Stocks opened the week as they closed the previous one — in a tailspin. However, aggressive moves by the Federal Reserve late in the day, coupled with the hope of a massive aid package from Congress, helped push stocks higher during early trading Tuesday.

News of the passage of massive stimulus legislation (see below) was enough of a positive impetus to send investors back to the markets in droves on Tuesday. The Dow surged to its highest single-day gain since 1933 as it climbed more than 11% by the end of the day. Unfortunately, as debate on the bill continued by the closing bell on Wednesday, the benchmark indexes gave back most of the previous day’s gains. The Dow closed up 2.39%, marking the first back-to-back daily gains since the first week of February.

Passage by the Senate of the coronavirus relief package Wednesday night spurred investor optimism as stocks surged Thursday, despite a record number of unemployment insurance claims primarily due to the COVID-19 virus. By the close of trading, each of the benchmark indexes had posted sizable gains, marking a legitimate bull run. But how long will it last?

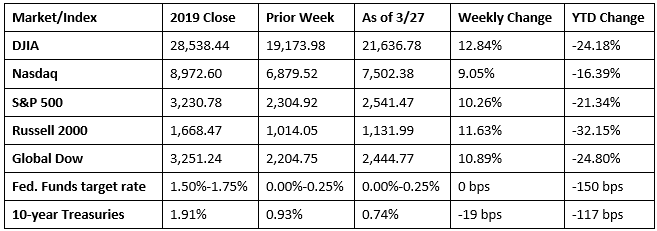

Unfortunately, the ride didn’t last as long as hoped as stocks closed last Friday in the red for the day, but significantly higher than they began the week. Following a volatile week of stock prices, the week closed with the Dow recording its best weekly gain since 1938. Ultimately, the passage of the massive coronavirus rescue package, referred to as the CARES Act, gave investors enough encouragement to plunge back into the market. Each of the benchmark indexes listed here posted double-digit weekly gains except for the tech stocks of the Nasdaq, which climbed 9.0% nonetheless. Long-term bond prices also rose, pushing yields lower by the end of the week as 10-year Treasuries yields fell almost 20 basis points.

Oil prices reversed course last week, closing marginally higher at $21.57 per barrel by late Friday afternoon, up from the prior week’s price of $19.84. The price of gold (COMEX) also spiked last week, closing at $1,625.30 by late Friday afternoon, up from the prior week’s price of $1,498.90. The national average retail regular gasoline price was $2.120 per gallon on March 23, 2020, $0.128 lower than the prior week’s price and $0.503 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Late last Friday afternoon, President Trump signed the CARES Act, a $2.2 trillion relief package, which is the largest emergency aid package in U.S. history. The legislation provides expanded unemployment benefits including an extra $600 per week, forgivable small business loans, funds to help bail out larger employers hurt by the virus, and cash payments to Americans estimated to reach up to 94% of all tax filers.

- The Federal Reserve called a third emergency meeting last Monday and unveiled a number of aggressive measures in an effort to help the American economy slowed by the coronavirus. In announcing its moves, the Fed warned, “it has become clear that our economy will face severe disruptions. Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.” The Fed’s moves are aimed at calming corporate debt markets and offering direct lending to businesses. The Fed committed to the establishment of a Main Street Business Lending Program, similar to the Small Business Administration, to support small and medium-sized businesses with the availability of direct loans.

- The third and final estimate for the fourth-quarter gross domestic product revealed that the economy grew at an annual rate of 2.1%, the same rate of growth as in the third quarter. In the fourth quarter, imports, private inventory investment, and consumer spending slowed, while government spending increased. Prices for consumer goods and services increased 1.4% in the fourth quarter. Excluding food and energy prices, consumer prices increased 1.3%. Consumer spending rose 1.8% in the fourth quarter, compared to an increase of 3.2% in the third quarter. The gross domestic product increased 2.3% in 2019, compared with an increase of 2.9% in 2018. Prices for consumer goods and services increased 1.4% last year, compared with an increase of 2.1% in 2018.

- In February, personal income increased 0.6% and disposable (after-tax) income increased 0.5%. Consumer spending climbed 0.2%, while consumer prices inched up 0.1%. Prices less food and energy increased 0.2%. Over the past 12 months, consumer prices are up 1.8% as inflationary pressures remain muted.

- Sales of new single-family homes fell 4.4% in February from the previous month. However, sales are 14.3% ahead of their February 2019 estimate. The median sales price of new houses sold in February 2020 was $345,900 ($325,300 in January). The average sales price was $403,800 ($384,000 in January). The estimate of new houses for sale at the end of February was 319,000. This represents a supply of 5.0 months at the current sales rate.

- New orders for manufactured durable goods increased 1.2% in February, marking the fourth increase out of the last five months. A 4.6% increase in transportation equipment drove the February gain. Excluding transportation, durable goods orders decreased 0.6%. Nondefense new orders for capital goods climbed 0.5% last month. Excluding aircraft, new orders for nondefense capital goods dropped 0.8%.

- The trade deficit for goods (excluding services) was $59.9 billion in February, down $6.0 billion from January’s deficit. Exports increased by $0.7 billion while imports fell $5.3 billion.

- For the week ended March 21, there were 3,283,000 claims for unemployment insurance, an increase of 3,001,000 from the previous week’s revised level, which was revised up by 1,000. This marks the highest level of seasonally adjusted initial claims in the history of the seasonally adjusted series. The previous high was 695,000 in October of 1982. According to the Department of Labor, the advance rate for insured unemployment claims remained at 1.2% for the week ended March 14. The advance number of those receiving unemployment insurance benefits during the week ended March 14 was 1,803,000, an increase of 101,000 from the prior week’s level, which was revised up by 1,000. This is the highest level for insured unemployment since April 14, 2018, when it was 1,824,000.

Eye on the Week Ahead

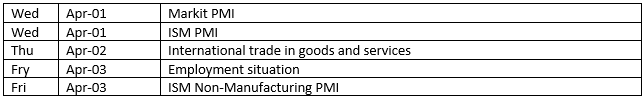

We are about to get more accurate information on the impact of the coronavirus on the economy with this week’s economic reports on employment and manufacturing. We may also begin to see whether the recently passed support legislation affects the stock market.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.