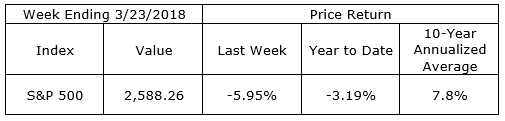

Last week, the Dow Jones Industrial Average failed to hold at its February 8, low close of 23,860.46, finishing the week at 23,533.20, down 11.6% from its high close of 26,616.71 on January 26. The broader S&P 500 fared slightly better finishing the week at 2,588.26, slightly above its early February low of 2,581.00 and down 9.91% from its January high of 2,872.87.

Stock price volatility is a fact of life in the markets. After more than 12 months of low volatility the recent return is being celebrated by trading desks enjoying the renewed activity and the resulting increased revenue. Another benefit is the increase in entertaining short-term market calls. Short-term market movements are impossible to consistently predict but this fact doesn’t stop the experts from trying. These attempts frequently result in entertaining, if useless, predictions. One of last week’s amusing market calls came from a group which noted its proprietary trend gauge, after being stuck in neutral for nearly two months, is now signaling “a potential breakout up or down soon”. I predict they will be correct. Plan accordingly.

On The One Hand

- Existing home sales increased 3.0% in February to a seasonally adjusted annual rate of 5.54 million. Sales are up 1.1% on an annual basis.

- For the 159th consecutive week, initial unemployment claims remained below 300,000 at 229,000. Continuing claims decreased by 57,000 to 1.828 million and were the lowest level since December1973.

- The Leading Economic Indicators rose for the fifth straight month with a 0.6% gain in February.

- Durable goods increased 3.1% in February offsetting a good part of January’s 3.5% decline. The rebound leaves durable goods orders up 9.1% year-over-year.

On The Other Hand

New home sales declined 0.6% in the month of February to a seasonally adjusted annual rate of 618,000. The third consecutive monthly decline left new home sales up just 0.5% year-over-year.

All Else Being Equal

The Fed raised 1/4 percent, as expected. Chairman Powell’s statements during the week contained no surprises, confirming the likelihood of two more one-quarter percent increases in 2018. Fixed income markets took the week’s news in stride, rising slightly in mid-week then finishing lower for the week with a 2.25% yield on the 2-Year Treasury and 2.83% on the 10-Year.

The Atlanta Fed continued to estimate a sub-2% growth rate for Q1 GDP, with its latest GDPNow forecast of 1.8%. This prompted a check of the New York Fed staff’s Nowcast for real GDP growth which last estimated Q1 growth of 2.9%. The takeaway – no indications of recession are in the data. Growth, somewhere around the annual rate of 2%, is likely in the quarter ending this Saturday.

Last Week’s Market

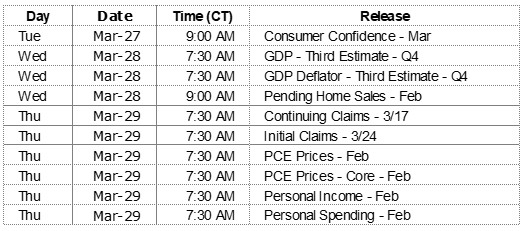

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.