Concern over a surge in COVID-19 cases drove equities lower last Monday. Each of the major indexes listed here fell, with the Dow plunging -2.3% and the S&P 500 (-1.9%) suffering its biggest one-day decline in a month. The losses could have been much worse had it not been for some encouraging words from House Speaker Nancy Pelosi on a fiscal stimulus deal. Nevertheless, an acceleration in COVID-19 cases coupled with the delay in fiscal stimulus was not a favorable combination of events for stocks. China’s plan to sanction major companies over arms sales to Taiwan added to the market’s slide. Each of the major market sectors took a hit with energy, communication services, financials, industrials, and information technology each sinking more than 2.0%. The dollar and Treasury yields rose, while crude oil prices sank.

The Dow fell for the third straight trading day last Tuesday. The Nasdaq was the only benchmark listed here that gained value. Among market sectors, financials and industrials took the brunt of the day’s losses. Gains in communication services, information technology, and consumer discretionary weren’t enough to stem the tide. The dollar and Treasury yields fell, while crude oil prices gained as oil producers shut down production ahead of Tropical Storm Zeta.

What was a minor tumble in stocks last Tuesday morphed into a thumping by the end of trading the following day. Each of the benchmark indexes plunged at least 3.0% last Wednesday in what turned out to be the worst day in the market in four months. Rising COVID-19 cases in the U.S. and Europe increased the prospect of tougher lockdowns, which sent equities, both here and abroad, plummeting. Adding to investor concerns is the possibility that the results of the upcoming presidential election may be contested. Treasury bond yields and the dollar each rose, while crude oil prices sank below $38 per barrel. Each of the market sectors plunged with energy, information technology, and communication services falling more than 4.0%, respectively.

Equities reversed course last Thursday and posted moderate to impressive gains. Mega-caps provided a big push as investors took advantage of lower stock prices resulting from days of declines. Favorable earnings reports and a solid third-quarter gross domestic product report also helped drive stocks higher. The Nasdaq was the big winner, gaining 1.6%, followed by both the Russell 2000 and S&P 500 (1.2%), the Dow (0.5%), and the Global Dow (0.3%). Treasury yields climbed nearly 7.0% as bond prices plunged. Crude oil prices continued to fall, while the dollar rose.

Last Friday saw stocks finish the day and week in the red. Each of the benchmark indexes listed here lost value at the close of trading, with the Nasdaq (-2.5%) suffering the largest drop, followed by the Russell 2000 (-1.5), the S&P 500 (-1.2), the Dow (-0.6%), and the Global Dow (-0.3%). Investors sold off on worsening pandemic fears. The mega-caps led the decline with many of the major market sectors following suit. Only energy and financials inched ahead last Friday. Crude oil prices declined, Treasury yields grew by 3.0%, and the dollar was mixed.

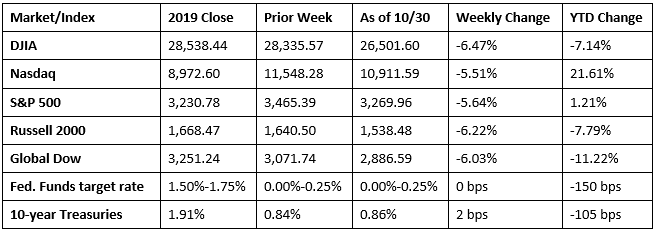

For the week, each of the major indexes fell by at least 5.5%. The Dow led the weekly tumble, followed by the Russell 2000, the Global Dow, the S&P 500, and the Nasdaq. Year to date, the Nasdaq is still well in front of last year’s closing value, while the S&P 500 is barely ahead. The remaining indexes are well off their respective 2019 marks.

Crude oil prices plunged lower last week, closing at $35.61 per barrel by late Friday afternoon, down from the prior week’s price of $39.75 per barrel. The price of gold (COMEX) closed the week at $1,878.00, down from the prior week’s price of $1,904.90. The national average retail price for regular gasoline was $2.143 per gallon on October 26, $0.007 lower than the prior week’s price and $0.453 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The economy picked up steam in the third quarter according to the initial, or advance, estimate of the gross domestic product report. The GDP increased at an annual rate of 33.1% after falling 31.4% in the second quarter. The increase in third-quarter GDP reflected continued efforts to reopen businesses and resume activities that were postponed or restricted due to COVID-19. The increase in real GDP reflected increases in personal consumption expenditures (PCE), private inventory investment, exports, nonresidential fixed investment, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased. The personal consumption expenditures price index increased 3.7%, in contrast to a decrease of 1.6% in the second quarter. Excluding food and energy prices, the PCE price index increased 3.5%, in contrast to a second quarter decrease of 0.8%.

- Consumer prices rose by 0.2% in September and are up 1.4% over the last 12 months. Personal income and disposable personal income each increased 0.9%. The gain in personal income was driven by proprietors’ income, which increased 5.1% in September over the prior month. Consumer spending ramped up 1.4% in September after advancing 1.0% the prior month.

- Sales of new single-family homes dipped in September from August. According to the latest information from the Census Bureau, new home sales fell 3.5% in September from the previous month. This marks the first decline in new home sales since March of this year. Nevertheless, sales are 32.1% above the September 2019 estimate. The median sales price of new houses sold in September 2020 was $326,800. The average sales price was $405,400. The estimate of new houses for sale at the end of September was 284,000, representing a supply of 3.6 months at the current sales rate.

- New orders for manufactured durable goods increased by 1.9% in September. This increase, up five consecutive months, followed a 0.4% August increase. Excluding transportation, new orders increased 0.8%. Excluding defense, new orders increased 3.4%. Transportation equipment, up four of the last five months, led the increase, climbing 4.1%. Shipment of durable goods increased 0.3% last month following a 0.3% August decrease. Unfilled orders fell 0.2% while inventories increased 0.4% following three consecutive monthly decreases. Nondefense new orders for capital goods in September increased 10.4%. Defense new orders for capital goods in September decreased 22.3%.

- The international trade in goods deficit was $79.4 billion in September, 4.5% below the August deficit. Exports of goods were $122.0 billion, 2.7% higher than exports in August. Imports of goods were $201.4 billion, 0.2% less than August imports.

- For the week ended October 24, there were 751,000 new claims for unemployment insurance, a decrease of 40,000 from the previous week’s level, which was revised up by 4,000. According to the Department of Labor, the advance rate for insured unemployment claims was 5.3% for the week ended October 17, a decrease of 0.5 percentage point from the prior week’s rate, which was revised up by 0.1 percentage point. The advance number of those receiving unemployment insurance benefits during the week ended October 17 was 7,756,000, a decrease of 709,000 from the prior week’s level, which was revised up by 92,000. For perspective, a year ago there were 217,000 initial claims for unemployment insurance, the rate for insured unemployment claims was 1.2%, and 1,700,000 people were receiving unemployment insurance benefits.

Eye on the Week Ahead

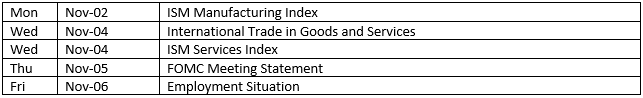

Election week will have plenty of news that will keep investors quite busy. Aside from the presidential election, a couple of reports are out that can move the market. The employment numbers for October are available this Friday. September saw 661,000 new jobs added and the unemployment rate dip to 7.9%. It is likely that hirings in October may not be quite as robust, but the unemployment rate should continue to drop. The Federal Open Market Committee meets this week. No change in the target interest rate is expected. However, it will be interesting to see what the Committee thinks about the economy currently and in the future.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.