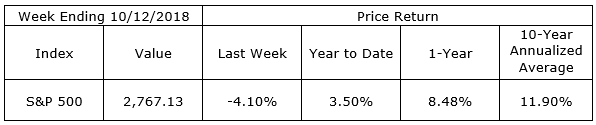

The S&P 500 lost 5.58% from last month’s record high but is still up 3.50% year to date. Was this the correction that didn’t come during the summer? Was this the beginning of another 10% correction similar to the 10.16% decline we experienced between January 26th and February 8th? Could this be the start of a bear market, headed down 20% or more?

The news of the week introduced no new significant data. There was a good deal of noise surrounding this year’s increase in interest rates, but the fact is, bond yields remain at historically low levels and the increases experienced this year reflect the stronger economy which should be good for stocks. There was no significant news on trade issues last week. Progress has been made with Mexico, Canada and the Eurozone. Trade negotiations with China remain stalled, but it is too early to determine if an agreement can never be reached. The noise surrounding the Fed distorts its latest statements to the extreme. There is no reason to think the Fed will raise rates high and fast without regard to the status of the current business cycle. A reading of Fed statements does not lead one to believe the Fed is crazy enough to engineer a quick end to the current business expansion.

The stock market experiences panics from time to time and last week may have been the beginning of a more significant correction. A bear market does not seem likely at this time given the current state of the economy and the outlook for corporate earnings. I am confident, however, that we will experience a bear market at some point in the future when the economic cycle turns down and into recession. A bear market seems to be many months away.

What do we do? We should continue to work our financial plans by reviewing our current personal situations and revising our goals as our personal employment, retirement, health or family situations change. We need to plan for the external events for which we have no control over because such events will occur. Our plans should be designed around things we can control, e.g., how much we spend, how much we save, how long we work. Plans should not be revised based on the most recent moves in stock prices.

We should avoid the temptation to get aggressive when the market is rising and seems to be giving money away. We should not abandon the market when it has a decline. Regardless of the market trend, we need to maintain our cash reserves, not subject to market volatility; reserves along with our income streams will prevent us from disrupting our progress toward achieving our goals. We should invest only the portion of our net worth in stocks that can be committed to achieving our long-term goals and commit to withstanding market corrections, even bear markets, which we will experience from time-to-time over several years.

On the One Hand

- The Producer Price Index (PPI) rose 0.2% in September and are up 2.6% versus a year ago. Going forward, a consistent monthly increase of 0.2% will amount to an annual rate of 2.43%.

- The Consumer Price Index (CPI) rose 0.1% in September. The CPI is up 2.3% from a year ago.

- Initial unemployment claims were up 7,000 to 214,000 leaving the four-week moving average for initial claims up 2,500 to 209,500, well under the 300,000 level which would signal problems in the labor market. Continuing claims increased by 4,000 to 1.66 million. The four-week moving average for continuing claims sits at 1.656 million, the lowest level for this measure since August 18, 1973.

On the Other Hand

- Export prices were flat in September after declining 0.2% in August and import prices were up 0.5% after being down 0.4% in August. Over the past 12 months, export prices were up 2.7% compared to 2.8% in the 2016-2017 12-month period and import prices were up 3.5% versus 2.7% in the 2016-17 12-month period. The export/import price data will add to inflation worries.

- The University of Michigan preliminary Index of Consumer Sentiment for October dipped to 99.0 from the final reading of 100.1 for September. The October reading did remain above 98.5, the average reading so far in 2018.

All Else Being Equal

With nominal GDP growth of 4.6% over the past two years, monetary policy is far from being tight, and a steady pace of rate hikes won’t stop the expansion. The current data indicates the economy is neither overheating nor has it peaked and headed toward recession.

This week’s inflation data was mixed but generally in line with expectations. Prices overall are increasing at rates which are slightly above the Fed’s target rate. With no consistent signs of immediate acceleration, the rate of inflation the Fed should continue its path toward ending its decade long, easy money policies.

Last Week’s Market

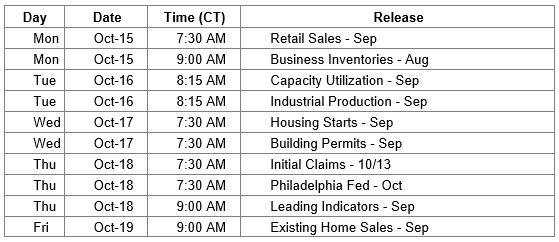

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.