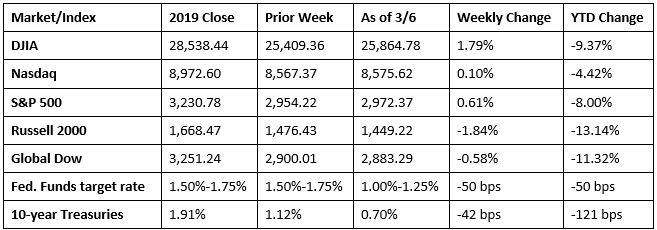

While it apparently took a day to take effect, the Fed’s decision to reduce the target range for the federal funds rate by 50 basis points quelled the massive rush to sell stocks and brought some investors back to the market. Following losses earlier in the week, the benchmark indexes surged with the Dow gaining more than 700 points last Wednesday. Unfortunately, the wild ride continued into Thursday with stocks losing most of the prior day’s gains. A final rally just before the close of the market on Friday was enough to push a few of the benchmark indexes listed here moderately higher. The Dow, S&P 500, and Nasdaq were the only indexes to post gains over their respective prior week’s closing values. The Russell 2000 and Global Dow couldn’t rally enough to finish in the black.

Money poured from stocks to long-term bonds, pushing prices higher and sending yields plummeting. The yield on 10-year Treasuries dropped below 1.0% for the first time ever last Tuesday, only to continue to fall to record lows each day thereafter until reaching 0.70% by the close of trading on Friday.

Oil prices fell to their lowest point in many years last week, closing at $41.56 per barrel by late Friday afternoon, down from the prior week’s price of $45.19. Russia’s apparent refusal to cut production greatly contributed to the drop in oil prices. The price of gold (COMEX) shot higher last week, closing at $1,674.30 by late Friday afternoon, up from the prior week’s price of $1,585.80. The national average retail regular gasoline price was $2.423 per gallon on March 2, 2020, $0.043 lower than the prior week’s price but $0.001 more than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Federal Reserve cut interest rates by half a percent last Tuesday in an emergency move. In making the adjustment, the Federal Open Market Committee indicated that while the economy remains strong, the coronavirus poses evolving risks to economic activity. The Committee indicated that it is closely monitoring developments and will consider further actions to support the economy. The Committee is not scheduled to meet until March 17. This emergency meeting and resulting rate cut are the first such actions since the financial crisis of 2008.

- Employment rose by a whopping 273,000 in February, with notable job gains occurring in health care and social assistance, food services and drinking places, government, construction, professional and technical services, and financial activities. The unemployment rate fell 0.1 percentage point to 3.5%. That rate has been either 3.6% or 3.5% since last October. The number of unemployed marginally decreased by 105,000 to 5.787 million. The employment participation rate remained at 63.4%. The employment-population ratio fell 0.1 percentage point to 61.1%. In February, average hourly earnings increased by $0.09 to $28.52. Over the past 12 months, average hourly earnings have increased by 3.0%. The average workweek rose by 0.1 hour to 34.4 hours in February.

- The goods and services trade deficit was $45.3 billion in January, down $3.3 billion from December’s revised figure. January exports were $208.6 billion, $0.9 billion less than December exports. January imports were $253.9 billion, $4.2 billion less than December imports. Of note, the goods trade deficit with Canada decreased $3.7 billion to $0.7 billion, the deficit with China shrunk $2.1 billion to $23.7 billion, and the deficit with Japan dropped $0.9 billion to $5.3 billion.

- According to the Manufacturing ISM® Report On Business®, manufacturing slowed in February. The purchasing managers’ index dropped 0.8 percentage point to 50.1% (a reading over 50% indicates growth, but at a slower rate) last month. New orders declined 2.2%, production fell 4 percentage points, new export orders decreased 2.1 percentage points, imports plummeted 8.7 percentage points, and inventories and prices receded 2.3 percentage points and 7.4 percentage points, respectively. On the other hand, backlog of orders rose 4.6 percentage points, employment marginally increased by 0.3 percentage point, and deliveries ramped up 4.4 percentage points.

- While not always the case, the IHS Markit final U.S. Manufacturing Purchasing Managers’ Index™ mirrored the ISM® survey with its purchasing managers’ index falling to 50.7 in February, down from January’s 51.9. According to the report, the health of the manufacturing sector was the weakest since last August.

- Although manufacturing slowed in February the services industry picked up steam, according to the Non-Manufacturing ISM® Report On Business®. The non-manufacturing index increased 1.8 percentage points in February, with new orders (+6.9 percentage points) driving the improvement. Employment increased 2.5 percentage points while prices and business activity fell 4.7 percentage points and 3.1 percentage points, respectively.

- For the week ended February 29, there were 216,000 claims for unemployment insurance, a decrease of 3,000 from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims remained at 1.2% for the week ended February 22. The advance number of those receiving unemployment insurance benefits during the week ended February 22 was 1,729,000, an increase of 7,000 from the prior week’s level, which was revised down by 2,000.

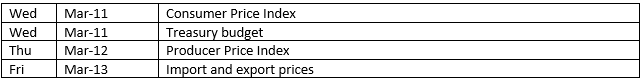

Eye on the Week Ahead

As the stock market continues to reel from the coronavirus, economic indicators bear watching as February’s information should begin to reflect the impact of the virus on the economy. Both consumer prices and producer prices are not expected to change much from their January totals, which edged marginally higher. Import and export prices in February could begin to show the effects of trade with China and other countries influenced by the virus.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.