There will be a two-week break in the Weekly Update. We will resume on Tuesday, September 4th.

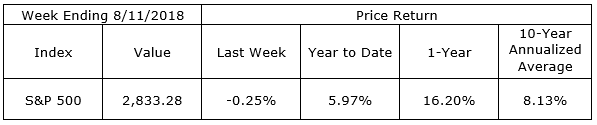

After five straight weekly gains, the S&P 500 took a vacation and closed 0.25% lower last week. Treasury yields drifted lower during the week. The 2-year and 10-year Treasury notes finished the week yielding 2.60% and 2.86% respectively. The news has provided plenty of headlines to trigger a summer correction but markets have shrugged off all the negative headlines.

On The One Hand

- Total outstanding consumer credit rose $10.2 billion in June following May’s increase of $24.3 billion. June’s increase was driven by nonrevolving credit as revolving credit declined by $0.2 billion from May, the first decrease in revolving credit since March.

- Initial jobless claims declined 6,000 to 213,000. The four-week moving average declined 500 to settle at 214,250. Continuing claims rose 29,000 to 1.76 million.

- Wholesale inventories increased 0.1% in June following a 0.3% increase in May. June wholesale sales declined 0.1% after a 2.1% increase in May. Year over year, inventories were up 5.1% while total sales have grown 10.2%.

On The Other Hand

- Producer prices were flat in July but are up 3.3% in the past year, exceeding the Fed’s 2% inflation target.

- The Consumer Price Index increased 0.2% in July leaving the CPI up 2.9% year-over-year.

All Else Being Equal

The PPI, up 3.3% over the past 12 months, and CPI, up 2.9% over the same period, have moved above the Fed’s target rate of 2%. Inflation has not yet shown up in real average hourly earnings which were flat in July and are down 0.2% in the past year. Economists we follow expect market forces to produce a notable increase in wages in the coming months. Wage earners will finally benefit from the tight labor market. At the same time, rising labor costs will keep upward pressure on rates of inflation, supporting expectations for another 1/4% increase in the Fed Funds rate in September. This will move the upper bound of the Fed’s target range from 2.00% to 2.25% and nudge all short-term fixed income rates higher.

The Atlanta Fed’s GDPNow model is projecting this current quarter will continue to produce real GDP growth in the 4.00%-plus range.

Last Week’s Market

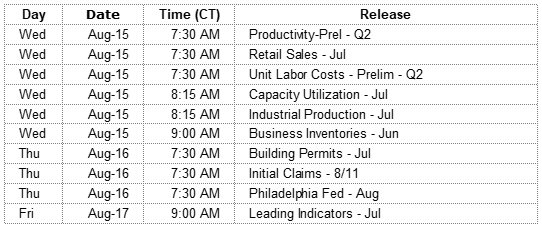

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.