Stocks continued to slide last Tuesday as falling tech shares pulled the Nasdaq down 4.1%. Crude oil prices plunged 7.5%, and Treasury yields sank 5.1% as money poured into bonds, driving prices higher. Investors, leery of overvaluations, continued to sell off shares. The relationship between the United States and China continued to sour as President Trump threatened recourse against American companies that create jobs overseas or that do business with China. By the close of trading, the S&P 500 lost 2.8%, the Dow fell 2.3%, the Russell 2000 lost 2.0%, and the Global Dow sank 1.6%.

After three days of sell-offs, tech shares reversed course last Wednesday. Lower stock prices were too tempting for some investors to pass up. The Nasdaq jumped 2.7%, the S&P 500 gained 2.0%, and the Dow climbed 1.6%. Crude oil prices and Treasury yields rose while the dollar declined.

Investors were clearly trying to scoop up some bargains last Wednesday as the sell-off resumed the following day. Tech and growth stocks plunged, pulling down the Nasdaq (-2.0%) and the S&P 500 (-1.8%). The Dow (-1.5%), the Russell 2000 (-1.2%), and the Global Dow (-1.0%) also lost value last Thursday. Crude oil prices and Treasury yields sank while the dollar was generally higher. Investors were also hit by a disappointing jobless claims report and the rejection by Senate Democrats of the Republican stimulus bill.

Stocks were mixed last Friday with the Dow, the S&P 500, and the Global Dow posting modest gains, while the Nasdaq and the Russell 2000 fell. Mega-caps and growth shares performed poorly and were outperformed by financials, industrials, and materials.

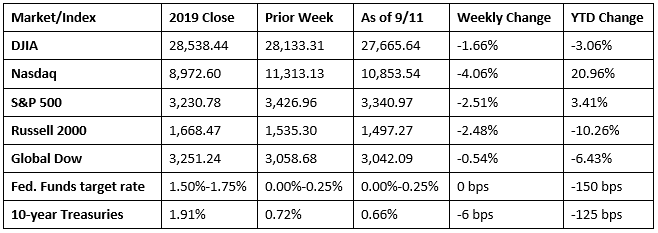

Overall, the major indexes fell for the second week in a row as each of the benchmarks listed here lost value. Tech stocks continued to fall, ending a five-month rally. The Nasdaq had its worst week since March. Global shares also plunged for the second consecutive week. Treasury prices rose sending yields lower, crude oil prices continued to sink, and the dollar dropped against most major currencies. Year to date, the Nasdaq and the S&P 500 remain ahead of last year’s pace, while the gap widened for the Russell 2000, the Dow, and the Global Dow.

Crude oil prices fell again last week, closing at $37.76 per barrel by late Friday afternoon, down from the prior week’s price of $39.59. The price of gold (COMEX) also rose last week, closing at $1,950.00, up from the prior week’s price of $1,940.60. The national average retail price for regular gasoline was $2.211 per gallon on September 7, $0.011 lower than the prior week’s price but $0.339 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The government deficit was $200 billion in August, relatively equal to the August 2019 monthly deficit. Through 11 months of the fiscal year, the deficit is $3.007 trillion, a 182% increase over the same period in fiscal year 2019. Government outlays for the current fiscal year are roughly 46% higher than the expenditures for the prior fiscal year.

- According to the latest Job Openings and Labor Turnover report, the number of job openings increased to 6.6 million in July (6.0 million in June). Hires decreased to 5.8 million (7.0 million in June), and separations were little changed at 5.0 million (4.9 million in June). Industries with the largest increase in hires include retail trade (172,000), health care and social assistance (146,000), and construction (90,000). Industries with the largest reduction in hires include accommodation and food services (599,000), followed by other services (143,000) and health care and social assistance (137,000). Over the 12 months ended in July, hires totaled 70.2 million and separations totaled 78.5 million, yielding a net employment loss of 8.2 million.

- Consumer prices are slowly rising. According to the latest Consumer Price Index, prices for goods and services rose 0.4% in August after advancing 0.6% in July. Over the last 12 months ended in August, the Consumer Price Index increased 1.3%. Consumer prices less food and energy rose 0.4% in August. Items experiencing notable price increases were used cars and trucks (5.4%) and fuel oil (3.9%). Food prices increased 0.1%, energy rose 0.9%, and apparel climbed 0.6%.

- Prices at the producer level rose 0.3% in August following a 0.6% jump in July. Producer prices have declined 0.2% over the last 12 months. A 0.5% spike in prices for services drove the climb in producer prices. Goods prices inched up 0.1%. Producer prices less foods, energy, and trade services moved up 0.3% in August, the same as in both July and June. For the 12 months ended in August, prices less food, energy, and trade services increased 0.3%.

- For the week ended September 5, there were 884,000 new claims for unemployment insurance, unchanged from the previous week’s level. According to the Department of Labor, the advance rate for insured unemployment claims was 9.2% for the week ended August 29, an increase of 0.1 percentage point from the prior week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended August 29 was 13,385,000, an increase of 93,000 from the prior week’s level, which was revised up by 38,000.

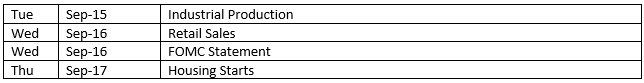

Eye on the Week Ahead

The Federal Open Market Committee meets this week, the first such meeting since July. It is expected that the Fed will maintain its present stance and maintain the target interest rate range at its current 0.00%-0.25%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.