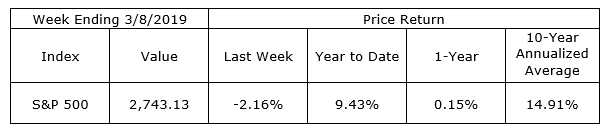

The anticipated consolidation of the post-Christmas rally got underway last week with understandable declines across the board. After a gain of 19.27% in the 41 trading days since Christmas, the S&P 500 eased 2.18%. As has been said many times before, short-term volatility is a feature of investing for growth. These and other days and weeks of volatility will be insignificant as you look toward a decade or two of investing for the goal of providing for a child’s or grandchild’s education.

Close behind retirement planning, preparation for children’s and grandchildren’s education expenses is a secondary, high priority planning need. 529 Plans have been around for over 20 years, yet a 2018 study indicated just 29% of Americans were aware of their usefulness as an education savings tool. Researchers have also found that utilizing 529 Plans could increase the amount available for college by roughly 25%. Chris English provides additional information in, The Case for 529 Plans. Contact Chris or your TCK officer for more information.

On the One Hand

1. The ISM Non-Manufacturing Index rose to 59.7 in February from its 56.7 reading in January.

2. New home sales increased 3.7% in December to an annual rate of 621,000 from November’s downwardly revised 599,000.

3. Initial unemployment claims for the week were 223,000 and the four-week moving average for initial claims declined 3,000 to 226,250. Continuing claims were down 50,000 to 1.755 million.

4. Productivity increased 1.9% in the fourth quarter. For the year, the annual average productivity growth was just 1.3%, below the long-term rate of 2.1%. Unit labor costs rose 2.0%.

5. Housing starts beat expectations by posting an increase of 18.6% in January to 1.230 million. Starts remain down 7.8% versus year ago levels. Permits rose 1.4% month-over-month to 1.345 million.

6. The unemployment rate fell to 3.8% in February from 4.0% in January. Average hourly earnings (excludes irregular bonuses/commissions and fringe benefits) rose 0.4% in February and are up 3.4% versus a year ago.

On the Other Hand

1. Total construction spending declined 0.6% in December after a 0.8% increase in November.

2. The trade deficit grew to $59.8 billion in December. For the year 2018, the deficit rose 12.5% to $68.8 billion. But the whole picture, the total volume of the movement of goods and services, is a positive one. Total US trade, imports and exports, rose $1.6 billion in December and $366.6 billion in the full year.

3. Nonfarm payrolls rose just 20,000 in February. Including revisions to December/January, nonfarm payrolls increased 32,000. The average workweek in February was 34.4 hours, down slightly from 34.5 hours in January. The average workweek declined 0.1 hour to 40.7 hours. The labor force participation rate was unchanged at 63.2% in February.

All Else Being Equal

The Atlanta Fed’s volatile GDPNow so far sees a very slow start to 2019 GDP growth. Its latest estimate for real Q1 growth is just 0.5%. The New York Fed Staff Nowcast is a bit more optimistic, with estimates of 1.4% for 2019’s Q1 and 1.5% for Q2.

Last Week’s Market

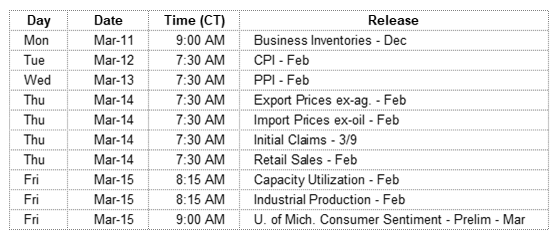

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.