The major benchmarks opened the week on a high note, led by the Russell 2000, which gained more than 6.0%. The large caps of the Dow (3.85%) and S&P 500 (3.15%) posted notable gains, as did the Global Dow (3.67%). The tech-heavy Nasdaq climbed nearly 2.5%. Investors were buoyed by positive COVID-19 news. Data showed new cases of the virus were growing at the slowest rate in months. Monday morning, biotech company Moderna reported encouraging results from human testing of a vaccine. This followed Sunday night’s remarks from Federal Reserve Chair Jerome Powell that more monetary stimulus may be on the way.

Stocks couldn’t keep up with the pace set on Monday, as gains were relinquished by the close of trading Tuesday. Investors seemed to ride the wave of information on a possible COVID-19 vaccine from Moderna. While Monday’s report was upbeat, another article on Tuesday questioned the sufficiency of the study’s data. Crude oil prices continued to rise, reaching $32.36 by late Tuesday afternoon.

Wednesday saw stocks rebound, led by the small caps of the Russell 2000, which jumped 3.0%, followed by the tech-heavy Nasdaq, and the large caps of the S&P 500 and the Dow. Once again, investors got encouraging news about a vaccine from another biotech firm. As more states relaxed restrictions, investors gleaned hope of an economic restart. Finally, oil prices rose for the fifth consecutive day. Many consumers are noticing higher gas prices at the pumps just in time for Memorial Day and the unofficial start of summer.

Thursday saw stocks dip on news of an additional 2.4 million claims for unemployment insurance last week, pushing the total number of claimants past 25 million. Adding to investor angst is rising trade tension between the United States and China. Energy, tech, and utilities sectors took hits, and gold prices fell while crude oil climbed for the sixth straight trading day. Of the benchmarks listed here, only the Russell 2000 grew, while the remaining indexes ended the day in the red.

Friday was a mixed bag of information and returns in the market. The Dow and Global Dow each fell less than a point while the S&P 500, the Nasdaq, and the Russell 2000 each ticked up less than a point. Trouble between Hong Kong and Beijing sparked protests and drove Asian securities lower, adding to the tensions between the United States and China. On the other hand, states continued to gradually relax stay-at-home orders. The price of crude oil fell for the first time in several days yet closed the week ahead.

Overall, the benchmark indexes listed here posted solid weekly returns, led by the small caps of the Russell 2000, which climbed nearly 8.0%. The remaining indexes ended the week with gains of over 3.0%, respectively. Long-term bond yields remained about the same as bond prices were relatively stable.

Crude oil prices continue to climb, closing last week at $33.33 per barrel by late Friday afternoon, up from the prior week’s price of $29.71. The price of gold (COMEX) dipped last week, closing at $1,734.00 by late Friday afternoon, down from the prior week’s price of $1,752.50. The national average retail regular gasoline price was $1.878 per gallon on May 18, 2020, $0.027 higher than the prior week’s price but $0.974 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- New home construction took a historic dip in April, according to the latest report from the Census Bureau. Housing starts fell 30.2% in April from March, the largest monthly percentage decline on record. April’s rate is 29.7% below the April 2019 rate. Single-family housing starts in April were 25.4% below the March figure. The number of building permits issued in April were 20.8% below the previous month’s level and 19.2% under the April 2019 rate. Permits for construction of single-family homes were down 24.3% for the month. Home completions were 8.1% below the March estimate and 11.8% under the rate a year ago. Single-family home completions in April were 4.9% under the March total.

- Sales of existing homes plummeted for the second consecutive month in April, falling 17.8% from the March sales pace. Overall, sales of existing homes are down 17.2% from a year ago. April’s sales have fallen to the lowest level and the largest month-over-month drop since July 2010 (-22.5%). The median price for existing homes sold in April was $286,800, 2.2% higher than the previous month’s price ($280,600) and 7.4% over the median price last April ($267,000). Total housing inventory was 1.47 million units, down 1.3% from March and 19.7% lower than the April 2019 total. Unsold inventory sits at a 4.1-month supply at the current sales pace, up from 3.4 months in March.

- For the week ended May 16, there were 2,438,000 claims for unemployment insurance, a decrease of 249,000 from the previous week’s level, which was revised down by 294,000. According to the Department of Labor, the advance rate for insured unemployment claims was 17.2% for the week ended May 9, an increase of 1.7 percentage points from the previous week’s rate, which was revised down by 0.2 percentage point from 15.7% to 15.5%. The advance number of those receiving unemployment insurance benefits during the week ended May 9 was 25,073,000, an increase of 2,525,000 from the prior week’s level, which was revised down by 285,000.

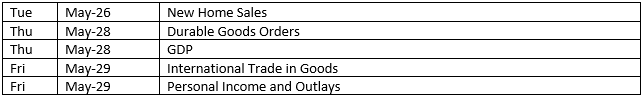

Eye on the Week Ahead

The last week of the month brings with it the remaining key economic reports for April. Two reports that will warrant particular attention are the gross domestic product report for the first quarter and the personal income and outlays report. This is the second iteration of the first-quarter GDP and is based on more complete data. The initial reading last month saw the economy regress by 4.8% from the fourth quarter of last year. The April report for personal income and outlays is expected to show notable drops in consumer income, spending, and prices for consumer goods and services.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.