Stocks were lower in the final two days of trading but still managed a small gain for the week, buoyed by the positive start to earnings season. Reports, while positive, have so far been in line with the positive expectations investors had built up going into the season. Market activity will again be influenced by the expanded reporting due out this week.

Treasury yields rose across the board last week. The 10-Year Treasury at 2.95%, is back to levels not seen since 2014. The spread between the 2-year and 10-year note ranged between 0.42% and 0.49%, levels not seen since 2007. This rising trend in rates across the yield curve is expected to continue.

On The One Hand

- Retail sales rebounded in March, rising for the first time in four months. Retail sales rose 0.6% in March putting sales up 4.5% versus a year ago.

- Housing starts increased 1.9% in March to a 1.319 million annual rate. Starts are up 10.9% versus a year ago. Building permits rose 2.5% in March to a 1.354 million annual rate. Compared to a year ago, permits for single-family units are up 1.7% while permits for multi-family homes are up 18.4%.

- Industrial production rose 0.5% in March and was up 0.7% if revisions to prior months are included. Capacity utilization rose to 78.0% in March from 77.7% in February.

- Weekly initial unemployment claims decreased by 1,000 to 232,000 while continuing claims decreased by 15,000 to 1.863 million.

- The Philadelphia Fed Index for March was 23.2, up from the previous month’s reading of 22.3 and well above zero, the dividing line between expansion and contraction of manufacturing in the region.

- The Leading Economic Index was up 0.3% in March following an upwardly revised 0.7% increase in February.

On The Other Hand

- The Empire State manufacturing index declined to a still healthy 15.8 in April from 22.5 in March.

- The National Association of Home Builders index fell slightly to 69 in April from 70 in March. The index remains at historically high levels signaling positive sentiment among builders.

- Inventory growth outpaced sales in February. Total business inventories increased 0.6% in February matching the 0.6% increase in January. Total business sales rose 0.4% following January’s 0.3% decline.

All Else Being Equal

The Fed’s Beige Book, its monthly summary of current economic conditions, was released last week. Regular readers of this weekly email should already be familiar with the points made in the Fed’s report:

Economic activity continued to expand at a modest to moderate pace… Outlooks remained positive, but contacts in various sectors including manufacturing, agriculture, and transportation expressed concern about the newly imposed and/or proposed tariffs.

Widespread employment growth continued… Upward wage pressures persisted but generally did not escalate; most Districts reported wage growth as only modest.

Prices increased, generally at a moderate pace. … Businesses generally anticipate further price increases in the months ahead, particularly for steel and building materials.

Looking forward, the Atlanta Fed adjusted its estimate for the current quarter’s real growth to 2.00%. On Friday, we will get the advanced first quarter GDP figures.

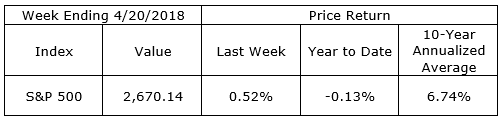

Last Week’s Market

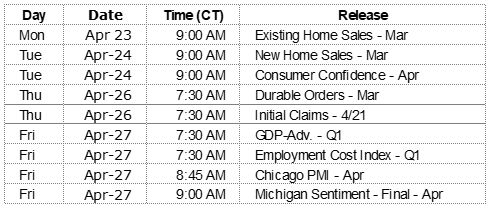

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.