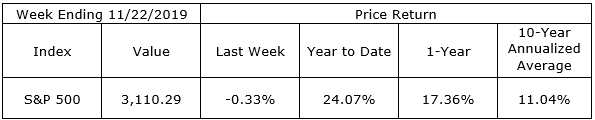

After six straight weeks of gains, which saw the S&P 500 Index rise over 7.25% to a new all-time high of 3,122.03, the equity markets stabilized last week, finishing a fraction lower for the week at 3,110.29. Interest rates have remained stable with the 2-Year Treasury yielding 1.62% and the 10-Year Treasury at 1.77%. The current concern in the markets is the deterioration of the U.S.-China trade negotiations. We still have plenty to be thankful for. With $3.5 trillion in money market funds, consumers and investors have enough reserves to provide for both Christmas retail purchases and additions to long-term investment portfolios.

On the One Hand

- Housing starts increased by 3.8% in October to a 1.314 million annual rate. Starts are up 8.5% versus a year ago. The increase in starts in October was due to both single-family and multi-family starts. In the past year, single-family starts are up 8.2% while multiunit starts are up 9.2%.

- New building permits rose 5.0% in October to a 1.461 million annual rate. Compared to a year ago, permits for single-family units are up 7.4% while permits for multifamily homes are up 26.9%.

- Initial unemployment claims were unchanged at 227,000. The four-week moving average for initial claims increased by 3,500 to 221,000.

- Existing home sales increased 1.9% month-over-month in October to a seasonally adjusted annual rate of 5.46 million. Sales were 4.6% higher than in the same period a year ago.

- The final University of Michigan Consumer Sentiment Index for November was 96.8 up from the final October reading of 95.5.

On the Other Hand

The Leading Economic Index declined by 0.1% in October, the third straight monthly decline for the index. The Coincident Economic Index was unchanged, and the Lagging Economic Index increased by 0.1% in October.

All Else Being Equal

Continued growth in the number of employed, the number of hours worked, and the rate of hourly earnings and benefits is providing the firm underlying base for the U.S. economic expansion. While not setting records in growth rates, it is providing a resilient base for what could be many more quarters of slow but steady growth. The solid jobs market, moderate consumer price increases and a monetary policy which is far from tight should postpone any recession for many quarters.

Speaking of slow growth, persistent, cautious business investment is behind the current quarterly growth rates. The early estimate for real GDP growth in the fourth quarter from the Atlanta Fed staff is just 0.4% while the New York Fed Staff Nowcast stands at 0.7%. The consensus for Q4 remains in a range of 1.2% to 2.1%. Looking out to 2020, the consensus range is between 1.3% and 2.1%.

Last Week’s Market

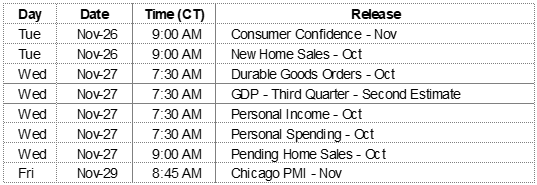

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.