fear but rather carefully buying to take up a position for long-term growth. Let us also remember a famous quote from our Berkshire Hathaway friend, Charlie Munger, as he explains his and his partner Warren Buffett’s enormous success, “If people weren’t wrong so often, we wouldn’t be so rich.”

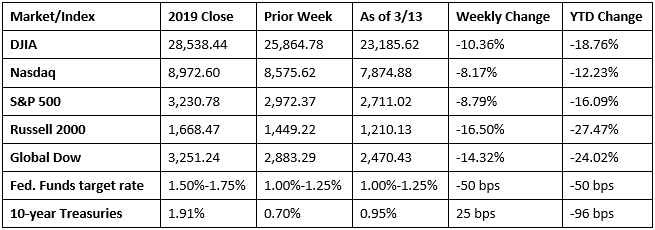

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The federal budget continued to expand in February. The deficit was $235.3 billion last month following January’s deficit of $32.6 billion. Last February, the deficit was $234.0 billion. Year-to-date, the deficit sits at $624.5 billion, $80.1 billion greater than the deficit over the same period last year. The largest source of revenue, individual income taxes, is $44.6 billion ahead of income taxes over the comparable period last year. Social Security continues to be the biggest expenditure, at $448.0 billion for this fiscal year, followed by national defense and Medicare, each of which has cost roughly $305.0 billion.

- Consumer prices rose 0.1% in February, the same bump as in January. Over the last 12 months ended in February, consumer prices are up 2.3%. Despite energy prices falling 2.0%, increases in food and shelter prices were enough to push overall consumer prices slightly higher.

- Producers saw their prices fall 0.6% in February after climbing 0.5% the previous month. Over the past 12 months ended in February, producer prices for goods and services have increased 1.3%. Prices for goods fell 0.9% in February, the largest decline since moving down 1.1% in September 2015. Over 60% of the broad-based February decrease can be traced to prices for energy, which dropped 3.6%. More specifically, gas prices fell 6.5% last month. Prices for services dropped 0.3% in February, the largest decline since last September. In February, over 70% of the decrease in prices for services can be traced to margins for trade services, which dropped 0.7%. (Trade indexes measure changes in margins received by wholesalers and retailers.)

- Prices for imports fell 0.5% in February after ticking up 0.1% the previous month. The decline in import prices was the largest decrease since a similar plunge last August. Since February 2019, import prices have fallen 1.2%. Import fuel prices decreased 7.7% in February, the largest monthly decline since the index dropped 7.8% in June 2019. Excluding fuel, import prices increased 0.3% in February. Export prices dropped 1.1% last month following a 0.6% increase in January. This marks the largest decrease in export prices since December 2015. Prices for exports declined 1.3% on a 12-month basis in February, after rising 0.4% from January 2019 to January 2020. Prices for agricultural exports declined 2.7% in February while nonagricultural export prices decreased 1.0%, pulled down by a drop in prices for industrial supplies and materials.

- For the week ended March 7, there were 211,000 claims for unemployment insurance, a decrease of 4,000 from the previous week’s level, which was revised down by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims remained at 1.2% for the week ended February 29. The advance number of those receiving unemployment insurance benefits during the week ended February 29 was 1,722,000, a decrease of 11,000 from the prior week’s level, which was revised up by 4,000.

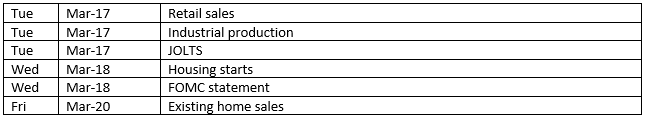

Eye on the Week Ahead

Although the Federal Open Market Committee was scheduled to meet later this week, the Committee gathered in an emergency session this past weekend and cut the federal funds rate to a range of 0.00%-0.25% — a 100 basis point slash, which, along with other moves, is intended to stabilize markets and the economy. The rate cut follows the House of Representatives passing of legislation that would make testing for the virus free and provide paid sick leave to certain workers.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.