Stocks rallied to new highs last week with all three of the major U.S. stock indexes closing at new all-time highs, the Dow Jones Industrial Average over 27,000, the S&P 500 breaching 3,000, and the NASDAQ breaking 8,200. The new highs hit in an atmosphere of caution rather than euphoria.

First, investors have been cautious due to concerns about the Fed’s role in coming months. Fed Chairman, Jerome Powell, seemed to ease some fears during his two days of congressional testimony. The market’s next target date for Fed data will come July 31, when Chairman Powell will announce the FOMC’s decision on rates.

Secondarily, the data coming from our foreign trading partners’ economies along with the ongoing trade negotiations. Slowing growth continues to be a concern and a UK exit from the EU is also on the calendar for later this year. It appears trade negotiations could continue for many months and the damage from the tariffs being used in the process will be severe in some sectors of the economies of the U.S and its trading partners.

Finally, estimates of lower corporate earnings for the second quarter are another source of caution. Reporting this week will be the large U.S commercial and investment banks and expectations for this industry have been on the positive side. Next week will be the start of the heavy flow of earnings reports from all other sectors of the economy and the outlook will continue to be cautious.

On the One Hand

- The Consumer Price Index (CPI) rose 0.1% in June and is up 1.6% on an annual basis.

- Initial unemployment claims declined 13,000 to 209,000, putting the four-week moving average for initial claims at 219,250, down by 3,250. Continuing claims for the week rose 27,000 to 1.723 million.

- The Producer Price Index (PPI) increased 0.1% in June and is up 1.7% for the year ending in June.

On the Other Hand

There were no negative reports among the major releases last week but there were a few worrisome data points among the minors. Mortgage applications dipped 2.4% following the previous week’s decline of 0.1%. The contraction in rail traffic continued for a 27th week. Total carloads and intermodal units were down 7.5% compared to the same week one year ago.

All Else Being Equal

FactSet Research is now estimating a Q2 earnings decline of 3.0% for the S&P 500 following the 0.1% decline in Q1.

The Atlanta Fed staff’s GDPNow forecast for real economic growth in the second quarter stood at 1.4%.

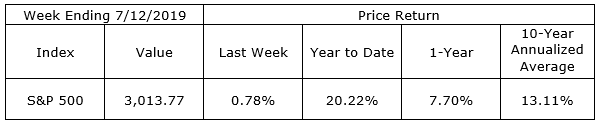

Last Week’s Market

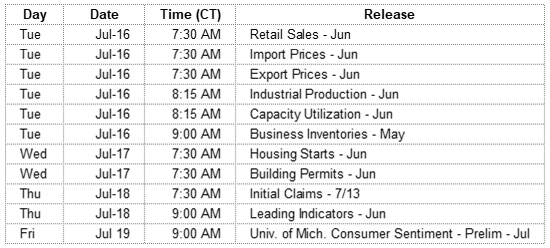

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.