Last week began with stocks vaulting higher for the tenth Monday in a row. The Nasdaq reached a record high as tech stocks surged. The dollar gained value following a poor July while prices for Treasuries dipped pushing yields higher. Investors were encouraged by news of progress made toward another round of financial stimulus to further help offset the financial and economic toll resulting from the pandemic. Of the indexes listed here, the Russell 2000 led the way, climbing 1.8%, followed by the Nasdaq, the Dow, the Global Dow, and the S&P 500, which advanced 0.7% by the end of last Monday’s trading.

Stocks closed higher last Tuesday, led by the energy and communications sectors. For most of the day, equities were surging. However, the latest stalemate in negotiations over new COVID-19 stimulus worried investors, putting a halt on the market gains. Nevertheless, each of the benchmark indexes listed here closed the day ahead, led by the Global Dow, followed by the Russell 2000 and the Dow. Both the S&P 500 and Nasdaq inched up 0.4%.

Last Wednesday, investors pushed stocks higher on renewed hopes for a quick passage of pandemic stimulus relief and progress on a COVID-19 vaccine. Cyclical, energy, and value stocks posted notable gains. Each of the indexes enjoyed positive returns, led by the Russell 2000, which gained 1.9%, followed by the Dow (1.4%), the Global Dow (1.0%), the S&P 500 (0.6%), and the Nasdaq (0.5%). Crude oil and gold prices pushed ahead. Treasury prices fell, lifting yields higher.

Large cap and tech stocks pushed higher last Thursday while the rest of the market sagged. The S&P 500 climbed for the fifth straight day, gaining 0.6%, while the Dow jumped 0.7% and the Nasdaq gained 1.0%. The Russell 2000 and the Global Dow each dipped 0.1%. Crude oil prices, the dollar, and Treasury yields all fell.

Stocks were a mixed bag last Friday as the Dow, the S&P 500, and the Russell 2000 posted end-of-day gains, while the Nasdaq and the Global Dow lost value. Investors showed some concern following President Trump’s order banning U.S. citizens from using TikTok or WeChat. Tech stocks lagged as did communications stocks.

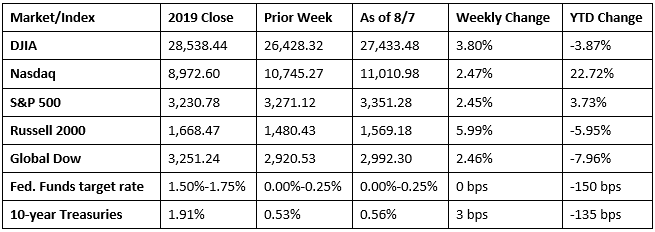

Overall, stocks rose higher week-over-week. Each of the indexes listed here enjoyed notable gains. The Russell 2000 was the week’s big winner, ratcheting up 6.0%, followed by the Dow, the Global Dow, the Nasdaq, and the S&P 500. Year to date, the Nasdaq is nearly 23.0% ahead of its 2019 closing value. The S&P 500 has added 4.0% since last year’s close, while the Rusell 2000 and the Dow are close to recouping pandemic-related losses.

Crude oil prices ended the week at $41.45 per barrel by late Friday afternoon, up from the prior week’s price of $40.41. The price of gold (COMEX) advanced for the eighth consecutive week, closing at $2,041.30, up from the prior week’s price of $1,989.90. The national average retail price for regular gasoline was $2.176 per gallon on August 3, $0.001 higher than the prior week’s price but $0.512 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Employment continues to rebound as more businesses reopen after being curtailed due to the COVID-19 pandemic. There were 1.8 million new jobs added in July, well below the 4.8 million employment increase in June and the 2.7 million new jobs added in May. The unemployment rate fell to 10.2%, and the number of unemployed persons fell 1.4 million to 16.3 million. Despite declines over the past three months, these measures are up by 6.7 percentage points and 10.6 million, respectively, since February. The largest employment increases in July occurred in leisure and hospitality, government, retail trade, professional and business services, other services, and health care. The labor force participation rate, at 61.4%, changed little in July, following increases in May and June. The employment-population ratio rose by 0.5 percentage point to 55.1% but remains lower than in February (61.1%). In July, average hourly earnings rose by $0.07 to $29.39. The average work week decreased by 0.1 hour to 34.5 hours in July.

- The manufacturing sector expanded in July for the third month in a row, according to the latest Manufacturing ISM® Report On Business®. The July purchasing managers’ index registered 54.2%, up 1.6 percentage points from the June index. New orders, production, backlog of orders, prices, and employment also increased in July. Supplier deliveries and inventories each dropped off slightly, likely due to the increase in demand. Overall, survey respondents were generally optimistic that the manufacturing sector would continue its recovery after the disruption caused by the pandemic.

- The services sector expanded in July for the second consecutive month, according to the latest Services ISM® Report On Business®. Supplier deliveries fell in July as demand ratcheted up following the gradual reopening of the economy. Prices for services also dropped in July compared to the previous month. Survey respondents remain concerned about the pandemic; however, they are mostly optimistic about business conditions and the economy as businesses continue to reopen.

- The trade deficit narrowed by $4.1 billion in June to $50.7 billion. Exports and imports increased in June following monthly declines since March that were, in part, due to the impact of COVID-19. June exports were $158.3 billion, $13.6 billion more than May exports. June imports were $208.9 billion, $9.5 billion more than May imports. The decrease in the trade deficit is a reflection of a greater monthly improvement in exports, up 9.4%, over imports, which increased 4.7%. Year to date, the goods and services deficit decreased $23.1 billion, or 7.8%, from the same period in 2019. Exports decreased $199.1 billion, or 15.7%. Imports decreased $222.3 billion, or 14.2%.

- For the week ended August 1, there were 1,186,000 new claims for unemployment insurance, a decrease of 249,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims was 11.0% for the week ended July 25, a decrease of 0.6 percentage point from the prior week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended July 25 was 16,107,000, a decrease of 844,000 from the prior week’s level, which was revised down by 67,000.

Eye on the Week Ahead

July reports focusing on inflation, the federal budget, import and export prices, and industrial production are on tap this week. Prices for consumer goods and services have been muted for much of the year, having risen less than 1.0% from last July.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.