Stocks ended last Monday mostly higher, as a rise in Treasury prices sent yields lower, which offered a boost to equities, particularly tech shares. The Nasdaq jumped 1.2%, the S&P 500 gained 0.7%, and the Dow rose 0.3%. Small-cap shares underperformed, driving the Russell 2000 down 0.9%. The Global Dow dipped 0.2%. Crude oil prices advanced, while the dollar weakened. Market sectors that gained included information technology, consumer staples, real estate, communication services, consumer discretionary, materials, and health care. Financials, energy, industrials, and utilities fell.

Stocks plunged last Tuesday as investors feared a delay in global economic reopenings following a rise in COVID-19 cases in Europe. Further adding to investor angst was news that the housing sector, which had been soaring, receded in February. Small caps continued to underperform, driving the Russell 2000 down 3.6%. The Global Dow lost 1.2%, the Nasdaq fell 1.1%, the Dow dipped 0.9%, and the S&P 500 gave back 0.8%. Treasury yields and crude oil prices plummeted, while the dollar gained. Utilities (1.5%), consumer staples (0.4%), and real estate (0.4%) were the only market sectors to advance. Materials (-2.1%), industrials (-1.8%), financials (-1.4%), and energy (-1.4%) declined the most.

Last Wednesday proved to be a rough day for equities as losses in communication services, consumer discretionary, and information technology outweighed gains in energy, industrials, and materials. The Russell 2000 and the Nasdaq were hit the hardest, falling 2.4% and 2.0%, respectively. The Global Dow and the S&P 500 each declined 0.6%, while the Dow broke even on the day. The yield on 10-year Treasuries dipped, while the dollar gained. Crude oil prices surged, partly due to the blockage of the Suez Canal by a giant cargo ship.

A rally last Thursday pushed stocks higher, rebounding from the dismal returns of the prior day. The Russell 2000 advanced 2.3%, but remains nearly 8.0% below its mid-February high. The Dow gained 0.6%, followed by the S&P 500 (0.5%), the Global Dow (0.4%), and the Nasdaq (0.1%). Financials, industrials, and materials were the leading sectors, while communication services and information technology lost value. Treasury yields closed unchanged from the previous day, while crude oil continued to fall. The dollar rose 0.4%.

Friday saw the S&P 500 enjoy its best day in three weeks, as each of the benchmark indexes posted solid gains by the close of trading. Investors were optimistic after President Biden promised to double the vaccine output and the Federal Reserve eased restrictions on dividends for banks. Energy, materials, real estate, and information technology each gained at least 2.5%, with only communication services lagging. The Russell 2000 led the way, adding 1.8%, followed by the S&P 500 (1.7%), the Global Dow (1.6%), the Dow (1.4%), and the Nasdaq (1.2%). Treasury yields and crude oil prices advanced, while the dollar dipped marginally.

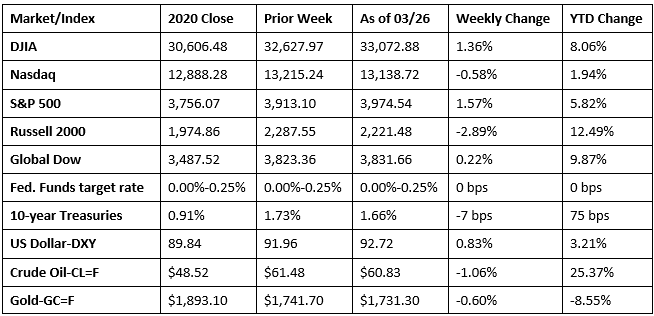

Equities ended the week mixed, with large caps outperforming small caps. The S&P 500 (1.6%) and the Dow (1.4%) advanced, while the Russell 2000 (-2.9%) and the Nasdaq (-0.6%) could not recover from their respective losses earlier in the week. Among the sectors, only communication services (-1.8%) and consumer discretionary (-0.2%) lost value. The remaining sectors enjoyed a solid week, led by real estate (4.3%), consumer staples (4.0%), and energy (3.1%). The yield on 10-year Treasuries fell, as did crude oil prices and gold. Despite Friday’s downturn, the dollar advanced for the week.

The national average retail price for regular gasoline was $2.865 per gallon on March 22, $0.012 per gallon more than the prior week’s price and $0.745 higher than a year ago. Over the same period, the national average retail price for diesel fuel was $3.194 per gallon, $0.003 per gallon above the prior week’s level and $0.535 higher than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The third and final estimate of fourth-quarter gross domestic product showed the economy grew at an annualized rate of 4.3%, 0.2 percentage point ahead of the second estimate but well below the stimulus-injected, third-quarter estimate of 33.4%. The increase in GDP reflected increases in exports, nonresidential (business) fixed investment, personal consumption expenditures (consumer spending), residential fixed investment, and private inventory investment that were partly offset by decreases in state and local government spending as well as federal government spending (reflecting fewer fees paid to administer the Paycheck Protection Program loans). Imports, which are a subtraction in the calculation of GDP, increased. The increase in exports primarily reflected an increase in goods (led by industrial supplies and materials). The increase in nonresidential fixed investment was primarily due to an increase in equipment (led by transportation equipment). The increase in personal consumption expenditures was mainly attributable to an increase in services (led by health care). The increase in residential fixed investment was largely driven by an increase in the sale of single-family homes. The increase in private inventory investment primarily could be traced to an increase in manufacturing, including both durable and nondurable goods industries.

- Inflation, as measured by the personal consumption expenditures price index, rose 0.2% in February, and only 0.1% excluding foods and energy. In what may soften fears of mounting inflationary pressures, consumer prices rose 1.6% over the 12 months ended in February, an increase of only 0.2 percentage point over the 12-month increase ended in January. Consumers earned less and spent less in February compared to January. Personal income fell 7.1% last month, while disposable (after-tax) personal income plunged 8.0%. Personal consumption expenditures, a measure of consumer spending, decreased 1.0% in February after increasing 3.4% in January.

- The housing sector slowed in February. Sales of existing homes dropped 6.6% in February after surging in both December and January. Year over year, existing home sales were up 9.1%. Low inventory is believed to be the primary reason for the decline in existing home sales in February. The median existing home price in February was $313,000, up from the January price of $303,900 and 15.8% over the January 2020 price of $270,400. Total housing inventory is at a scant 2.0-month supply at the current sales pace. Sales of existing single-family homes also fell 6.6% in February but are up 8.0% from a year ago. The median existing single-family home price was $317,100 in February, well above the January price of $308,300 and up 16.2% from the February 2020 price.

- Sales of new single-family homes also declined last month, plunging 18.2% from January. However, new home sales remained 8.2% above the February 2020 estimate. The median sales price of new houses sold in February 2021 was $349,400 ($353,200 in January). The average sales price was $416,000 ($410,400 in January). Available inventory actually increased to a 4.8-month supply in February, up from 3.8 months in January.

- New orders for durable goods fell 1.1% in February after increasing 3.5% the previous month. Transportation led the decrease, falling 1.6% in February after five monthly increases. Within transportation, new orders for motor vehicles and parts decreased 8.7%, while new orders for nondefense aircraft and parts vaulted 103.3%. In February, shipments dropped 3.5%, while unfilled orders (0.8%) and inventories (0.7%) increased. New orders for nondefense capital goods in February increased 5.6%. Conversely, new orders for defense capital goods plunged 10.6% last month.

- The international trade in goods deficit was $86.7 billion in February, an increase of $2.1 billion, or 2.5%, over January’s deficit. Exports of goods for February were $130.1 billion, which is $5.1 billion, or 3.8%, less than January exports. Imports of goods for February were $216.9 billion, down $3.0 billion, or 1.4%, less than January imports. Automotive vehicles contributed to the drop in both imports (-10.7%) and exports (-5.9%). Year over year, exports are down 5.4% while imports are up 10.1%, indicative of the relative weakness in domestic trade during the pandemic.

- For the week ended March 20, there were 684,000 new claims for unemployment insurance, a decrease of 97,000 from the previous week’s level, which was revised up by 11,000. According to the Department of Labor, the advance rate for insured unemployment claims was 2.7% for the week ended March 13, a decrease of 0.2 percentage point from the previous week’s rate. For comparison, during the same period last year, there were 3,307,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%, as the full effects of the pandemic on the labor market were becoming evident. The advance number of those receiving unemployment insurance benefits during the week ended March 13 was 3,870,000, a decrease of 264,000 from the prior week’s level, which was revised down by 2,000. States and territories with the highest insured unemployment rates in the week ended March 6 were in Pennsylvania (5.8%), the Virgin Islands (5.6%), Nevada (5.4%), Alaska (5.3%), New York (4.9%), Connecticut (4.8%), Rhode Island (4.5%), Massachusetts (4.1%), and New Mexico (4.1%). The largest increases in initial claims for the week ended March 13 were in Texas (+24,492), Illinois (+13,692), Indiana (+4,728), Alabama (+2,914), and Massachusetts (+2,560), while the largest decreases were in Ohio (-12,987), West Virginia (-3,321), South Carolina (-2,711), Mississippi (-2,117), and New York (-935).

Eye on the Week Ahead

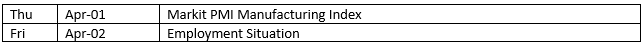

There isn’t much out this week in the way of economic reports other than the employment figures for March. Nearly 380,000 new jobs were added in February, but the unemployment rate was still a lofty 6.2%. With unemployment claims remaining relatively high, the March employment report isn’t expected to greatly surpass the prior month’s figures. The markets are generally closed for the week following Thursday’s trading in observance of Good Friday.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.