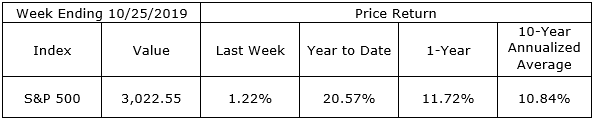

We are having a better October than last year when the S&P 500 was beginning its fourth quarter correction. With four trading days to go, this October finds the index up 1.50% compared to the 7.0% decline we experienced in October 2018. Corporate earnings have been mixed but are in no way signaling the beginning of the broad earnings decline many predicted twelve months ago. As this realization has unfolded, the S&P 500 has recovered from its late 2018 low by 11.7% and finished the week just 1% under its July high of 3025.86.

In addition to the stability of corporate earnings, the reversal of the uptrend in interest rates over the last 12 months has also contributed to higher stock prices. The yields on the 2-Year Treasury and 10-Year Treasury, which averaged 2.86% and 3.15% respectively in the month of October 2018, have averaged 1.54% and 1.69% in the current month.

On the One Hand

- Initial unemployment claims declined by 6,000 to 212,000, leaving the four-week moving average of 215,000 down 750 from the previous week. Continuing claims were down 1,000 to 1.682 million.

- New home sales were 0.7% lower in the month of September, coming in at a seasonally adjusted annual rate of 701,000. While lower, they were in line with expectations and represented a breather after the 6.2% growth spike in the month of August. On an annual basis, new home sales were up 15.5%.

- Consumers continue to be optimistic according to the University of Michigan’s Index of Consumer Sentiment which posted at 95.5 in October, up from the final reading of 93.2 for September.

On the Other Hand

- Existing home sales were 2.2% lower to a seasonally adjusted annual rate of 5.38 million in September compared to 5.50 million in August. For the year ending with September, total sales were 3.9% higher than the same twelve month period a year ago.

- Durable goods orders declined 1.1% in September following a slightly positively revised 0.3% increase in August. Nondefense capital goods orders, excluding aircraft, declined 0.5% following a 0.6% decline in August.

All Else Being Equal

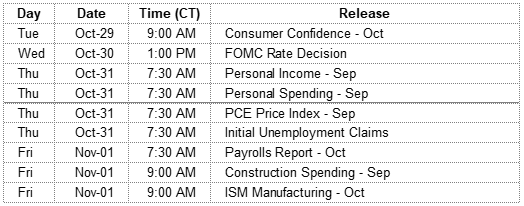

It will be a big week for Fed watchers. The FOMC meets early this week and chairman Powell will announce its fed funds rate decision early Wednesday afternoon. A reduction of 0.25% in the current fed funds range is anticipated.

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.