An October Surprise is typically a phrase used in politics to describe an orchestrated event timed to be sprung in the weeks immediately preceding a November election. It is difficult to imagine a surprise this October which could have stood out among this year’s already overabundant supply of orchestrated political events. Instead, we will use the term to reference the surprise investors experienced over the past month.

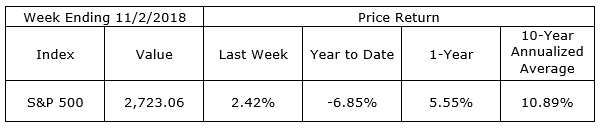

The correction spilled over into Monday of last week, then got some relief from three days of gains of more than 1% each. The S&P 500 settled the week 2.52% above the October low established eight trading days ago. October finished with a net decline of 6.94% and a gain of 1.43% year-to-date. While the volatility may continue and another test of the low could be in store, conditions are ripe for a year-end rally.

As expected, interest rates edged higher over the month of October. The 2-year and 10-year Treasury yields rose from 2.82% and 3.06% to finish the month at 2.87% and 3.14% respectively. The trend is likely to continue its gradual increase through year-end. Expectations into early 2019 are for the 10-year Treasury yield to average 3.25% plus or minus 25 basis points.

As for potential November surprises, it is best to not let your short-term political feelings influence your long-term financial decisions.

On the One Hand

- Personal income rose 0.2% in September. Personal consumption increased 0.4% in September, matching consensus expectations. Personal income is up 4.4% in the past year, while spending is up 5.0%.

- The PCE deflator rose 0.1% in September and is up 2.0% in the past year and in line with the Fed’s 2% target.

- One of the soft indexes, a survey of attitude as opposed to a hard estimate of recent economic activity, The Conference Board’s Consumer Confidence Index, rose to 137.9 in October. The September reading was revised downward to 135.3 from 138.4. The index is at its highest level since September 2000.

- The third quarter employment cost index increased 0.8% compared to 0.6% in the second quarter. Wages and salaries, which comprise about 70% of compensation costs, increased 0.9%, while benefit costs rose 0.4%. Compensation costs for civilian workers increased 2.8% for the 12-month period ending in September 2018 compared with a compensation costs increase of 2.5% in September 2017.

- Third quarter productivity increased 2.2% after an upwardly revised 3.0% in the second quarter.

- Weekly initial unemployment claims dropped by 2,000 to 214,000 putting the four-week moving average at 213,750, a slight increase of 1,750 for the week. Continuing claims continued to drop, declining by 7,000 to 1.631 million, the lowest level since July 28, 1973.

- October nonfarm payrolls increased by 250,000, leaving the unemployment rate at 3.7%. Average hourly earnings increased by 3.1% over the past 12 months compared to an increase of 2.8% over the same 12-month period in 2017. The labor force participation rate rose modestly to 62.9% from 62.7% in September.

- Factory orders increased 0.7% in September following a revised 2.6% increase for August, up from the originally reported 2.3%. Excluding transportation, orders were up 0.4% for the second straight month. While orders were higher, shipments of nondefense capital goods excluding aircraft declined 0.1%, unchanged from the Advance Durable Orders report, after declining 0.2% in August.

On the Other Hand

The ISM Manufacturing Index declined to 57.7 in October. Readings above 50 show expansion, so October’s report shows continued healthy growth, if at a slower pace.

All Else Being Equal

Wage gains are finally beginning to show up in the data, boosting workers’ ability to participate in the expansion. The potential downside is these costs could begin to show up in higher prices (inflation), unless productivity increases also begin to show up. The data this week showed signs of a pickup in productivity. As old as this expansion is, it is too soon to talk about wage push inflation requiring an expansion ending increases in interest rates. The data continues to support the Fed’s planned 25 basis point increase in the Fed Funds rate next month. This would be a normal response to the strength exhibited in the economy.

Last Week’s Market

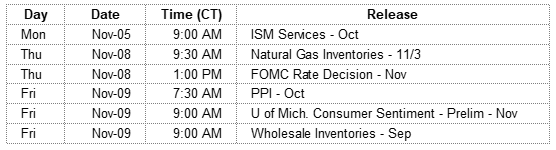

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.