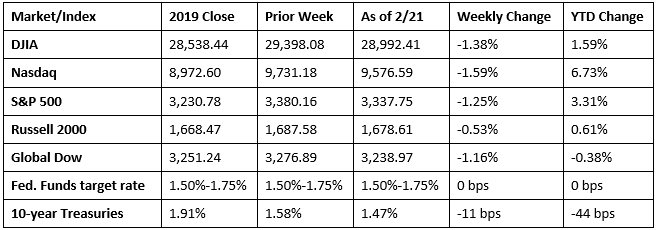

The run of positive weekly market gains ended last week as each of the benchmark indexes listed here lost value. The spread of the coronavirus from China to other countries has investors worried about the impact on global economies. Tech stocks were hit hard as the Nasdaq dropped 1.59%, followed by the Dow, which lost close to 1.40%. The large-cap S&P 500 fell 1.25%, followed by the Global Dow and the small caps of the Russell 2000. Money seemed to flow from stocks to long-term bonds and gold, pushing prices higher. The 10-year Treasuries saw yields fall 11 basis points (prices and yields move in opposite directions) while the price of gold jumped almost 4.00% over the prior week’s closing price.

Oil prices rose higher last week, closing at $53.35 per barrel by late Friday afternoon, up from the prior week’s price of $52.09. The price of gold (COMEX) soared last week, closing at $1,646.10 by late Friday afternoon, up from the prior week’s price of $1,587.20. The national average retail regular gasoline price was $2.428 per gallon on February 17, 2020, $0.009 higher than the prior week’s price and $0.111 more than a year ago.

Last Week’s Economic News

- The first quarter of the year should be a good one in the new home market, according to the latest information on housing starts. Building permits jumped 9.2% in January and are up 17.9% above the January 2019 rate. Building permits issued for single-family homes rose 6.4% in January. Housing starts fell 3.6% in January but are 21.4% above the January 2019 rate. Housing completions also dropped 3.3% last month and single-family housing completions in January fell 3.5%.

- Following a strong December, sales of existing homes fell 1.3% in January. However, year-over-year, existing home sales are up 9.6%. Single-family existing home sales dropped 1.2% in January from December’s total. The median existing-home price in January was $266,300 ($274,500 in December), up 6.8% from January 2019 ($249,400). The median existing single-family home price was $268,600 in January 2020 ($276,900 in December), up 6.9% from January 2019. Total inventory rose 2.2% in January from the prior month.

- Prices for producers advanced 0.5% in January after climbing 0.2% in December. Producer prices are up 2.1% for the 12 months ended in January, the largest advance since moving up 2.1% for the 12 months ended May 2019. In January, 90.0% of the increase in the Producer Price Index is attributable to prices for final demand services, which climbed 0.7%. The index for final demand goods inched up 0.1%. Producer prices less foods, energy, and trade services advanced 0.4% in January, the largest increase since a 0.4% rise in April 2019. For the 12 months ended in January, the index for final demand less foods, energy, and trade services moved up 1.5%.

- For the week ended February 15, there were 210,000 claims for unemployment insurance, an increase of 4,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims remained at 1.2% for the week ended February 8. The advance number of those receiving unemployment insurance benefits during the week ended February 8 was 1,726,000, an increase of 25,000 from the prior week’s level, which was revised up by 3,000.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Eye on the Week Ahead

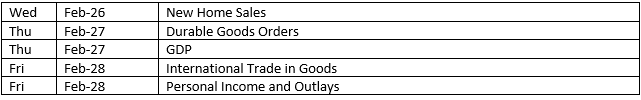

A busy week is ahead for important economic and market-moving reports. January’s figures on new home sales are available early in the week. December saw sales of new, single-family homes dip below November’s totals. Also out this week are reports on durable goods orders and the gross domestic product. December’s new orders for durable goods rebounded following a poor November. The fourth-quarter GDP increased 2.1%, according to the advance estimate. January’s figures will be based on more economic data, but are expected to reveal a comparable growth rate for the economy during the last quarter of 2019.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.