Domestic stocks surged last Monday, as a robust pending home sales report overshadowed an increase in COVID-19 cases. Pending sales of existing homes soared over 44% in May, a record-setting rate that should lead to gains in existing homes sales in June and July. A jump in Boeing Co. stock helped propel the S&P 500, which virtually wiped out its June losses. The small caps of the Russell 2000 climbed more than 3.0%, followed by the Dow, the S&P 500, the Nasdaq, and the Global Dow. Crude oil prices gained nearly 3.0% while bond yields were unchanged.

Equities closed what proved to be a volatile June on a high note. The Dow ended Tuesday up 0.9%, the S&P 500 gained 1.5%, and the Global Dow rose 0.8%. But the big winners were the Russell 2000, up 1.4%, and the Nasdaq, which climbed 1.9%. Investors pushed stocks higher despite sobering news related to the ongoing battle against COVID-19. Top government health adviser, Dr. Anthony Fauci cautioned that a COVID-19 vaccine remains uncertain. Also, Federal Reserve Chairman Jerome Powell, during testimony before the House Committee on Financial Services, stated that while economic data is showing some positive signs, economic growth remains extraordinarily uncertain and will depend in large part on success in containing the virus.

Wednesday produced a mixed bag for stocks. The Nasdaq, Global Dow, and S&P 500 posted gains, while the Dow and Russell 2000 lost value. Crude oil prices advanced, while Treasuries and the dollar fell. Early in the day stocks climbed on news that preliminary tests of a COVID-19 vaccine developed by Pfizer and BioNTech were favorable. However, the stock gains were short-lived following reports that both California and Arizona had their biggest daily increases in virus cases.

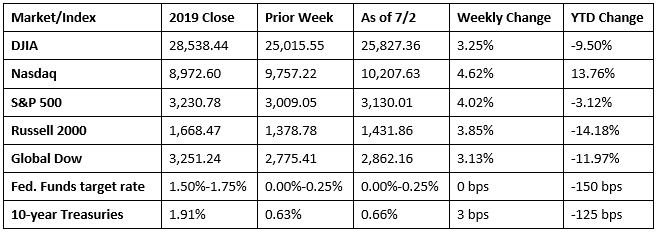

June’s employment figures far surpassed expectations with more than 4.8 million new jobs added, giving investors another sign that the economy is picking up steam. Heading into the Fourth of July weekend, the major markets were closed last Friday in observance of the holiday. Nevertheless, each of the benchmark indexes listed here enjoyed solid weekly returns. The Nasdaq, once again, led the way, gaining over 4.6%, followed by the S&P 500, which closed up by more than 4.0%. Treasury yields remained steady, while crude oil prices gained and the dollar fell slightly.

Crude oil prices rebounded last week, closing at $40.32 per barrel by late Thursday afternoon, up from the prior week’s price of $38.10. The price of gold (COMEX) advanced for the third consecutive week, closing at $1,787.60 by late Thursday afternoon, up from the prior week’s price of $1,784.10. The national average retail regular gasoline price was $2.174 per gallon on June 29, $0.045 higher than the prior week’s price but $0.539 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- There were 4.8 million new jobs added in June, and the unemployment rate declined by 2.2 percentage points to 11.1%. These improvements in the labor market reflected the continued resumption of economic activity that had been curtailed in March and April due to the COVID-19 pandemic and efforts to contain it. In June, employment in leisure and hospitality rose sharply. Notable job gains also occurred in retail trade, education and health services, other services, manufacturing, and professional and business services. The number of unemployed persons fell by 3.2 million to 17.8 million. Although unemployment fell in May and June, the jobless rate and the number of unemployed are up by 7.6 percentage points and 12.0 million, respectively, since February. The labor force participation rate increased by 0.7 percentage point in June to 61.5%, but is 1.9 percentage points below its February level. The employment-population ratio, at 54.6%, rose by 1.8 percentage points over the month but is 6.5 percentage points lower than in February. In June, average hourly earnings fell by $0.35 to $29.37, reflecting job gains among lower-paid workers. The average work week decreased by 0.2 hour to 34.5 hours in June.

- According to the latest purchasing managers’ index from IHS Markit, manufacturing continued to retract in June, but at a much slower pace than in April and May, as companies began to reopen. New orders from customers helped push production higher last month. The manufacturing sector saw employment decline for the fourth consecutive month in June, however, the overall loss of jobs was considerably weaker than those seen in the prior two months.

- The news was more positive from the Institute for Supply Management® as it reported that manufacturing actually grew in June. According to the Manufacturing ISM® Report On Business®, the June purchasing managers’ index registered 52.6%, up 9.5 percentage points from the May reading. This figure indicates expansion in the overall economy for the second straight month after April’s contraction. New orders increased dramatically, climbing nearly 25 percentage points from May. Production and employment also expanded notably in June.

- The international trade in goods and services report for May, out July 2, shows the trade deficit was $54.6 billion, up $4.8 billion, or 9.7%, from April. In May, exports fell 4.4% and imports slid 0.9%. Year to date, the goods and services deficit decreased $22.3 billion, or 9.1%, from the same period in 2019. Of particular note, the trade deficit with China increased $1.9 billion to $27.9 billion in May. Exports to China increased $0.7 billion to $10.0 billion, and imports from China increased $2.7 billion to $37.9 billion.

- For the week ended June 27, there were 1,427,000 claims for unemployment insurance, a decrease of 55,000 from the previous week’s level, which was revised up by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims was 13.2% for the week ended June 20, unchanged from the prior week’s revised rate. The advance number of those receiving unemployment insurance benefits during the week ended June 20 was 19,290,000, an increase of 59,000 from the prior week’s level, which was revised down by 291,000.

Eye on the Week Ahead

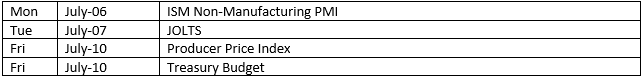

The end of the week offers a glimpse at inflationary trends with the latest information on producer prices. Also this week is the June Treasury budget report. Government spending has been up and income has been down, primarily due to the pandemic.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.