Last Monday saw stocks start the week on a high note, with each of the indexes listed here posting notable gains. The Russell 2000 led the way, adding 2.8%, followed by the Nasdaq (2.3%), the S&P 500 (1.8%), the Dow (1.7%), and the Global Dow (1.7%). Treasury yields and crude oil prices rose while the dollar fell. Energy, health care, and tech stocks led the market gains. Investors were encouraged by word that President Trump was expected to leave the hospital and return to the White House. That news, coupled with the possibility of fiscal stimulus in the near term, also helped propel stocks higher on the day.

Stocks plunged last Tuesday after President Trump called off stimulus talks until after the November election. The announcement came after Fed Chair Powell warned that the economy would likely regress without additional fiscal stimulus. Prior to that announcement, stocks were up as investors anticipated a deal was in the offing. By the end of trading, mega-caps, technology, communication services, and airlines were sectors that were hard hit. Each of the benchmark indexes listed here fell. The Nasdaq lost 1.6%, the S&P 500 fell 1.4%, the Dow dropped 1.3%, the Russell 2000 declined 0.3%, and the Global Dow sank 0.2%. Treasury prices surged pushing yields lower. Crude oil prices and the dollar advanced.

Equities rebounded last Wednesday as the president appeared to soften his stance on halting stimulus negotiations until after the election. Each of the major indexes listed here climbed higher, led by the Russell 2000 (2.1%), followed by the Dow (1.9%), the Nasdaq (1.9%), the S&P 500 (1.7%), and the Global Dow (0.9%). Treasury yields jumped ahead by 5.8%. Crude oil prices fell after a report showed that stockpiles increased. The dollar fell against a basket of currencies. Sectors that performed well include communication services, consumer discretionary, industrials, materials, and information technology.

Stocks posted a second consecutive day of gains last Thursday. Hopes for fiscal stimulus outweighed a larger-than-expected number of unemployment claims. Treasury bond yields and the dollar fell while crude oil prices rebounded from the prior day’s retreat. Energy, utilities, financials, and real estate led the market surge. The Russell 2000 (1.1%) posted the largest gain for the second day in a row, followed by the Global Dow (0.9%), the S&P 500 (0.8%), the Nasdaq (0.5%), and the Dow (0.4%).

Equities got a jolt last Friday following President Trump’s call for a bigger fiscal relief package. While the president said he favored a relief package larger than what has been proposed by either Democrats or Republicans, Senate Majority Leader McConnell warned that no deal was likely before the November election. The number of COVID-19 cases rose in several areas, with Europe emerging as a new hot spot. Nevertheless, each of the indexes listed here advanced by the close of Friday’s trading, led by the Nasdaq (1.4%), followed by the S&P 500 (0.9%), the Dow (0.6%), the Russell 2000 (0.6%), and the Global Dow (0.5%). Treasury yields rose while crude oil and the dollar fell.

For the week, the Nasdaq and the S&P 500 each posted their best weekly gains since July, climbing 4.6% and 3.8%, respectively. The Dow advanced 3.3% and the Global Dow gained 3.9%. But the week’s big winner was the Russell 2000, which shot up 6.4%. Sectors that helped drive the market last week include energy, health care, industrials, and information technology. For the year, the Dow is back in the black after this latest surge, joining the Nasdaq and the S&P 500 as the benchmark indexes with values ahead of their respective 2019 closing values.

Crude oil prices rebounded last week, closing at $40.54 per barrel by late Friday afternoon, up from the prior week’s price of $37.00. The price of gold (COMEX) climbed for the second consecutive week, closing at $1,934.20, up from the prior week’s price of $1,905.40. The national average retail price for regular gasoline was $2.172 per gallon on October 5, $0.003 higher than the prior week’s price but $0.473 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- According to the latest Services ISM® Report On Business®, the services purchasing managers’ index registered 57.8% last month, 0.9 percentage point higher than the August reading. Not surprisingly, with expanded demand, deliveries slowed in September. Prices also fell in the services sector, while new orders, employment, and inventories each grew in September over August.

- According to the latest report from the Bureau of Economic Analysis, the goods and services trade deficit was $67.1 billion in August, up $3.7 billion from July. August exports were $171.9 billion, $3.6 billion more than July exports. August imports were $239.0 billion, $7.4 billion more than July imports. The August increase in the goods and services deficit reflected an increase in the goods deficit of $3.0 billion to $83.9 billion and a decrease in the services surplus of $0.7 billion to $16.8 billion. Year to date, the goods and services deficit increased $22.6 billion, or 5.7%, from the same period in 2019. Exports decreased $296.1 billion, or 17.6%. Imports decreased $273.5 billion, or 13.1%. The trade balance with notable trade partners, the deficit with Germany increased $1.6 billion to $4.6 billion in August; the deficit with Japan increased $1.0 billion to $4.3 billion; and the deficit with China decreased $1.9 billion to $26.4 billion.

- There were 6.5 million job openings in August, according to the latest Job Openings and Labor Turnover report from the Bureau of Labor Statistics. The August total of job openings is slightly below the July figure of 6.7 million. There were 5.9 million hires in August, roughly the same number as from the prior month. August saw total separations decrease to 4.6 million from July’s 5.0 million total. The number of job openings in August decreased over the year to 6.6 million (-685,000), reflecting the continued impact of the COVID-19 pandemic on the labor market.

- For the week ended October 3, there were 840,000 new claims for unemployment insurance, a decrease of 9,000 from the previous week’s level, which was revised up by 12,000. According to the Department of Labor, the advance rate for insured unemployment claims was 7.5% for the week ended September 26, a decrease of 0.7 percentage point from the prior week’s rate, which was revised up by 0.1 percentage point. The advance number of those receiving unemployment insurance benefits during the week ended September 26 was 10,976,000, a decrease of 1,003,000 from the prior week’s level, which was revised up by 212,000.

Eye on the Week Ahead

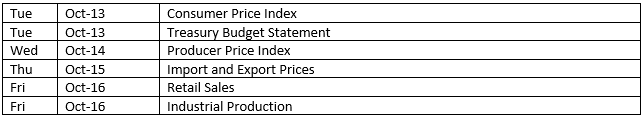

The latest inflation indicators are available this week with the September release of the Consumer Price Index, the Producer Price Index, and the retail sales report. The CPI is up 1.3% year to date, while prices at the producer level are down 0.2%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.