This weekly update has often explained that a successful financial plan is about focusing on personal goals and the variables in our lives which we can control. Short-term market action is obviously not one of those variables. Weekly market moves will only distract investors. This is not an original thought. Legendary investor, economist and university professor, Benjamin Graham said, “Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

Developing your game plan and focusing on the efficient execution of the steps necessary for success should have all of our attention. Avoid the market media personalities and the financial product salespeople who benefit from raising anxiety and urging action based on weekly volatility. Instead, read Paul Fowler’s article, Avoid Retirement Surprises. The issues raised will help you focus on some of the variables which will be useful in updating and fine tuning your personal game plan.

On the One Hand

- Industrial production rose 0.3% in September, the fourth consecutive month of growth and a new all time high.

- Initial unemployment claims for the week dropped by 5,000 to 210,000 and the four-week moving average rose by 2,000 to 211,750. Continuing claims declined by 13,000 to 1.640 million, a level not seen since August 1973.

- While softening a bit in October, the Philadelphia Fed Index came in at 22.2, down from 22.9 in September but remains well above zero, the dividing point between expansion and contraction.

- The Leading Economic Index rose 0.5% in September following the 0.4% increase in August.

On the Other Hand

- Retail sales were below expectations, rising just 0.1% in September and were unchanged if prior month revisions were included in the September number. On the bright side, retail sales are up 4.7% versus a year ago. Overall, capacity utilization was unchanged at 78.1% in September and manufacturing capacity utilization increased to 75.9% from 75.8% in August.

- Housing starts declined 5.3% in September to an annual rate of 1.201 million. Starts are up 3.7% versus a year ago. New building permits declined 0.6% in September.

- Existing home sales declined 3.4% in September to a seasonally adjusted annual rate of 5.15 million. Total sales were down 4.1% from the same period a year ago.

All Else Being Equal

Is the soft residential construction industry in the process of leading the economy into recession? Or is it currently lagging in this cycle and about to be lifted into expansion along with other industries? The fact is, residential construction remains stubbornly below need. As Brian Wesbury points out, “Based on fundamentals – population growth and scrappage – the US needs about 1.5 million new housing units per year but hasn’t built at that pace since 2006”. The problems have been the high and rising materials costs and labor shortages. Tariffs on lumber, steel, and aluminum have not been helpful. These may begin to abate. Last week’s NAHB report indicated lumber prices are 50% lower after reaching record high prices in May. The very real need for housing will eventually have to be met and we will be watching the data closely in coming months to see if progress toward meeting this need will be met during the current economic expansion. We suspect some progress in the industry will be made before the start of the next recession.

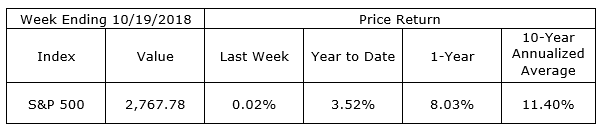

Last Week’s Market

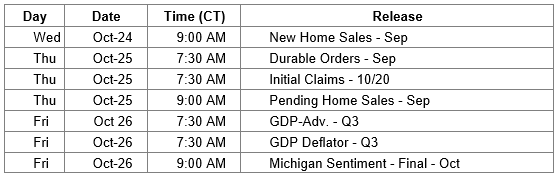

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.