Stocks continued to rally at the beginning of last week amid hopes of enhanced testing for COVID-19. But by the end of the day Wednesday stocks slid, with the S&P 500 and Nasdaq posting their largest single-day declines since March 18. Energy shares in particular were hit hard. The Dow fell 4.4% and the small caps of the Russell 2000 continued to collapse, dropping over 7.0% on Wednesday. Economically, the virus is overwhelming the job market, as the number of unemployment insurance claims broke records for the second consecutive week.

For the past several weeks Thursdays have become rebound days for the market, and last Thursday was no exception. The Dow and the S&P 500 closed the day up about 2.25%, respectively, while the Nasdaq picked up about 1.75%. Oil prices pushed higher on word of output cuts. But COVID-19 has shrunk the demand for oil, which will likely keep prices in check even with reduced production.

A dismal jobs report (see below) drove stocks lower by the close of trading last Friday. Analysts believe as poor as this report may be, it doesn’t reflect the magnitude of the damage done by the virus. They point to the more than 10 million claims for unemployment insurance over the past two weeks as a further indicator that the worst is yet to come. As more information is released, investors will be able to assess the economic damage done by COVID-19.

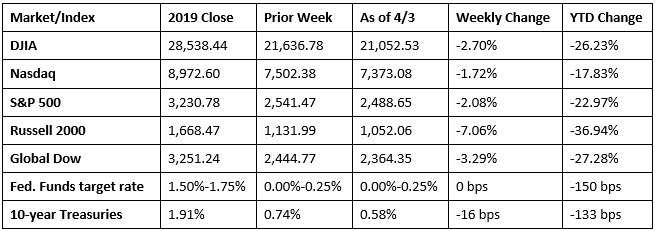

After rallying to close the prior week with double-digit gains, investors reeled in those profits last week, pulling the benchmark indexes lower. The small caps of the Russell 2000 were hardest hit, falling more than 7.0%, followed by the Global Dow, the Dow, the S&P 500, and the Nasdaq, which was the only index not to fall at least 2.0%. The yield on the 10-year Treasury note fell to a three-week low as bond prices soared, also affected by the latest job figures.

Oil prices climbed higher last week following news that production would be reduced, closing at $28.79 per barrel by late Friday afternoon, up from the prior week’s price of $21.57. The price of gold (COMEX) rose again last week, closing at $1,649.30 by late Friday afternoon, up from the prior week’s price of $1,625.30. The national average retail regular gasoline price was $2.005 per gallon on March 30, 2020, $0.115 lower than the prior week’s price and $0.686 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Reflective of the impact of COVID-19 and efforts to contain it, March saw employment fall by 701,000 jobs. For perspective, the average number of jobs added per month for the 12 months ended in February was 196,000. About two-thirds of the drop occurred in leisure and hospitality, mainly in food services and drinking places. Notable employment declines also occurred in health care and social assistance, professional and business services, retail trade, and construction. The unemployment rate spiked to 4.4%, the largest monthly increase since January 1975. The number of unemployed persons jumped 1.4 million to 7.1 million. The labor force participation rate, at 62.7%, decreased by 0.7 percentage point over the month. The employment-population ratio, at 60.0%, dropped by 1.1 percentage points over the month. The average workweek fell by 0.2 hour to 34.2 hours in March. The decline in the average workweek was most pronounced in leisure and hospitality, where average weekly hours dropped by 1.4 hours. In March, average hourly earnings increased by $0.11 to $28.62. Over the past 12 months, average hourly earnings have increased by 3.1%.

- Not unexpectedly, purchasing managers saw manufacturing decline in March, impacted by COVID-19. In fact, according to the IHS Markit final U.S. Manufacturing Purchasing Managers’ Index™, these were the worst downturns in output and new orders since the financial crisis of 2009. The overall deterioration in the health of the manufacturing sector was the fastest since August 2009. Emergency measures to tackle the spread of the virus also led to a solid fall in workforce numbers and business confidence, as factories laid off staff and shutdown.

- The Manufacturing ISM® Report On Business® also saw survey respondents describe a downturn in manufacturing due to COVID-19. New orders fell notably, while production, prices, and employment also contracted.

- Purchasing managers in service industries noted a significant drop-off in business activity for March. Also tailing off were new orders, employment, and prices.

- The international trade in goods and services deficit was $39.9 billion in February, down $5.5 billion from January. February exports were $207.5 billion, $0.8 billion less than January exports. February imports were $247.5 billion, $6.3 billion less than January imports. Year to date, the goods and services deficit decreased $19.7 billion, or 18.7%, from the same period in 2019. Exports increased $1.1 billion, or 0.3%. Imports decreased $18.6 billion, or 3.6%.

- According to the Department of Labor, the COVID-19 virus continues to impact the number of initial claims for unemployment insurance. Most claims are coming from services industries, particularly accommodation and food services. However, a significant number of claims involve health care, social assistance, and manufacturing. For the week ended March 28, there were 6,648,000, an increase of 3,341,000 from the previous week’s level, which was revised up by 24,000. This marks the highest level of initial claims in the history of the series. According to the Department of Labor, the advance rate for insured unemployment claims jumped from 1.2% for the week ended March 14 to 2.1% for the week ended March 21. The advance number of those receiving unemployment insurance benefits during the week ended March 21 was 3,029,000, an increase of 1,245,000 from the prior week’s level, which was revised down by 19,000. This is the highest level for insured unemployment since July 6, 2013, when it was 3,079,000.

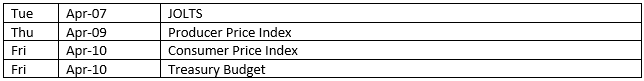

Eye on the Week Ahead

For economic reports, the focus this week is on inflation. The latest price information is available for March with the Consumer Price Index and the Producer Price Index. Last month consumer prices inched ahead 0.1% and were up 2.3% over the last 12 months. Producers saw their prices drop by 0.6% in February and are looking for a strong rebound in March.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.