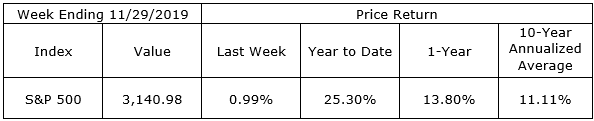

Stocks, as measured by the S&P 500 Index, continued to show strength last week, moving to another new high and closing the week up another 0.99%. Treasury yields were little changed with the 10-Year finishing the week at 1.78%. Versus one year ago, the S&P 500 is up 13.8% and the 10-Year Treasury yield is down from 3.00%.

Rising interest rates and recession, common themes of the popular financial media last year, failed to materialize. Based on current economic data, recession appears to be delayed until the middle of 2021 at the earliest, and debt market activity and recent Fed pronouncements make significant interest rate increases unlikely through the new year. These views are data-dependent and we will provide you with updates as the weeks wear on.

Even with low interest rates and a positive economic outlook for the new year, short-term reversals in the markets will occur. It does not take a recession to trigger a stock market selloff. Corrections are a feature of long-term investing. While we could see a traditional year-end rally with the S&P 500 already up over 25% year to date, we might also see a year-end correction. We may even experience a bit of both. The market will fluctuate – guaranteed.

On the One Hand

- Although the headlines showed a decline of 0.7%, October’s new home sales report, including revisions to the initial September report, was surprisingly positive. October sales came in at an annual rate of 733,000. The decline was from the revised September figure of 738,000 units but was up 4.6% from the initial September sales report of 701,000 units. The year over year gain in new home sales was 31.6%.

- Real third-quarter GDP growth was at a 2.1% annual rate, beating the original estimate and the consensus expected 1.9% growth rate.

- Durable goods orders increased 0.6% in October following a downwardly revised 1.4% decline (from -1.1%) in September. Excluding transportation, orders were also up 0.6% following a downwardly revised 0.4% decline (from -0.3%) in September. Nondefense capital goods, excluding transportation, increased 1.2% following a 0.5% decline in September.

- Initial unemployment claims dropped by 15,000 to 213,000. The four-week moving average for initial claims decreased by 1,500 to 219,750. Continuing claims declined by 57,000 to 1.640 million.

- Personal income was unchanged in October. Personal spending in the month rose by 0.3%. Incomes are up 4.4% in the past year, while spending has increased by 3.7%. The PCE Price Index was up 1.3% for the year, unchanged from September.

On the Other Hand

The Conference Board’s Consumer Confidence Index for November slipped to 125.5 from 125.9 in October.

All Else Being Equal

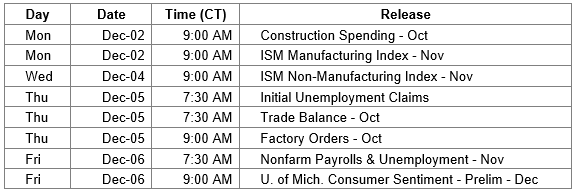

The Chicago PMI index rose to 46.3 from 43.2 in October. This, along with other regional manufacturing surveys, suggests this week’s national ISM report will be positive.

With the data from last week’s economic reports added to its model, the Atlanta Fed staff’s GDPNow estimate for Q4 real growth has improved from single digits to 1.7%. The NY Fed’s Nowcast improved slightly to 0.8%.

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.