The rally in stocks has taken a breather ahead of the release of first quarter earnings which will be in full swing beginning this week. FactSet’s latest expectations are for the S&P calendar year to have a revenue growth of 5.3% and the calendar year to have an earnings growth of 9.8%. At some point, solid earnings growth will be necessary to increase the denominator in the P/E formula in order to support what are relatively high current stock valuations. Solid revenue and earnings growth is essential.

What We Are Watching So You Don’t Have To

On The One Hand

- U.S. import prices declined 0.2% in the month of March, driven by fuel prices. February was revised upward to an increase of 0.4%. U.S. export prices rose 0.2% in March. February was left unchanged at a 0.3% increase.

- Initial unemployment claims declined 1,000 to 234,000 while continuing claims for the week dropped by 7,000 to 2.028 million.

- The University of Michigan preliminary Index of Consumer Sentiment reported an increase to 98.0 (Briefing.com consensus 96.3) from the final reading of 96.9 for March.

- Final demand PPI was down 0.1% in March. Producer prices are up 2.3% in the past year, the largest twelve-month rise since March 2012.

On The Other Hand

- The Consumer Price Index decreased 0.3% in March.

- Advance estimates of U.S. retail and food services sales for March declined 0.2% from the previous month. Retail sales were 5.2% above year ago levels.

All Else Being Equal

Interest rates are a barometer for real economic growth and inflationary expectations. So far, market interest rates indicate little expectation in which U.S. GDP growth rates will improve significantly in the near future. On the inflationary front, continued low interest rates imply inflation is not expected to be a significant problem anytime soon. Another source of demand for Dollar denominated, U.S. Treasury debt is international buyers seeking a safe haven in times of geopolitical tensions and economic uncertainty. A new twist in markets since the financial panic which began in 2008 is the expansion and contraction of central bank balance sheets which have the potential to mask normal market forces.

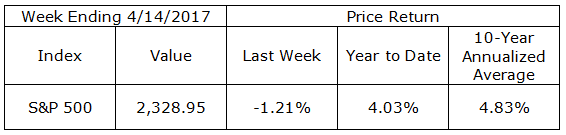

Last Week’s Market

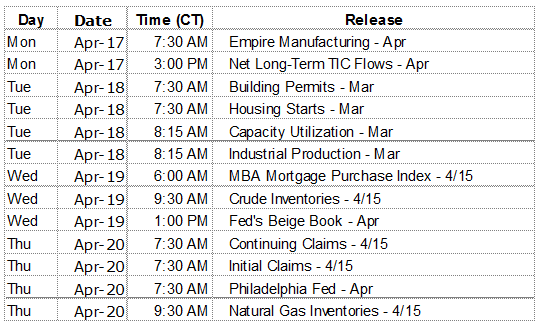

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.