Although the S&P 500 finished 2.13% higher for the week, the correction’s presence continued to be felt with a decline of more than 1% in the final two days of the week. Fundamentals continue to be positive and the outlook for 2019 remains upbeat.

Factset Research Systems Inc provides the following points from this season’s quarterly reporting:

- With 90% of the companies in the S&P 500 reporting, 78% of companies have reported a positive EPS surprise and 61% have reported a positive sales surprise.

- The blended (year-over-year) earnings growth rate for Q3 2018 is 25.2%.

- The blended (year-over-year) revenue growth rate for Q3 2018 is 9.4%.

- The forward 12-month P/E ratio is 16.0. This P/E ratio is below the 5-year average of 16.4, but above the 10-year average of 14.5.

On the One Hand

Initial unemployment claims declined by 1,000 to 214,000 resulting in a four-week moving average of 213,750, a decline of 250. Continuing claims declined by 8,000 to 1.623 million. Initial claims have been below 300,000 for 192 straight weeks and continuing claims is the lowest it has been since July 28, 1973.

On the Other Hand

- The ISM services index for October dipped to 60.3 following last month’s surge to 61.6, a twenty year high and the second highest level in the history of the index. The supplier deliveries index rose in October, signaling orders continue to be delayed. Survey respondents noted delays are the result of labor shortages, component shortages, and freight issues.

- Producer prices surged 0.6% in October, the largest single-month increase in more than six years. Producer prices are up 2.9% versus a year ago.

- The University of Michigan Index of Consumer Sentiment for November posted a preliminary reading of 98.3, down slightly from the final reading of 98.6 for October.

All Else Being Equal

Total outstanding consumer credit increased by $11.0 billion in September, half the $22.8B expansion in August. A deceleration in credit expansion is both, a “one-hand” and an “other-hand” development. It can be a sign of sound spending and savings decisions on the part of consumers or it can signal consumers slowing spending in anticipation of peak growth. We think it is the former, consumers let up on the accelerator ahead of heavier holiday spending.

The Fed meeting last week was void of new information. The Fed remains on course to raise the Fed Funds rate at its meeting next month. The increase to a range of 2.25% to 2.5% is in the markets and warranted given the strength of the expansion and trend in the inflation rate.

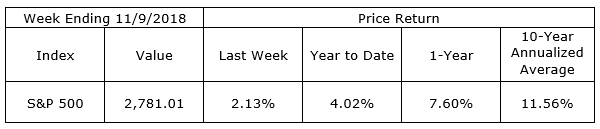

Last Week’s Market

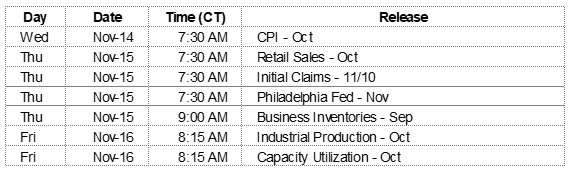

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.