In aggregate, buyers were more anxious than sellers last week. Fears of rapid acceleration in the rate of inflation temporarily faded. This likely reduced the fear of an immediate large increase in interest rates. With renewed expectations that the 10-Year Treasury yield will remain well under the 4% to 5% range, stocks again seemed the best short-term bet. Chaotic short-term swings in anxiety are again a feature of the stock market after many months of absence. Fears of inflation gloom return this week if the Consumer Price Index and Producer Price Index releases are much above expectations of 0.3% and 0.2% respectively.

Over the balance of the year and into early 2019, expectations for the economy are for them to continue on the path of growth with little chance of recession. Trade policies are a concern but do not yet appear to be at levels which would be disruptive. Another troublesome force would be a private sector leverage bubble of one form or another of which there are few signs at present. Inflation expectations may continue to be an underlying concern throughout the year but at present there is little in the data to indicate a significant acceleration in the rate of price increases.

On The One Hand

- The ISM Non-Manufacturing Index dipped slightly to 59.5 in February. It remained above the 50.0 dividing line between expansion and contraction and not far from January’s 59.9 reading which was the highest level for the index since August 2005.

- Nonfarm productivity in Q4 was revised slightly higher from a preliminary reading of -0.1% to an unchanged reading. Productivity is up 1.1% versus a year ago.

- The ADP Employment index showed private payrolls rose 235,000 in February.

- For the 157th week, initial unemployment claims remained below 300,000. They rose 21,000 to 231,000. Continuing claims declined by 64,000 to 1.870 million.

- Nonfarm payrolls increased by 313,000 in February beating the consensus by more than 100,000. Including revisions to prior months, the report added 367,000 jobs to the U.S. economy. Average hourly earnings were up 0.2% for the month putting the rate for the past 12 months at 2.6%. The average workweek in February was 34.5 hours up slightly from 34.4 the previous month. A rise in the labor force participation rate to 63.0% in February from 62.7% left the unemployment rate steady at 4.1%.

On The Other Hand

- Factory orders for manufactured goods declined 1.4% in January (Briefing.com consensus -1.3%) following an upwardly revised 1.8% increase (from 1.7%) in December.

- The trade deficit in goods and services came in at $56.6 billion in January. Exports fell $2.7 billion. Imports were unchanged. Over the past twelve months, exports are up 5.1% while imports are up 7.4%.

- In the slightly positive productivity report released by the Bureau of Labor Statistics, unit labor costs were revised up to 2.5% from 2.0%. This was above expectations and bolstered fears of rising inflation.

- Wholesale inventories rose 0.8% in January and sales declined 1.1% in the month.

All Else Being Equal

The persistent positive soft data in the sentiment indicators began to show up in this week’s hard data particularly in Friday’s employment report. The jobs market continues to improve.

The bears fret about this week’s increase in outstanding consumer credit which rose to a record $3.855 trillion. Left out of their hand wringing pronouncements is the additional fact that household net worth has also reached a record $98.746 trillion. Even after making allowances for the one-percenters’ share of net worth, consumers are in very good shape.

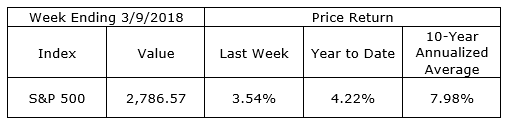

Last Week’s Market

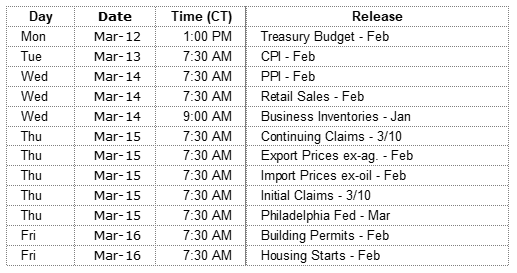

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.