Interest rates moved to new near-term highs last week. The yield on the 10-Year Treasury ended the week at 3.23%, a level not seen since 2011. The backdrop for this move was statements by Federal Reserve Board Chairman, Jerome Powell, which included, “The really extremely accommodative low interest rates that we needed when the economy was quite weak, we don’t need those anymore.”

Media pundits echoed stock market bears with predictions the Fed would overshoot with rate increases and crush the current economic expansion. They chose to ignore another Powell statement, “…interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral. We may go past neutral, but we’re a long way from neutral at this point.”

Interest rates are far from neutral. Evidence of this appears in the yield curve. One month ago, the 2-10 Year yield spread had flattened at 20 basis points and was supposed to be on its way to inversion, signaling recession. Instead, the curve steepened to 35 basis points last week.

Noise aside, we are not experiencing rate increases as the result of aggressive Fed tightening. Monetary policy remains a good distance from neutral with Fed funds rates barely above zero. Rising market interest rates are the natural result of a strong economy.

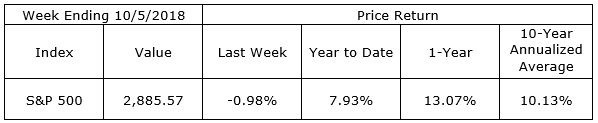

The S&P 500 Index corrected nearly 1% for the week leaving the index up 7.93% year-to-date excluding dividends. Contrary to recent history, stock market corrections are a common occurrence experienced by long-term investors. Recent interest rate increases are not going to end the expansion. The first of this quarter’s earnings and guidance are due out late this week. Let’s ignore the current noise and review the data as it is released.

On the One Hand

- Total construction spending increased 0.2% in August and was up 6.5% in the past year, an acceleration from the pace over the same periods ending in 2017 and 2016.

- The ISM non-manufacturing index rose to 61.6 in September from 58.5% in August. The Institute for Supply Management reported this was the highest reading for the Non-Manufacturing Index since its inception in 2008.

- Initial unemployment claims declined by 7,000 to 207,000 and continuing claims decreased by 13,000 to 1.650 million. The four-week moving average for initial claims increased by 500 to 207,000.

- Factory orders increased 2.3% in August on top of a 0.3% revision for July, adjusted upwardly to a decline of 0.5% decline from the previously reported decline of 0.8%. On the other hand, orders excluding transportation were up just 0.1% in August, the same rate seen in July.

- September non-farm payrolls lagged expectations, coming in with an increase of 134,000 in September, unless you add in the net upward revisions to the July and August numbers, in which case payrolls increased 221,000. The unemployment rate declined to 3.7%. Average hourly earnings increased 0.3% in September and are up 2.8% versus the previous year.

On The Other Hand

- The ISM Manufacturing Index declined to 59.8 in September. The decline was slightly below the 60.0 reading expected by the consensus. but all major components of the index, while mixed, remained comfortably above 50.0, signaling growth.

- Total trade dipped slightly in August back to the June level of $472.1 billion from July’s $472.2. The U.S. trade deficit came in at $53.2 billion, slightly below expectations but higher than the July deficit of $50.0 billion.

All Else Being Equal

The Fed is raising rates for the right reasons. The Atlanta Fed’s staff doesn’t expect an end to the expansion. Its GDPNow forecast for Q4 GDP is for real growth of 4.1%.

Last Week’s Market

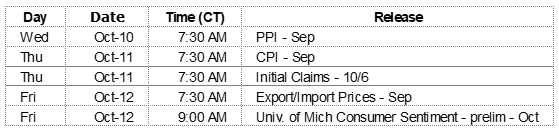

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.