Stocks rebounded to begin last week on a positive note, as each of the benchmark indexes listed here posted notable gains by the close of trading last Monday. Tech stocks surged, pushing the Nasdaq up 1.9%. Hopes for a COVID-19 vaccine moved pharmaceutical shares higher. Energy shares fell as crude oil prices dropped. The dollar declined, while Treasury yields moved slightly higher.

Last Tuesday saw stocks post their second consecutive session of gains. Tech stocks and mega-caps continued to rebound. Other than the Dow, which was flat, each of the benchmark indexes listed here posted gains, led by the Nasdaq (1.2%), followed by the S&P 500 (0.5%), the Russell 2000, and the Global Dow, each of which gained 0.8%. Crude oil prices and Treasury yields rose, and the dollar was mixed against a basket of currencies.

Stocks were mixed last Wednesday, with the Dow, the Russell 2000, and the Global Dow posting modest gains, while the S&P 500 and the Nasdaq fell. Mega-caps and tech stocks reversed course from the prior few days and sank. Energy shares rose, boosted by advancing oil prices. Value stocks performed better along with financial shares. Treasury yields, the dollar, and crude oil prices each rose.

Last Thursday, each of the benchmark indexes gave back any gains from earlier in the week. Word that Congress and the president may be nearing an accord on a new round of stimulus wasn’t enough to keep money from flowing out of the market. Investors may have been perplexed by the confusing government rhetoric on when a COVID-19 vaccine would be available. Tech stocks and mega-caps took a big hit, pulling stock indexes lower. The Nasdaq lost 1.3%, the S&P 500 fell 0.8%, both the Russell 2000 and the Global Dow dropped 0.6%, and the Dow declined 0.5%. Treasury yields and the dollar fell, while crude oil prices rose.

Tech stocks and mega-caps continued to slide last Friday. Each of the benchmark indexes listed here lost value by the end of the day, with the S&P 500 and the Nasdaq each falling 1.1%, closely followed by the Dow (-0.9%), the Global Dow (-0.7%), and the Russell 2000 (-0.4%). Treasury yields advanced, crude oil prices fell, and the dollar rose.

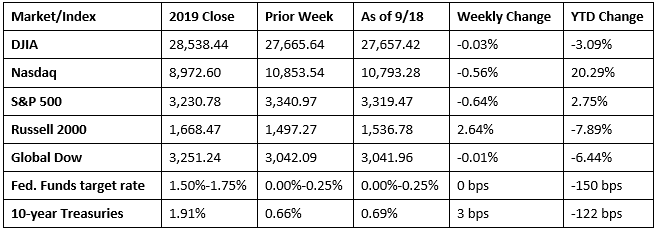

Overall, stocks lost value for the week. Mixed signals from the federal government as to whether and when a virus vaccine would be available, coupled with the Federal Reserve’s somber assessment of the state of the economy, prompted investors to pull away from equities. Only the small caps of the Russell 2000 gained value last week. The S&P 500, the Nasdaq, the Dow, and the Global Dow each fell behind. Despite the past few weeks of downturns, the Nasdaq remains solidly ahead of its year-end value. The S&P 500 is marginally ahead, while the other indexes listed here remain below their respective 2019 closing marks.

Crude oil prices rebounded last week, closing at $40.84 per barrel by late Friday afternoon, up from the prior week’s price of $37.76. The price of gold (COMEX) advanced last week, closing at $1,958.10, up from the prior week’s price of $1,950.00. The national average retail price for regular gasoline was $2.183 per gallon on September 14, $0.028 lower than the prior week’s price but $0.369 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Following its meeting held last week, the Federal Open Market Committee decided to keep the target range for the federal funds rate at 0.00%-0.25% and expects to maintain this target range until labor market conditions have reached maximum employment and inflation has risen to at least 2.0%, or exceeds 2% for some time. The Committee noted that economic activity and employment have picked up in recent months but remain well below their levels at the beginning of the year. Weaker demand and significantly lower oil prices are holding down consumer price inflation. Overall financial conditions have improved in recent months, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses. Nevertheless, the Committee noted that the path of the economy will depend on the course of COVID-19, which will continue to weigh on economic activity, employment, and inflation in the near term, while posing considerable risks to the economic outlook over the medium term.

- U.S. import prices rose 0.9% in August, following advances of 1.2% in July and 1.4% in June. Higher prices for both fuel (+3.3%) and nonfuel (+0.7%) imports contributed to the August increase. The increase in nonfuel prices was the largest since April 2011. Driving the nonfuel price increase was a 3.6% jump in industrial supplies and materials prices. Prices for U.S. exports also advanced in August, rising 0.5% after increasing 0.9% the previous month.

- According to the Federal Reserve, industrial production rose 0.4% in August for its fourth consecutive monthly increase. However, even after the recent gains, industrial production in August was 7.3% below its February pre-pandemic level. Manufacturing output continued to improve in August, rising 1.0%, but the gains for most manufacturing industries have gradually slowed since June. Mining production fell 2.5% in August, as Tropical Storm Marco and Hurricane Laura caused sharp but temporary drops in oil and gas extraction and well drilling. The output of utilities moved down 0.4%. The level of total industrial production was 7.7% lower in August than it was a year earlier.

- Sales at the retail level advanced 0.6% in August from the previous month and 2.6% above their August 2019 pace. Retail trade sales inched ahead 0.1% in August. Nonstore (online) retail sales were flat last month but are 22.4% ahead of August 2019. Retailers that had a favorable August include furniture and home furnishing stores (2.1%); building material and garden equipment and supplies dealers (2.0%); clothing and clothing accessories stores (2.9%); and food services and drinking places (4.7%). Retailers that slumped last month include sporting goods, hobby, musical instrument, and book stores (-5.7%); department stores (-2.3%); grocery stores (-1.6%); and food and beverage stores (-1.2%).

- Overall, housing starts and building permits fell in August, although the market for new single-family residential construction excelled. The number of building permits issued in August was 0.9% below the July total. However, single-family building permits were 6.0% higher than July. Housing starts also fell in August, dropping 5.1% below the prior month’s figure. Single-family housing starts rose by 4.1% last month. Housing completions fell 7.5% in August from July. Single-family housing completions were 4.4% below the July rate.

- For the week ended September 12, there were 860,000 new claims for unemployment insurance, a decrease of 33,000 from the previous week’s level, which was revised up by 9,000. According to the Department of Labor, the advance rate for insured unemployment claims was 8.6% for the week ended September 5, a decrease of 0.7 percentage point from the prior week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended September 5 was 12,628,000, a decrease of 916,000 from the prior week’s level, which was revised up by 159,000.

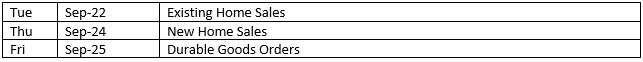

Eye on the Week Ahead

Two important reports in the housing sector are available this week. August data for both new and existing home sales should reveal continued growth, following July’s robust sales report. Orders for durable goods are also out this week for August. July saw new orders jump more than 11.0% as the economy continues to slowly pick up steam.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.