Last week, we wrote about analysts’ expectations for the economy for the next twelve to eighteen months. Inflation is expected to hold at 2.0% to 2.5% for the full year. The Federal Reserve’s well-advertised plan for short-term interest rates is to raise the Fed Fund rate (the rate at which financial institutions lend to one another, usually overnight) by 1/4 of one percent this week to the range of 1.50% to 1.75% with two additional increases this year to the range of 2.00% to 2.25% by year-end. This, combined with the Fed’s balance sheet reduction would place expectations for market interest rates to rise to a level of 3.00% to 3.50% as measured by the 10-Year Treasury yield. In the current environment, market interest rates below 4.0% are considered to be supportive for stock prices.

Underlying those estimates are expectations for economic growth. Last quarter, the median forecast from Fed officials was for real GDP growth of 2.5% for 2018 and 2.1% for 2019. All will be watching the Fed this week and carefully reviewing statements from new Fed Chairman, Jerome Powell, for signals which might indicate any changes to these expectations. During this process the volatility in stock prices is expected to continue as is a possible test of recent lows.

On The One Hand

- The Consumer Price Index (CPI) increased 0.2% following last month’s 0.5% increase. The CPI was up 2.2% for the 12 months ending February.

- The Producer Price Index (PPI) showed a 0.2% increase in February. Year-over-year, the PPI was up 2.8%.

- Initial claims declined 4,000 to 226,000, the four-week moving average declined by 750 to 221,500. Continuing claims rose by 4,000 to 1.879 million.

- Industrial production increased 1.1% in February. The capacity utilization rate rose to 78.1% from a downwardly revised 77.4% in January.

- The University of Michigan’s preliminary Consumer Sentiment Index for March rose to 102.0, the highest reading for the index since April 2004.

On The Other Hand

- Retail sales declined 0.1% in February following a decline of 0.1% in January. Excluding autos, retail sales rose 0.2%.

- Total business sales declined 0.2% in January while inventories grew 0.6%.

- The Philadelphia Fed Index declined to 22.3 in March from the previous month’s reading of 25.8. Labor shortages were reported by 64% of firms in the region and 70% reported skills mismatches between requirements and available labor.

- Housing starts declined 7.0% in February to a 1.236 million annual rate leaving starts down 4.0% versus a year ago. New building permits fell 5.7% in February to a 1.298 million annual rate.

All Else Being Equal

The FOMC is meeting this week. The announcement of a 1/4 of one percent increase is widely expected with a small minority anticipating a 1/2 rise. Concerns about overheating were contradicted by the Atlanta Fed’s GDPNow estimate for growth of 1.8% in the first quarter.

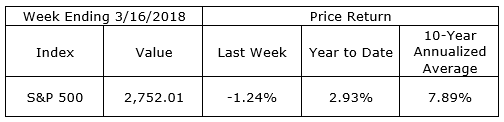

Last Week’s Market

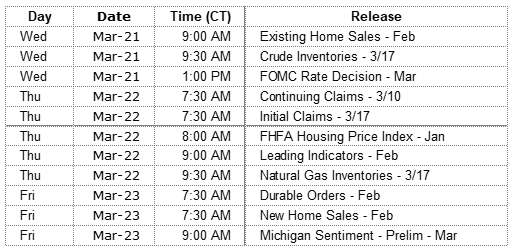

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.