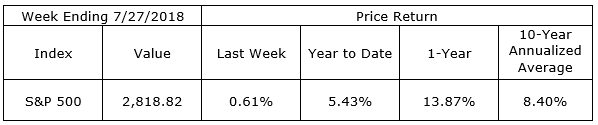

The S&P 500 index was up for the fourth week in a row, closing +0.61% for the week and +3.70% for the four weeks combined. The gains have been supported by good earnings and revenue growth even though these have been accompanied by cautious guidance due to the uncertainty over the near-term effects of trade disputes. Earnings for the S&P 500 members who have so far reported for Q2 are up 23% on revenues which are 9% higher on average.

During the past 4 weeks, the yield on the 10-year Treasury has traded up from 2.85% to settle Friday at 2.96%. The 2-year yield sits at 2.67% This puts the spread at 29 basis points and holding.

In the planning department, Pam Ryser, Assistant Vice President and Trust Officer, provides some useful thoughts on the process of selecting a successor trustee in her piece, Five Traps for Amateur Trustees to Avoid.

On The One Hand

- New orders for durable goods rose 1.0% in June. Orders are up 3.2% from a year ago while orders excluding transportation are up 9.1%.

- Initial jobless claims rose 9,000 to a still very low 217,000. The four-week moving average for initial claims decreased by 2,750 to 218,000. Continuing claims declined 8,000 to 1.75 million.

- The first estimate for Q2 real GDP growth was 4.1% at an annual rate. Real GDP was up 2.8% from a year ago. Personal consumption, business investment, and home building, combined, grew at a 4.3% annual rate in Q2 and are up 3.2% in the past year. The GDP price deflator increased at a 3.0% annual rate in Q2.

On The Other Hand

- Sales of previously-owned homes fell 0.6% in June to a 5.38 million annual rate. This was the third straight month of declines. Sales are down 2.2% versus a year ago.

- New single-family home sales declined 5.3% in June to a 631,000 unit annual rate. Sales are up 2.4% from a year ago.

- While consumer sentiment, according to the University of Michigan Sentiment report, remains at high levels, July’s dip to 97.9 from 98.2 in June did extend its drift from the 14-year high of 101.4 posted in March.

All Else Being Equal

Recent data topped off by Friday’s GDP growth report provide little evidence of a near-term end to the the economic expansion. Recent home sales and starts figures have a few economists worried that growth in residential construction has peaked for this business cycle. At present, most believe the volatile monthly reports indicate a temporary stall in home construction in this long, drawn out business cycle expansion. Rising construction prices have temporarily gotten ahead of consumers’ willingness to spend on housing. We will be watching the coming months for more clues.

Consumers remain upbeat about better job prospects and lower tax rates but are reporting fresh concerns about potential inflation, higher interest rates and fallout from the tariffs.

The data at this time suggests the Fed will raise its Fed Funds rate by one-quarter percent in both September and December.

Last Week’s Market

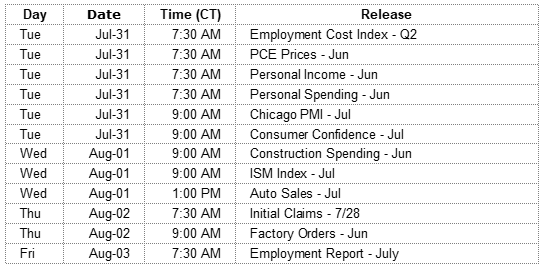

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.