Treasury note yields pushed lower as investors raised allocations to what were deemed to be safer assets. The 10-year note yield ended the week 18 basis points lower at 3.06% and the 2-year note finished 12 basis points lower at a yield of 2.80%.

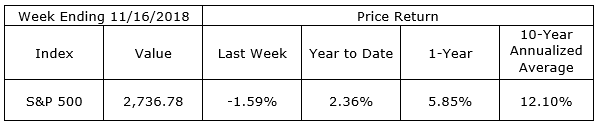

Stocks were lower last week with the S&P 500 settling down 1.3%. The adjustments to price to earnings multiples, while painful for shortsighted traders, is beneficial for investors searching for high quality companies at favorable prices.

The focus has been on international issues. In addition to ongoing concerns about trade disputes, traders are buzzing about slowing growth abroad, the effects of Brexit on the UK and EU, and Italy’s stand against the EU Commission’s budget requests. President Trump and China’s President Xi Jinping are scheduled to meet November 30th and December 1st. A broad framework for continued negotiations between the two nations would be welcome news.

On the One Hand

- Consumer price increases remain moderate. The Consumer Price Index rose 0.3% in October, putting the annual increase at 2.5%, versus 2.3% in September.

- Retail sales increased 0.8% in October, following a September print which was revised downward by 0.2% to -0.1%.

- While rising slightly, weekly initial unemployment claims remain well under 300,000 signaling a healthy jobs market. Initial claims for the week increased by 2,000 to 216,000. The four-week moving average for initial claims increased by 1,500 to 215,250. Continuing claims increased by 4,600 to 1.676 million.

- Business sales continue to outpace inventory growth. Business inventories rose 0.3% in September, following a rise of 0.5% in August. Business sales increased 0.4%, following a 0.5% increase in August.

- Industrial production was 0.1% percent in October. As a result of upward revisions, the index is now reported to have advanced at an annual rate of 4.7% in the third quarter, well above the gain of 3.3 percent reported initially. Capacity utilization was 78.4%, 1.4% below its long-run (1972–2017) average, leaving plenty of room to grow.

On the Other Hand

Manufacturing growth slowed in the Philadelphia Fed region in November. The volatile Philly Fed Index fell to 12.9 from 22.2 in October.

All Else Being Equal

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 was 2.8% on November 15th, down from 2.9% on November 9th. The New York Fed Staff Nowcast for the fourth quarter of 2018 stands at 2.6%.

Last Week’s Market

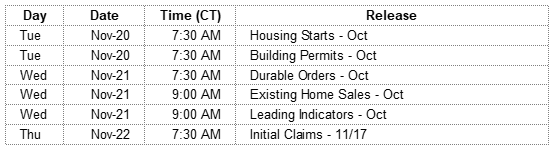

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.