Jason Zweig, author and investment and finance columnist for the Wall Street Journal, has written a good deal about the financial services industry. I like the summary he used at the end of one of his recent articles:

“A lot of Wall Street Journal readers have told me they think hiring a financial adviser is a waste of money. I disagree. A good adviser doesn’t only manage investments but can help you save or make a fortune through better decisions on tax, estate and retirement planning, buying or selling a home or business, and so on. Such advice is well worth paying for — and the biggest investment you can make in it is the time you put into picking the right person in the first place.”

More thoughts on selecting investment advisors are available in the short article, Paying for investment advice, posted by our CEO, Steve English.

On The One Hand

- Housing starts rose 3.3% in November to a seasonally adjusted annual rate of 1.297 million units. Building permits dipped 1.4% to a seasonally adjusted annual rate of 1.298 million.

- Existing home sales were up 5.6% in November to a seasonally adjusted annual rate of 5.81 million. The median existing single-family home price was up 5.4% year-over-year to $248,800. The inventory of homes for sale at the end of November was estimated to be 1.67 million, down 7.2% for the month and 9.7% on an annual basis.

- Third quarter real GDP, although revised slightly lower by one-tenth of one percent, remained at 3.2%. The GDP Deflator was unchanged at 2.1%. The PCE Price Index for the quarter also remained unchanged at 1.5%.

- The Philadelphia Fed Index jumped in December to 26.2 from 22.7 in November.

- Initial unemployment claims rose by 20,000 to 245,000 and continuing claims were higher by 43,000 to 1.932 million.

- The Leading Economic Index increased 0.4% in November, the 15th straight monthly increase in the index.

- Personal income increased 0.3% in November, following an unrevised 0.4% increase in October. Personal spending rose 0.6%, following a downwardly revised 0.2% increase in October. The PCE Price Index rose 0.2% for the month of November, putting the annual rate of increase at 1.8%.

- Durable orders rose 1.3% in November and the October orders figure was revised upward to -0.4% from the originally reported decline of 1.2%.

- New home sales rose sharply in November with a 17.5% gain to a seasonally adjusted annual rate of 733,000. Sales are up 26.6% from a year ago. The median price of new homes sold was $318,700 in November, up 1.2% from a year ago.

On The Other Hand

The final reading for the University of Michigan Consumer Sentiment survey for December was reported at 95.9, down from both the preliminary report of 96.8 and the final November reading of 98.5. On a positive note, the December reading was just slightly under the 2017 average of 96.8 which has been the highest average since 2000.

All Else Being Equal

This month is the ten year anniversary of the beginning of what is now known as the Great Recession. The National Bureau of Economic Research (NBER), the official declarer of the beginnings and ends of recessions, established December 2007 as the beginning of the financial crisis which continued through 2008 and into early 2009. The economists at the NBER were able to make this determination nearly twelve months after the fact in their release on November 28, 2008. Thanks for the hindsight.

Clients have asked for an explanation of the difference between a recession and a depression. I haven’t taken the time to check with the NBER for an official definition, relying instead on the belief the difference is in the eye of the beholder as Ronald Reagan explained many years ago. “Recession is when your neighbor loses his job. Depression is when you lose yours.”

In the desire to gain some foresight into our position in the current business cycle we glance at the Atlanta Fed who recently adjusted its forecast for real GDP to 2.8% growth in the current quarter. Another forecast is attempted by the New York Fed with its Nowcast, which is projecting current Q4 growth of 3.9% and Q1 2018 real GDP growth of 3.2%.

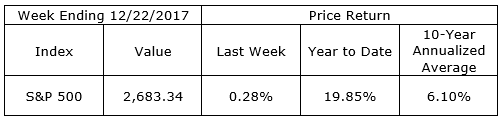

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.