Tax policy, interest rates, trade policies, regulatory reform, job growth, consumer spending and finance, technological transformation, and political dysfunction are potentially disruptive. Investors must continuously monitor these and other changing external variables and make corresponding adjustments to their models for the economy and securities markets. These changing variables are part of life, but change is not an enemy of an investment plan.

In addition to external variables, investors also monitor the personal variables they face. Personal health, the needs of children and grandchildren, the well-being of aging parents, personal relationships, work and professional life, personal accomplishments outside of work, retirement plans and life in retirement are the types of internal variables addressed in personal financial plans. The changing, personal challenges that must be planned for are not foes of a sound investment process.

The real enemy of investors is within us. Behavioral finance, presented in recent years as a new field of study, has been understood by investment professionals for generations. Jesse Livermore, a well know speculator in the early 1900s, identified the chief enemies of investors as the natural human emotions we experience that interfere with rational decision making. He observed, “It is inseparable from human nature to hope and to fear.” Modern studies have begun to quantify the effects of our emotions on investment and other financial decision making. Our emotions, especially the emotions of fear and hope are so powerful that left unchecked they will overwhelm rational thinking. It is critical to be aware of these emotions and examine these feelings whenever they arise. These enemies within, if left unchecked, will have us buying into market tops and selling out at market lows and at those moments the decisions will “feel” right even though they will be factually disastrous over time. Investment decisions require rational analysis. Our emotions, the fear of loss in particular, will prevent sound decision making if left unchecked. Like Pogo said, “We have met the enemy and he is us.”

On The One Hand

- Personal income rose 0.4% in September, matching expectations. Personal consumption increased 1.0%, beating expectations by 0.1%. Personal income is up 3.0% in the past year, while spending is up 4.4%. The Personal Consumption Expenditure (PCE) deflator rose 0.4% in September, putting consumer inflation 1.6% versus a year ago.

- The third quarter Employment Cost Index reported compensation costs for civilian workers increased 0.7%, following a 0.5% increase for the second quarter. Wages and salaries, which are approximately 70% of compensation costs, were 0.7% higher while benefits, which make up the difference, rose 0.8%. For the year, compensation costs increased 2.5%, with a wage and salary increase of 2.5% and a benefit cost increase of 2.4%.

- The Chicago Purchasing Managers Index (PMI), rose to 66.2 in October from 65.2 in September. The PMI is now at its highest reading since March 2011.

- The Conference Board’s Consumer Confidence Index rose to 125.9 in October, from an upwardly revised 120.6 in September.

- October U.S. light vehicle sales were a seasonally adjusted annual rate (SAAR) of 18.09 million units versus a SAAR of 18.57 million units for September and the SAAR of 17.87 million units for October 2016.

- Initial unemployment declined by 5,000 to 229,000 and continuing claims were down 15,000 to 1.884 million.

- Third quarter productivity increased 3.0%, rising at the fastest pace in three years. Unit labor costs were up 0.5% for the quarter.

- October nonfarm payrolls increased by 261,000 but adding the 90,000 job upward revisions in the previously reported September and August jobs numbers brings the total jobs increase to 351,000. The October unemployment rate was 4.1%. The U-6 unemployment rate, which includes discouraged workers and part-timers who want full-time work, fell to 7.9%, the lowest since 2006. The labor force participation rate disappointed with a reading of 62.7% in October compared to 63.1% in September.

- Total trade is up 5.4% in the year ending September. Exports for the period rose 4.6% and imports rose 6.0%. The trade deficit rose by $0.7 billion during the month, in line with expectations.

- Service sector activity grew last month. The ISM Non-Manufacturing Index increased from 59.8% in September to 60.1% in October

- Factory orders increased 1.4% in September

On The Other Hand

- The Institute of Supply Managers’ Manufacturing Index declined to 58.7 in October from its September reading of 60.8.

- Headline construction spending rose 0.3% in September but the gain was offset by the downward revision of 0.4% to the August increase.

All Else Being Equal

Reports continue to indicate solid, if subdued growth in the economy. While severe in the areas of the country directly affected, the short-term impact from the hurricanes has been insignificant in the economy as a whole.

A slight increase in compensation costs in the third quarter was not enough to trigger inflation fears. The consumer confidence reading hit its highest level since December 2000. The ISM Manufacturing Index, while lower in October, still hovers near the highest reading for the index since May 2004. The productivity report was a positive sign U.S. economic activity and workers’ standards of living may begin to improve at a faster pace. The Federal Open Market Committee declined to increase rates during last week’s meeting.

The GDPNow model, developed and maintained by the Atlanta Fed, currently forecasts real fourth quarter GDP growth of 3.3%.

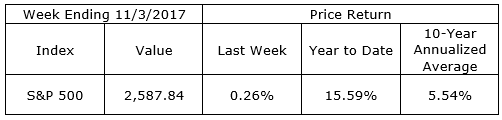

Last Week’s Market

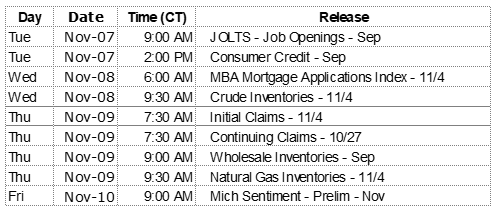

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.