Last week, Fed Chairman Powell confirmed the Fed’s future interest rate and balance sheet reduction decisions are not predetermined. Previous Fed boards and chairs have a spotty history of setting Fed policy, so some concern is understandable but current criticism seems excessive. We believe current FOMC members are at least as smart as the majority of their outspoken critics. Forever rising short-term interest rates are not in the cards unless economic growth picks up in the U.S.

The pundits were not able to put what had become a persistently negative spin on Powell’s comments or the positive December jobs report. The fact is, the U.S. economy is experiencing growth without inflation with no recession currently in the data. The market provided some relief for investors following the sharp year-end selloff. The stocks of financially sound companies have gone on sale and investors should take advantage of the situation.

On the One Hand

- Low initial unemployment claims continue to be reported at levels which are well under those which might indicate stress in the labor market. Initial claims for the week increased by 10,000 to 231,000 and the four-week moving average for initial claims decreased by 500 to 219,250. Continuing claims increased by 32,000 to 1.740 million.

- Nonfarm payrolls rose 312,000 in December. Revisions to the October and November reports added an additional 58,000 jobs.

- Average hourly earnings rose 0.4% in December and are up 3.2% versus a year ago.

- The average workweek in December was 34.5 hours up from 34.4 hours in November. December manufacturing workweek increased to 40.9 hours from 40.8 hours in the previous month and factory overtime increased to 3.6 hours from 3.5 hours.

- The labor force participation rate moved up to 63.1% in December from 62.9% in November. This amounted to a 419,000 person increase in the labor force and was largely responsible for the rise in the December unemployment rate to 3.9% from 3.7% in November. The U6 Unemployment rate, which includes underemployed workers, was 7.6%, unchanged from November.

On the Other Hand

- The ISM manufacturing index fell to its lowest reading in two years yet remained above 50 and in expansion territory. The December reading came in at 54.1, down from November’s post of 59.3.

- Pending home sales slipped 0.7% in November after dropping 2.6% in October. These results will likely lead to a decline in existing home sales for December.

All Else Being Equal

The December Fed Funds rate increase moved the top of the current range to 2.50%. This is not an expansion ending interest rate level. Fed minutes and another Powell speech later this week should help provide more guidance.

The latest Atlanta Fed GDPNow estimate for real growth in the fourth quarter stands at 2.60%.

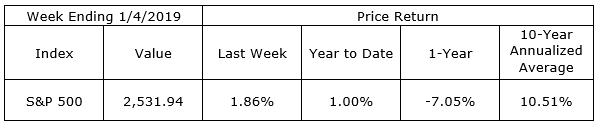

Last Week’s Market

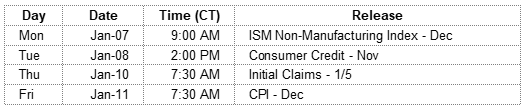

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.