The week started with stock indexes falling sharply on the heels of an historic plunge of crude oil into negative territory. The Dow dropped nearly 600 points and more than 2.4% by Monday’s close. Minimal demand sent the prices for crude oil (CL=F) to -22.02 per barrel — down 222.06%.

Stocks continued to tumble on Tuesday as oil prices remained historically low. Each of the benchmarks listed here lost at least 2.3%, with the Nasdaq losing close to 3.5%. Concerns are increasing that the depressed demand for oil caused by the COVID-19 pandemic will continue well into the future. Also, the negative impact of the virus on the economy is being felt almost daily as more information is released.

The indexes recaptured some of the losses from earlier in the week on Wednesday. Some better-than-expected earnings reports, coupled with the Senate’s passage of a deal to add another $484 billion earmarked for the small business aid program, COVID-19 testing, and hospital support, provided positive news for investors.

Oil prices surged last Thursday and Congress voted for further aid to small businesses, helping to boost stocks, but only marginally. Unfortunately, test results of a drug that might offer treatment for COVID-19 may not be as promising as hoped, weakening stock returns.

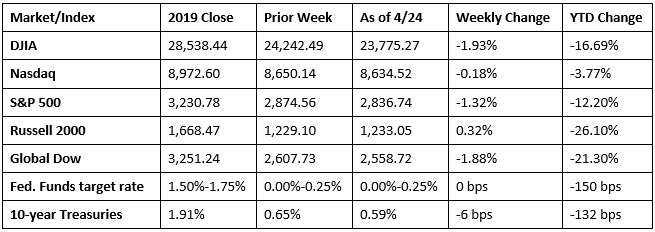

A rally pushed the benchmark indexes listed here higher last Friday, but not enough to avoid closing in the red for the week. The president signed a fourth piece of COVID-19 funding legislation last Friday. The Paycheck Protection Program and Health Care Enhancement Act, a $484 billion bill, provides over $320 billion in new funding to replenish the Paycheck Protection Program, plus new funding for Economic Injury Disaster Loans, $75 billion for hospitals and community health centers, and $25 billion to enhance COVID-19 testing. Oil prices rose Friday but remain at historic lows. Of the indexes listed here, only the Russell 2000 closed the week ahead of its prior-week mark, but only barely. Both the Dow and Global Dow ended the week down by nearly 2.0%, while the S&P 500 fell over 1.25%. The tech stocks of the Nasdaq finished close to even, falling about 0.2% for the week.

Crude oil prices suffered their worst one-week decline in history last week, ultimately closing at $17.13 per barrel by late Friday afternoon, down from the prior week’s price of $18.34. The price of gold (COMEX) rose last week, closing at $1,741.50 by late Friday afternoon, up from the prior week’s price of $1,694.50. The national average retail regular gasoline price was $1.812 per gallon on April 20, 2020, $0.041 lower than the prior week’s price and $1.029 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Following a robust February, sales of existing homes fell 8.5% in March. Despite the decline, existing-home sales are still slightly (0.8%) ahead of their pace a year ago. The median existing home price was $280,600 in March ($270,100 in February), which is 8.0% higher than the price in March 2019. Inventory rose 2.7% from February, representing a 3.4-month supply at the current sales pace.

- Sales of new single-family houses in March were 15.4% below the February rate and 9.5% lower than the sales pace of March 2019. The median sales price of new houses sold in March 2020 was $321,400. The average sales price was $375,300. The estimate of new houses for sale at the end of March was 333,000, which represents a supply of 6.4 months at the current sales rate.

- New orders for manufactured durable goods decreased $36.0 billion, or 14.4%, in March. This decrease, down following three consecutive monthly increases, followed a 1.1% February increase. Excluding transportation, new orders fell 0.2%. Excluding defense, new orders dropped 15.8%. Transportation equipment, down two of the last three months, led the decrease, down $35.6 billion, or 41.0%. New orders for nondefense capital goods plunged 33.4%.

- For the week ended April 18, there were 4,427,000 claims for unemployment insurance, a decrease of 810,000 from the previous week’s level, which was revised down by 8,000. According to the Department of Labor, the advance rate for insured unemployment claims was 11.0% for the week ended April 11, an increase of 2.8 percentage points from the previous week’s rate. This marks the highest level of insured unemployment rates in the history of the series. The advance number of those receiving unemployment insurance benefits during the week ended April 11 was 15,976,000, an increase of 4,064,000 from the prior week’s level, which was revised down by 64,000. Nevertheless, this marks the highest level of insured unemployment in the history of the series.

Eye on the Week Ahead

The initial estimate of the first-quarter gross domestic product is released later this week. The fourth quarter saw the economy grow at an annualized rate of 2.1%. It will be interesting to note the impact, if any, COVID-19 has had on the overall economy. The Federal Open Market Committee also meets this week. More stimulus and responsive actions from the Committee are expected following this meeting.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.