Stocks opened last week generally down, with only the Dow posting a marginal 0.3% gain. The Russell 2000 plunged 2.8%, the Nasdaq dropped 0.6%, while the Global Dow and the S&P 500 each slipped 0.1%. The sectors were mixed, with utilities, consumer staples, communication services, and health care pushing ahead, while energy, financials, information technology, consumer discretionary, materials, and real estate fell. The yield on 10-year Treasuries, crude oil prices, and the dollar advanced.

The Dow retreated from a three-day surge, falling 0.3% last Tuesday. The S&P 500 also dropped 0.3%, and the Nasdaq lost 0.1%. The Russell 2000 recovered from a notable tailspin after gaining 1.7%. The Global Dow inched ahead 0.2%. Treasury yields and the dollar advanced, while crude oil prices dropped nearly 2.0%. Consumer discretionary, financials, and industrials were the only sectors to post gains. Each of the remaining sectors declined, led by consumer staples, which sank 1.1%.

Tech stocks and cyclicals surged last Wednesday, driving equities higher. The Nasdaq (1.5%) and the Russell 2000 (1.4%) led the way, with the S&P 500 posting a moderate (0.4%) gain. The Dow fell 0.3% and the Global Dow dropped 0.5%. Consumer discretionary, information technology, utilities, communication services, and health care gained ground, while energy and financials faded. Crude oil prices and the dollar fell. The yield on 10-year Treasuries jumped higher.

The market closed for the week following last Thursday’s trading in observance of Good Friday. Stocks ended the first day of the second quarter in fine fashion. The S&P 500 topped 4,000 for the first time as investors were encouraged by President Biden’s $2.25 trillion spending plan. Tech shares led the surge, followed by value stocks. Each of the benchmark indexes closed last Thursday well in the black, led by the Nasdaq (1.8%), followed by the Russell 2000 (1.3%) and the S&P 500 (1.2%), with the Global Dow and the Dow each gaining 0.5%. Only consumer staples, health care, and utilities closed the day in the red. Communication services, energy, and information technology all rose above 2.0%. Yields on 10-year Treasuries declined 3.8% and the dollar fell 0.4%. Crude oil jumped 3.5%.

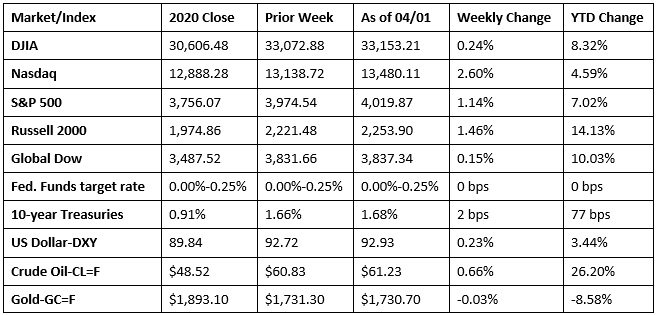

A late-week surge pushed stocks higher overall last week. The Nasdaq, which had been weakening as investors retreated from tech shares, climbed 2.6%. The small caps of the Russell 2000 continued to climb. The S&P 500 reached an all time high, while the Dow and the Global Dow posted modest weekly gains. Information technology posted a 4.7% gain for the week, making it the top-performing sector, followed by communication services, consumer discretionary, and real estate, each of which advanced about 3.0%. Treasury yields closed the week up slightly. Crude oil prices closed last week above $61.00 per barrel. The dollar advanced, while gold continued to slide. The Russell 2000 continues to lead the pack, year to date, followed by the Global Dow, the Dow, the S&P 500, and the Nasdaq.

The national average retail price for regular gasoline was $2.852 per gallon on March 29, $0.013 per gallon less than the prior week’s price but $0.847 higher than a year ago. Over the same period, the national average retail price for diesel fuel was $3.161 per gallon, $0.033 per gallon below the prior week’s level but $0.575 higher than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- There were a whopping 916,000 new jobs added in March, reflecting the continued resumption of economic activity that had been curtailed by the COVID-19 pandemic. Nevertheless, total employment is down 8.4 million, or 5.5%, from its pre-pandemic peak in February 2020. Job growth in March was widespread, with the largest gains occurring in leisure and hospitality, public and private education, and construction. The unemployment rate edged down 0.2 percentage point to 6.0%, well below its April 2020 high of 14.7%, but still 2.5 percentage points higher than its pre-pandemic level in February 2020. The number of unemployed persons, at 9.7 million, continued to trend down in March but is 4.0 million higher than in February 2020. The number of persons on temporary layoff declined by 203,000 in March to 2.0 million. This measure is down considerably from the recent high of 18.0 million in April 2020 but is 1.3 million higher than in February 2020. The number of permanent job losers, at 3.4 million, was little changed in March but is 2.1 million higher than February 2020. The labor force participation rate changed little at 61.5% in March. This measure is 1.8 percentage points lower than in February 2020. The employment-population ratio, at 57.8%, was up by 0.2 percentage point over the month but is 3.3 percentage points lower than in February 2020. In March, 21.0% of employed persons teleworked because of the pandemic, down from 22.7% in the prior month. In March, 11.4 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic — down from 13.3 million from the previous month. In March, average hourly earnings fell by $0.04 to $29.96. Average hourly earnings have increased 4.2% since March 2020. The average workweek increased by 0.3 hour to 34.9 hours in March.

- According to the latest report, the IHS Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) registered 59.1 in March, the second-strongest improvement in the manufacturing sector since May 2007. New orders enjoyed their steepest rise since June 2014, despite production being curtailed due to supply shortages. Increased customer demand is fueling a buildup in backlog orders, but also driving selling prices higher.

- For the week ended March 27, there were 719,000 new claims for unemployment insurance, an increase of 61,000 from the previous week’s level, which was revised down by 26,000. According to the Department of Labor, the advance rate for insured unemployment claims was 2.7% for the week ended March 20, unchanged from the previous week’s rate. For comparison, during the same period last year, there were 5,985,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 2.1%, as the effects of the pandemic continued to impact the labor market. The advance number of those receiving unemployment insurance benefits during the week ended March 20 was 3,794,000, a decrease of 46,000 from the prior week’s level, which was revised down by 30,000. States and territories with the highest insured unemployment rates in the week ended March 13 were in Pennsylvania (5.5%), Nevada (5.4%), Alaska (5.0%), Puerto Rico (4.9%), Connecticut (4.7%), New York (4.4%), California (4.0%), Rhode Island (4.0%), the Virgin Islands (4.0%), and Illinois (3.9%). The largest increases in initial claims for the week ended March 20 were in Massachusetts (+11,386), Texas (+7,599), Connecticut (+4,170), Maryland (+2,605), and Virginia (+2,035), while the largest decreases were in Illinois (-55,580), Ohio (-45,808), California (-13,331), New York (-4,251), and Florida (-2,991).

Eye on the Week Ahead

The Producer Price Index for March is available this week. The prices that producers charge for goods and services jumped 0.5% in February and were up 2.8% for the year.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.