The lack of volatility is again being discussed as a sign of the end of the bull market. Low volatility by itself is not a danger to markets. Markets become dangerous when low volatility causes investors to become complacent. Long periods of low volatility can lull investors into becoming comfortable with typically risky assets to the point of overconfidence. As low volatility becomes accepted as stability, investors become comfortable taking on more risk. Over allocation is a typical first response which can backfire when the calm comes to an end. A far greater danger for the markets arises when investors’ relaxed attitudes result in extreme use of leverage.

Leverage is the use of borrowed funds and/or derivatives (options and futures) in the effort to take on larger equity positions. Leverage increases the potential for over allocation which can ultimately turn price corrections into significantly larger and longer declines. Periods of high volatility will inevitably return and when they do, complacency will disappear and those who have allowed themselves to become over allocated will become anxious, even frantic sellers. Those who have leveraged their portfolios can easily suffer permanent loss. Those who have stuck to a process of investing rather than speculating with leverage can easily hold their high quality stocks through periods of sharp, temporary decline and will even be able to take advantage of such declines by purchasing shares which are “on sale”.

Low volatility is therefore not the problem. The problem arises when investors allow themselves to become complacent about risk during periods of low volatility then overreact in a negative way when periods of higher volatility return. Note that warnings about low volatility were also popular in early 2014 when the S&P 500 Index was at 1,870. Obviously, with the S&P 500 currently around the 2,570 mark, a fear of low volatility was not warranted. Volatility today remains low and while there are a few signs of over allocation, leverage does not appear to be a significant threat at present. Beware of leverage not low volatility.

On The One Hand

- The National Federation of Independent Business (NFIB): Small Business Optimism Index rose in October to 103.8, up from 103 the previous month.

- The Consumer Price Index (CPI) increased 0.1% in October. Core CPI rose 0.2%. Both figures were within expectations.

- Retail sales were up 0.2% in October and up 0.5% if the upward revisions to previous months are included. Expectations were for flat sales. The consensus expected no change. Retail sales are up 4.6% versus a year ago.

- Total business inventories were unchanged in September and total business sales increased 1.4% providing businesses with potential for some pricing power.

- Initial unemployment claims rose 10,000 to 249,000, the 141st straight week claims have been below 300,000. Continuing claims declined 44,000 to 1.86 million, the lowest level for continuing claims since December 29, 1973.

- Industrial production rose 0.9% in October and is now up 2.8% versus a year ago. The capacity utilization rate increased to 77.0% from an upwardly revised 76.4% in September.

- Housing starts rebounded sharply in October, increasing by 13.7% to a 1.290 million annual rate. Starts are down 2.9% versus a year ago. New building permits rose 5.9% in October to a 1.297 million annual rate. Compared to a year ago, permits for single-family units are up 7.7% while permits for multi-family homes are down 9.5%.

On The Other Hand

The October Producer Price Index (PPI) increased 0.4%, significantly higher than expectations. Core PPI was also up 0.4%. There may be effects of hurricane impacts in the pricing data but prices were rising well before the storms in Texas and Florida.

All Else Being Equal

The disappointing news in last week’s PPI report was real average hourly earnings which declined 0.1% in October. Earnings are up just 0.4% over the past year but the Bureau of Labor Statistics employment report shows overall worker earnings (which takes into account both wage gains and increased hours worked) rose at a 4% annual rate. Including the longer hours, consumers have healthy household balance sheets and room to increase spending.

Based on the data so far reported this quarter, the Atlanta Fed’s GDPNow model is forecasting real Q4 growth of 3.4%. The Federal Open Market Committee continues on track to raise the Fed Funds rate on December 13.

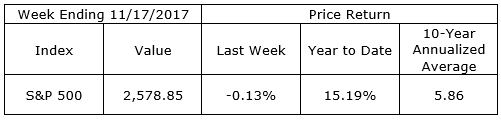

Last Week’s Market

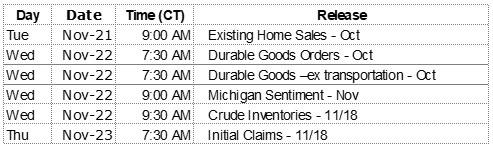

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.