The markets have been jolted by raised tensions in the current trade negotiations. Most economists agree the best trade policy is free trade, with no tariffs, no barriers to entry, and no subsidies. Free markets and global trade have proven to be the best way to promote global prosperity. But we were a long way from free trade with China and other trading partners before the current administration’s attempts to negotiate open trade policies. Progress will be a long and arduous struggle.

The financial media’s insistence on a binary view of events is not helpful. If the economy is not wonderful, then it must be terrible. We will be at economic peace or we are headed for trade wars. The facts, as always, lie somewhere in between those extremes. Life will go on in fits and starts in between the extremes. Expect trade negotiations to continue for many more months and even years with slow progress interrupted by frequent setbacks.

The markets will react with their usual volatility. In short spans of time, stock prices will rise as progress is made then fall sharply when setbacks occur. If you do not believe you can get used to these fluctuations, then you probably have too much of your portfolio invested in stocks. Visit with your TCK advisor about your concerns and consider the alternatives which are available.

If volatility does not concern you and you are more interested in the long view on trade and the status of trade negotiations with China, you might be interested in the Scott Grannis post, U.S. and China play Trade Chicken, and both are likely to win.

On the One Hand

- Initial unemployment claims for the week declined by 16,000 to 212,000. Continuing claims dropped by 28,000 to 1.66 million.

- Housing starts increased 5.7% in the month of April to a seasonally adjusted annual rate of 1.235 million units, due primarily to a 6.2% increase in single-unit starts. Building permits rose 0.6% in the month of April to an annual rate of 1.280 million, though permits for single-unit dwellings declined 4.2%.

- The Leading Economic Index increased 0.2% in April following March’s 0.3% increase.

- The preliminary University of Michigan Index of Consumer Sentiment rose to 102.4 in May from the 97.2 reading in April. The May index is the highest since 2004.

On the Other Hand

- Retail sales declined 0.2% in April following the 1.7% increase in March.

- Industrial production declined 0.5% in April following a 0.2% increase in March. Capacity utilization fell to 77.9% from a downwardly revised 78.5% in March.

All Else Being Equal

As has been the case during this expansion, growth continues with a few sluggish reports thrown in from time to time. There is little sluggish about the job market, however, and moderate inflation continues. The overall growth rate may be a bit lower than first quarter’s rate but a negative rate of growth, the recession some were expecting a few months ago, is still not on the horizon.

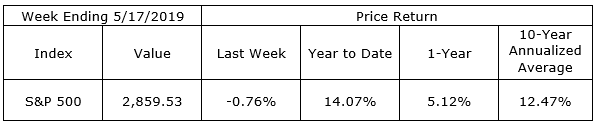

Last Week’s Market

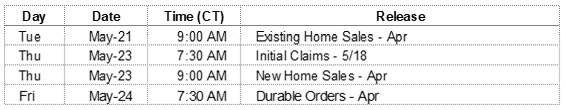

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.